As the second week of August begins, the total crypto market capitalization has surpassed $4 trillion, officially setting a new all-time high. With trading sentiment improving, bullish expectations deepen the imbalance between long and short positions.

As a result, some altcoins could face significant liquidations this week if prices move against the expectations of short-term leveraged traders.

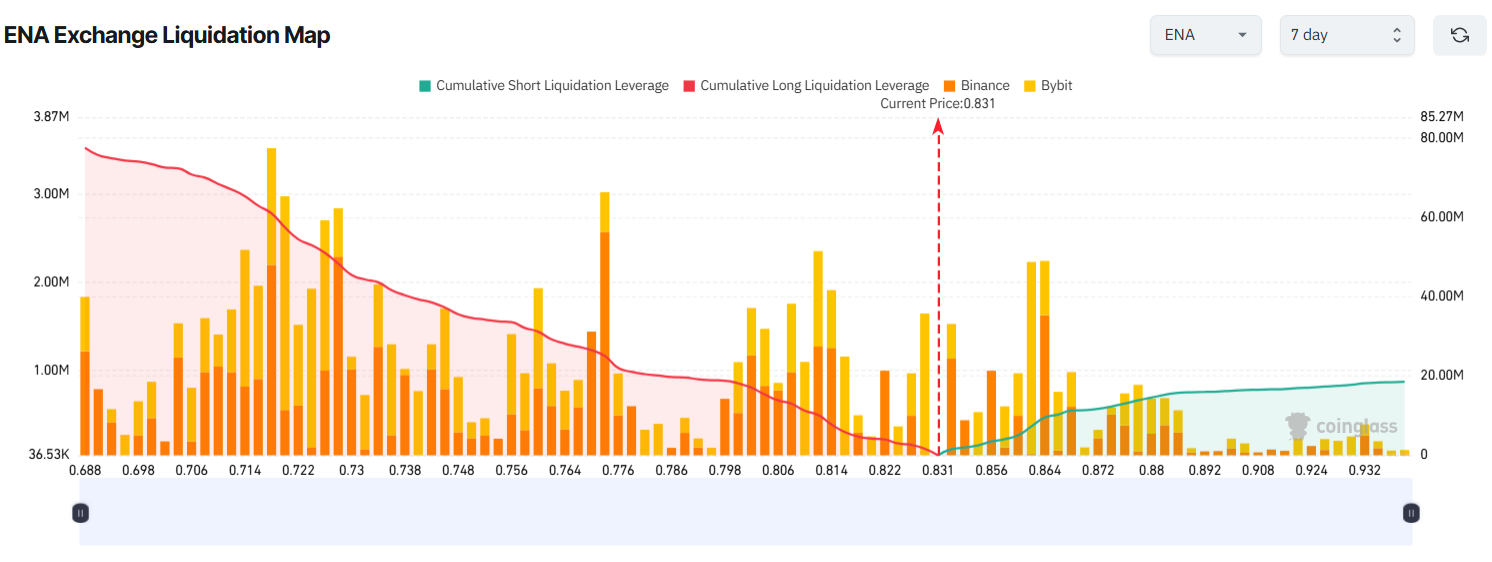

1. Ethereum (ETH)

Ethereum’s 7-day liquidation map shows a major imbalance between accumulated liquidation volumes on the long and short sides. Traders continue to allocate capital and leverage to bets that ETH will keep rising after breaking above $4,300.

Coinglass data indicates that longs could lose over $5 billion if ETH drops 7% this week and falls below $4,000. In contrast, a 7% rise to $4,600 would trigger $2 billion in liquidations for shorts.

Some traders worry that liquidity flows mainly into ETH, while other altcoins do not see the same inflows. They believe ETH’s rally could lack sustainability if buying pressure fades, potentially leading to a sharp drop and as much as $7 billion in long liquidations.

“If Ethereum drops to $3,600, over $7 billion in long positions would be liquidated — a highly attractive liquidity pool for exchanges… Since liquidity has flowed mainly into ETH while other altcoins remain inactive, this suggests ETH might be positioning to balance the overall crypto market cap in response to potential Bitcoin dominance moves,” investor Marzell said.

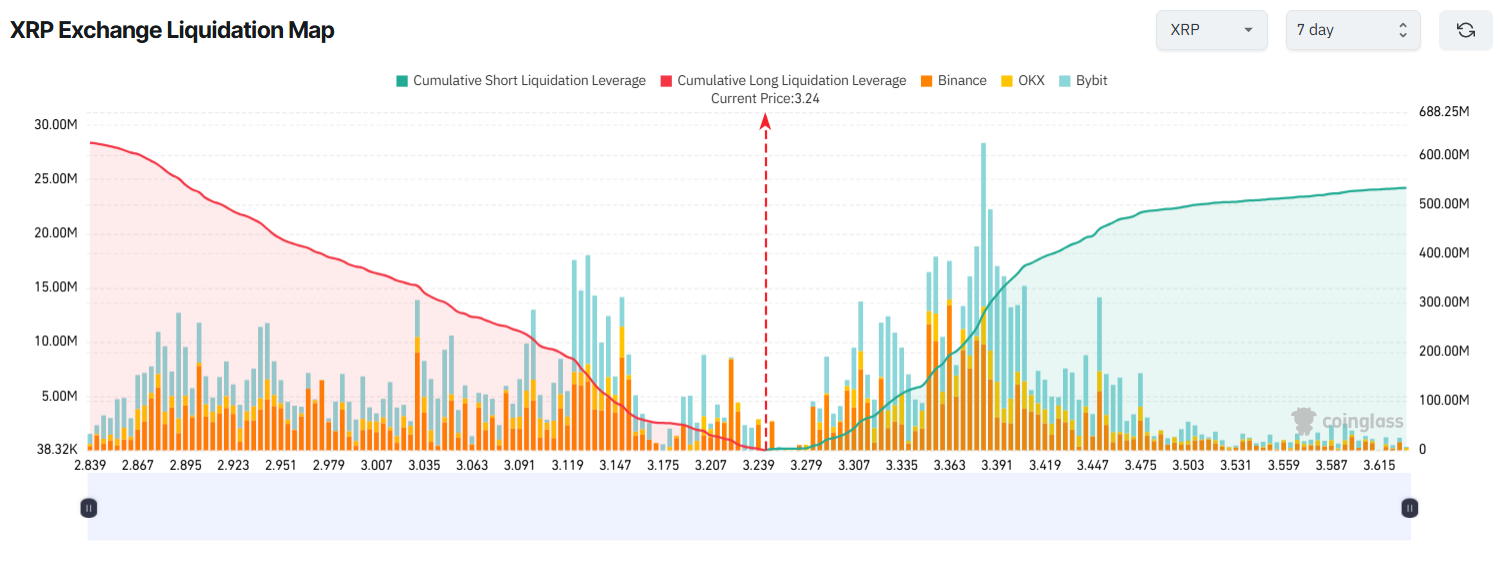

2. Ethena (ENA)

Ethena (ENA) has been one of the most talked-about altcoins in August. Thanks to the passage of the GENIUS Act on July 18, Ethena’s USDe stablecoin reached a $10 billion market cap, becoming the third-largest stablecoin after USDT and USDC.

The bullish sentiment for ENA has surged, pushing its price from $0.50 to over $0.80 in August. A recent BeInCrypto report showed that whales are still accumulating ENA, and the liquidation map reflects traders’ expectations of further short-term gains.

ENA’s 7-day liquidation map shows that longs’ total accumulated liquidation volume far exceeds that of shorts.

If ENA falls to the psychological support level of $0.70 this week, longs could face over $70 million in losses. On the other hand, if ENA climbs to $0.90, shorts would lose just $16.5 million.

Some traders believe ENA could keep rallying toward $1.50. However, they warn that the token could face profit-taking pressure in the $0.80–$0.90 range.

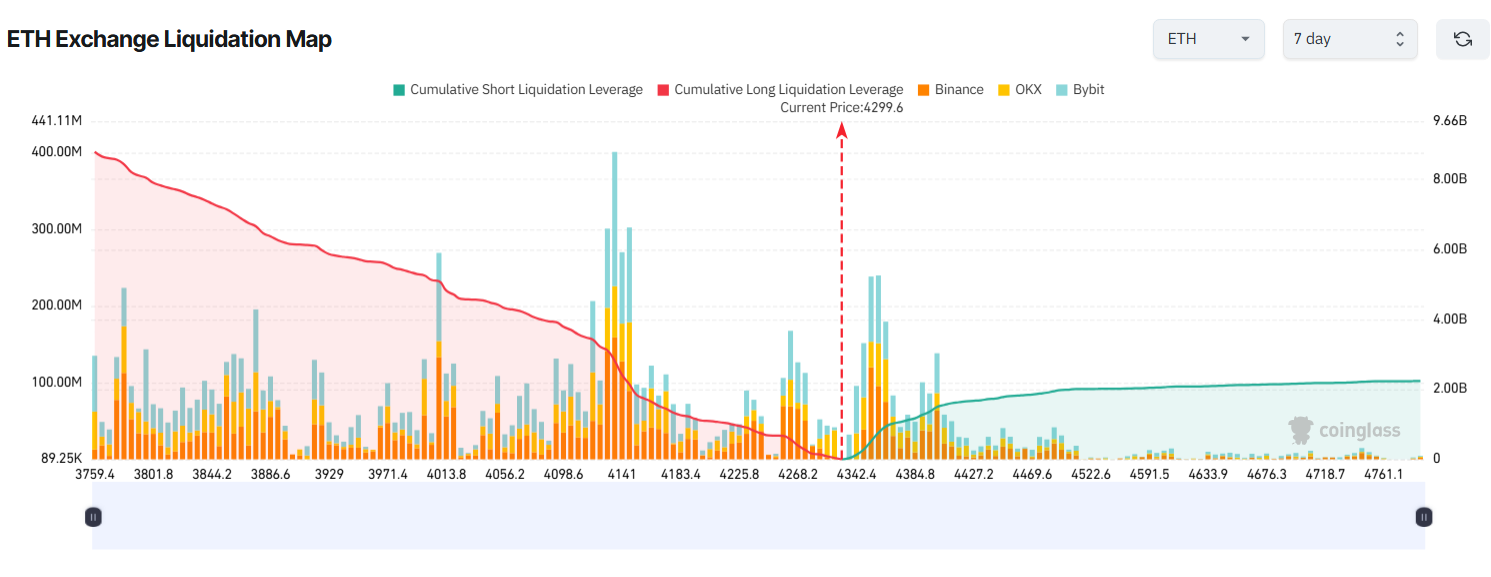

3. XRP

While many altcoins show imbalances in their liquidation maps skewed toward bullish expectations from short-term traders, XRP presents a different picture.

A recent BeInCrypto report revealed that Ripple unlocked 1 billion XRP, sparking concerns of downward pressure. Technical signals also suggest that sellers could soon take control.

Possibly for these reasons, XRP’s 7-day liquidation map shows that traders are placing more money on a bearish scenario.

If XRP moves against these bearish bets, shorts could suffer heavy losses this week.

Specifically, if XRP rises 8% to hit $3.50, nearly $500 million in shorts would be liquidated. Conversely, if XRP drops 8% to $3.00, longs would face about $370 million in liquidations.

The post 3 Altcoins at Risk of Major Liquidations in The Second Week Of August appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Ethena USDe

Ethena USDe  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Zcash

Zcash  WhiteBIT Coin

WhiteBIT Coin  USDT0

USDT0  Monero

Monero  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Dai

Dai  Polkadot

Polkadot  Bittensor

Bittensor  MemeCore

MemeCore  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  sUSDS

sUSDS  Aave

Aave  Bitget Token

Bitget Token  OKB

OKB  Figure Heloc

Figure Heloc  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund