HIVE Digital Provides September 2023 Production Update and Purchase of 1,000 S19k Pro ASICs

This news release constitutes a “designated news release” for the purposes of the Company’s amended and restated prospectus supplement dated August 17, 2023, to its short form base shelf prospectus dated May 1, 2023.

Vancouver, British Columbia–(Newsfile Corp. – October 6, 2023) – HIVE Digital Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: YO0) (the “Company” or “HIVE”) is pleased to announce the unaudited production figures from the Company’s global Bitcoin operations for the month of September 2023, with 269.5 Bitcoin produced in September. The Company has maintained over 3.83 Exahash (“EH/s”) of Bitcoin mining capacity on average for September 2023, including ASIC and GPU BTC hashrate (all amounts in US dollars, unless otherwise indicated).

Summary Overview:

- HIVE produced 269.5 Bitcoin in the month of September, from ASIC and GPU mining operations, representing an average of 70 Bitcoin Per Exahash, with an average hashrate of 3.83 EH/s for the month of September 2023;

- HIVE produced an average of 9 BTC per day in September 2023;

- HIVE ended the month with 3.98 EH/s of mining capacity, including ASIC and GPU BTC hashrate, an 8.3% month over month increase.

Bitcoin Halving Strategy

Frank Holmes, Executive Chairman, of the Company stated, “HIVE was the first publicly listed crypto miner, listing on the TSX-V in 2017, and since then we skillfully and successfully navigated the last halving event in 2020, and additionally the bear markets of 2019, 2020 and 2022. Our team’s track record, couple with our fiscal prudence, puts us in a strong position to weather the halving event next April. Our focus is to maximize ROI on Bitcoin mining ASICs we purchase now, by making strategic acquisitions of only the very best offers in the market.”

Mr. Holmes continued, “For example, we made a series of Bitmain S19 jPro purchases in Q4 2022, and thus far they have already made an ROI of between approximately to 80-105% ROI after accounting for electrical costs. Thus some of these investments are already free-cash flowing, and the remainder soon will be as well.” The Company notes this variance in ROI is accounted for by purchase price and delivery date.

Mr. Holmes, HIVE’s Executive Chairman, added, “We’re laser focused on acquiring high-efficiency Bitcoin mining rigs at the best possible price. HIVE produced an average of 9 Bitcoin per day in September, which is exactly 1% of total Bitcoin network block reward average of 900 Bitcoin per day. We’re doing this as a clean, green energy focused Bitcoin miner. Going forward we will continue to invest in new Bitcoin mining machines at prices that will have optimal payback before the halving next April, and through our analytics, we expect they should continue to be cashflow positive after the halving correction. Furthermore, the high margin fixed-rate revenue from our GPU HPC and AI business unit, will supplement our income from Bitcoin, as we carefully plan for the halving in 2024.”

Bitcoin ASIC Upgrade with S19k Pro

Aydin Kilic, President & CEO of HIVE, stated, “We are thrilled to announce the acquisition of 1,000 Bitmain S19k Pro miners, with an efficiency of 23 J/TH and 120 TH/s per machine. This purchase is part of our strategic acquisitions to prepare for the halving. Our objectives with our equipment procurement strategy are the optimization of ROI, and sustaining positive cash flow post-halving. We note that 2022 was a choppy market for many crypto-miners, and I’m very proud of our team at HIVE, as we navigated this bear market with positive gross mining margins each quarter. This is a testament to our commitment to shareholders, to mine profitably, and our goal to realize the best possible cash flow return on invested capital.”

Quarterly Mining Recap

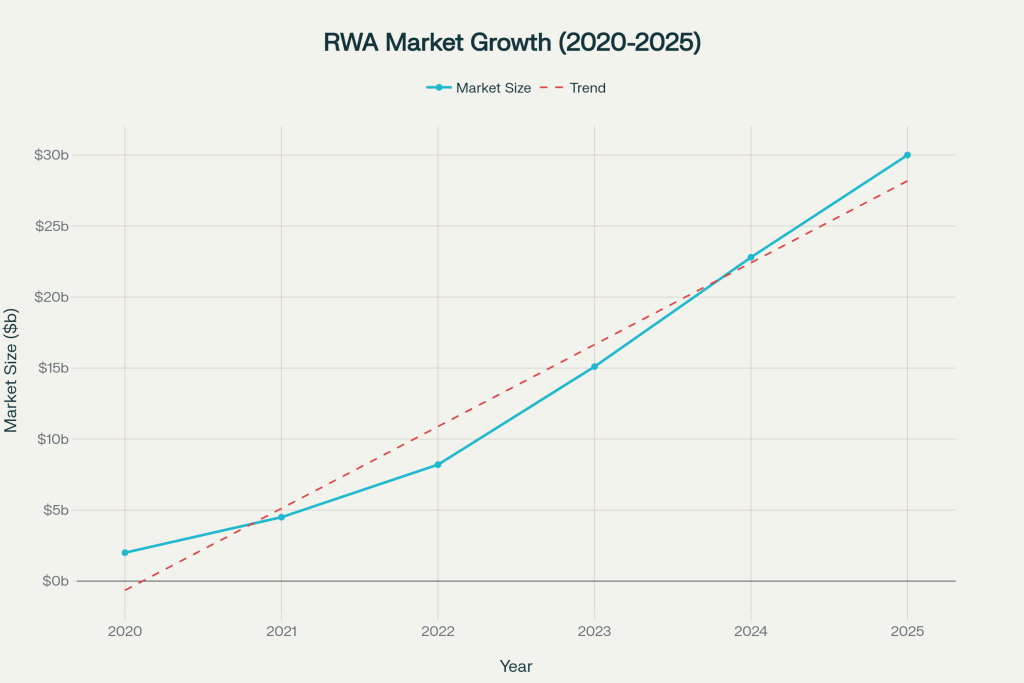

The Company notes that, based on publicly available filings, measuring revenues, direct operating costs, and corporate costs (also know as General & Administrative costs), recording the publicly available information from peers in the Bitcoin mining sector (including monthly production press releases, and financial statements for the period end June 30, 2023), HIVE lead the sector in Operating Margin per Average PetaHash and Revenue per Average PetaHash.

The Company defines Operating Margin as a non-IFRS metric, measured as revenue less direct operating costs (commonly expressed as Cost of Goods Sold or “COGS” in the MD&A filings for public companies) less corporate operating costs or G&A. The Company believes this provides the basis for a direct comparison of listed Bitcoin miners operating margins, to effectively compare all streams of income, against all cash operating costs, which are generally recorded in a similar manner. Since there are many non-cash line items that various companies may each record on a differing basis (including depreciation).

Furthermore, average Revenue per PetaHash is an effective measure of efficiency of uptime as a Bitcoin miner. The more uptime a Bitcoin miner has during a certain period, the more time hashing and earning Bitcoin. Publicly listed Bitcoin miners generally follow similar IFRS reporting methods for Revenue, this expresses the effective up-time or efficiency of a miner. Similarly, one may evaluate the Average Bitcoin per Exahash mined during the same period.

Figure 1: Operating Margin per Average Petahash period end June 30, 2023

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/183129_fig_1_hive.png

Figure 2: Revenue per Average Petahash period end June 30, 2023

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/183129_fig_2_hive.png

The Company notes June 30, 2023 is actually its first quarter of the fiscal year. The title of the bar chart describes the second calendar quarter of the year. Therefore, all data presented is for the same April to June 2023 reporting period for all companies.

September 2023 Production Figures

The Company’s total Bitcoin production in September 2023 was:

- 259 BTC produced from ASICs from an average hashrate of 3.69 EH/s from ASICs in September;

- 8.6 BTC produced per day on average from ASICs, and 70.2 BTC/EH from ASICs in September;

- 3.98 EH/s of BTC month end hashrate as of September 30, comprised of 3.83 EH/s of ASIC BTC hashrate and 0.15 EH/s of GPU BTC hashrate;

- This represents an 8.3% month over month end increase in BTC ASIC hashrate (August 31 month end was 3.53 EH/s)

- Monthly average of 3.83 EH/s, comprised of an average of 3.69 EH/s of ASIC mining capacity and average of 150 PH/s of Bitcoin GPU mining capacity during the month of September;

- This is a 4% month over month increase in BTC average hashrate from ASICs and GPUs combined (August average BTC hashrate was 3.67 EH/s).

Bitcoin Global Network Mining Difficulty Is Volatile

Network difficulty factors are a significant variable in the Company’s gross profit margins. The Bitcoin network difficulty was 55.62 T as of September 1, and increased to an all-time high of 57.12 T as of September 30th. Accordingly, Bitcoin mining difficulty ended the month about 3% higher than the beginning of the month.

The Bitcoin Network Difficulty is a publicly available statistic, which reflects the total number of Bitcoin miners online and is important in analyzing a company’s gross profit margins, and number of Bitcoin produced. This data is available on many websites, here is one citation: https://www.blockchain.com/explorer/charts/difficulty.

As more people mine Bitcoin (difficulty increases), the daily Bitcoin block reward which presently is fixed at 900 Bitcoin per day, gets split amongst more miners; thus, each miner receives a smaller portion of the block reward. Conversely, as Bitcoin prices fall, many miners may lose money, and power down, thus taking their hashrate off the network, causing Network Difficulty to decrease.

Those miners with the lowest costs of production, by virtue of having more efficient machines and/or lower energy costs, are able to continue their production during these volatile cycles. Not all miners will continuously mine during the month, as a result some miners will produce less Bitcoin than expected, relative to their advertised hashrate. For the foregoing reasons, HIVE will self-curtail part of its operations if the unhedged spot energy prices are uneconomical, thereby leaving part of its total gross hashrate unutilized.

All Bitcoin miners are striving to use the most efficient Bitcoin ASIC chips, and we are happy that we have been able to upgrade our global fleet during this crypto market downturn.

About HIVE Digital Technologies Ltd.

HIVE Digital Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a sustainable green energy focus.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we endeavour to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of ETH and BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEdigitaltechnologies.com. Follow @HIVEDigitalTech on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Digital Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. “Forward-Looking information” in this news release includes but is not limited to: business goals and objectives of the Company; the results of operations for September 2023; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, the volatility of the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company’s operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company’s ability to utilize the Company’s at-the-market equity offering program (the “ATM Program”) and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company’s electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company’s profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or law that will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company’s disclosure documents under the Company’s filings at www.sec.gov/EDGAR and www.sedarplus.ca.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company’s normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/183129

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Ethena USDe

Ethena USDe  Sui

Sui  Figure Heloc

Figure Heloc  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  WETH

WETH  Hedera

Hedera  LEO Token

LEO Token  Litecoin

Litecoin  USDS

USDS  Cronos

Cronos  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  Monero

Monero  Mantle

Mantle  Ethena

Ethena  Dai

Dai  Aave

Aave  Pepe

Pepe  OKB

OKB  NEAR Protocol

NEAR Protocol  MemeCore

MemeCore  Bitget Token

Bitget Token  Jito Staked SOL

Jito Staked SOL  Story

Story