Cryptocurrencies sure have been enjoying the last couple weeks of trading, with bitcoin, ethereum and dogecoin surging off the lows. That’s got the miners moving too.

While the equity markets have enjoyed the last few trading weeks, so has this group. To see both rallying adds to the “risk-on” observation, in my opinion.

Granted, these groups — tech and crypto — have been crushed, so some sort of bounce should be expected. That said, it’s gone further and longer than most investors had expected.

When I look at bitcoin, I see a 27.5% rally from the mid-March low to Monday’s high. In that stretch, it has been up in 11 of the last 15 sessions and has now closed higher in seven straight sessions.

How much longer can the rally continue? Let’s look at the charts.

Trading Bitcoin

On Sunday, bitcoin made what I refer to as a “deliberate” breakout. The reason I call it deliberate is because the asset pushed through several significant levels when it could have easily rallied to this area and failed.

But no. Bulls deliberately jammed bitcoin up through this key zone. That zone was $45,400 to $45,900.

Scroll to Continue

In that area, we had prior support turned resistance ($45,400), followed by last month’s high at $45,900. Clearing February’s high gave bitcoin a monthly-up rotation. However, this zone also included the 50-week and 21-week moving averages, as well as the weekly VWAP measure.

Given how many measures were in this area, it would have easy for bitcoin to pullback, especially with that nice streak of daily gains.

Now pushing higher, I want to see how it handles channel resistance and the 200-day moving average. If it can clear these measures, it puts $50,000 in play, followed by the 50% and 61.8% retracements, respectively.

On the downside, bulls would love to see the $45,400 to $45,900 area hold as support, along with the 10-day moving average. Below that and the 50-day could be in play.

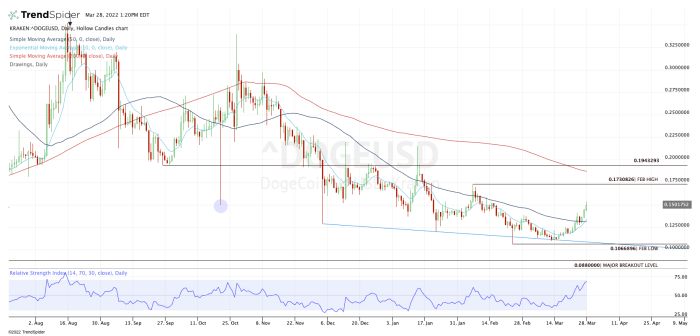

Trading Dogecoin

As for dogecoin, it could have some more upside provided that it can get through the 15 cent level. If it can do that, dogecoin could push up to the February high near 17.3 cents.

Above 17.3 cents and dogecoin will be looking for a test of its 200-day, followed by a possible push to the 19.5 to 20 cent area.

While these sound like small moves, a rally from 15 cents to 20 cents would represent a gain of ~33%.

If dogecoin needs to pull back — as it’s up in seven of the past eight sessions — let’s see if the 10-day and 50-day moving averages are support.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Dai

Dai  Shiba Inu

Shiba Inu  USDT0

USDT0  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Mantle

Mantle  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Canton

Canton  Polkadot

Polkadot  USD1

USD1  Bitget Token

Bitget Token  Rain

Rain  Aave

Aave