A leading digital asset manager says institutional investors are taking an interest in Cardano (ADA) and Polkadot (DOT) while heavily de-risking from Bitcoin (BTC).

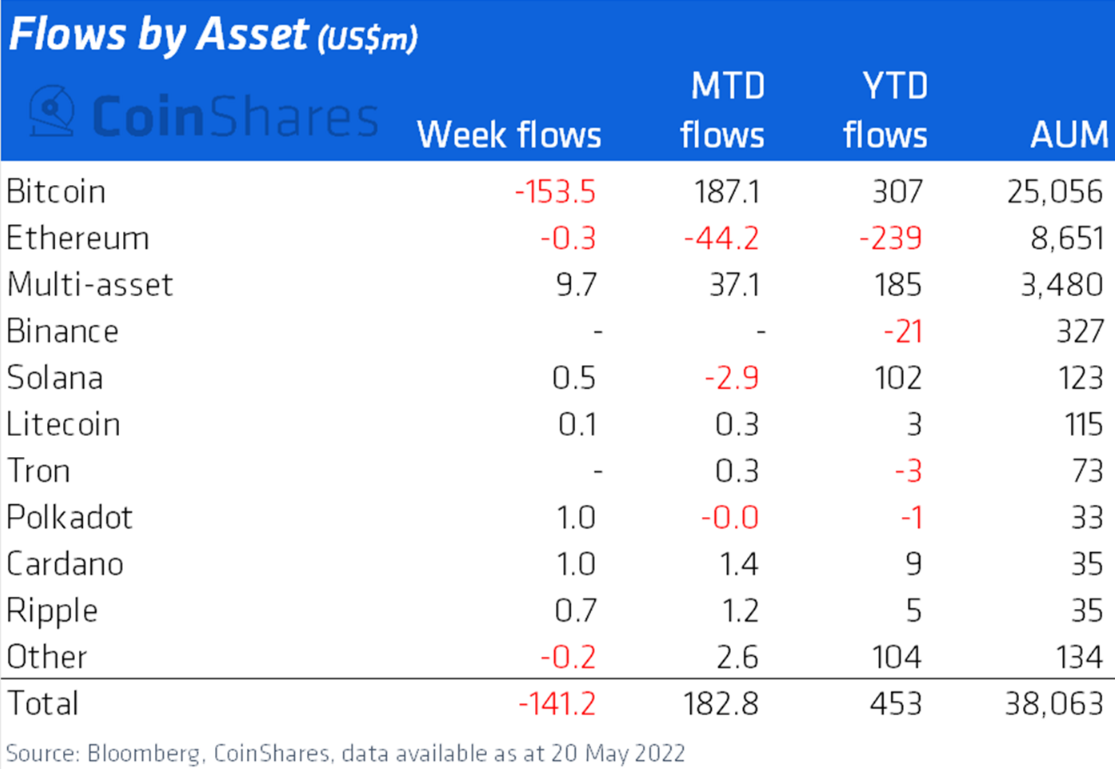

In the latest Digital Asset Fund Flows Weekly report, CoinShares finds that BTC suffered $154 million in outflows last week, leading a digital asset market that saw outflows of $141 million total.

“Digital asset investment products saw outflows totaling $141 million last week. The ongoing volatility has led to fickle investors with some seeing this as an opportunity while the aggregate sentiment is predominantly bearish. Outflows totaling $154 million were seen in the Americas while Europe saw inflows totaling $12.4 million.”

Despite last week’s monstrous Bitcoin outflows, BTC’s year-to-date flows remain positive at $307 million. Ethereum (ETH) products, on the other hand, has year-to-date flows of negative $239 million, suffering an additional $300,000 in outflows last week.

Institutional investors poured $1 million apiece into digital asset investment products focused on Polkadot and Cardano while also investing $700,000, $500,000 and $100,000 in XRP, Solana (SOL) and Litecoin (LTC) products, respectively, according to CoinShares.

Multi-asset digital investment products, those investing in multiple crypto assets, enjoyed $9.7 million in inflows last week as investors sought refuge in diversity.

“[Multi-asset] investment products have seen only two weeks of outflows this year, much lower relative to its peers. We believe investors see multi-asset investment products as safer relative to single line investment products during volatile periods.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/SpicyTruffel

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Dai

Dai  Shiba Inu

Shiba Inu  USDT0

USDT0  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Mantle

Mantle  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Canton

Canton  Polkadot

Polkadot  USD1

USD1  Bitget Token

Bitget Token  Rain

Rain  OKB

OKB  MemeCore

MemeCore