Sergo2/iStock via Getty Images

The semiconductor earnings season has been eventful. So far we have seen these key data points:

- Micron (MU) reported solid earnings but weak guidance, and then further reduced full-year guidance a month later

- Taiwan Semiconductor Manufacturing Company (TSM) reported strong earnings, and guided for solid growth, while acknowledging that their customers were facing reduced demand in some product segments but still clamoring for more supply in others

- Intel (INTC) reported a disastrous quarter (a very rare net loss!) and terrible guidance for the rest of the year

- AMD (AMD) reported a solid quarter, with strong growth, and maintained strong guidance for the rest of the year, while acknowledging that the industry was facing reduced demand in client and gaming but strong demand in the datacenter

- Nvidia (NVDA) pre-announced a horrendous quarter, with “gaming” revenue down 44% sequentially

Why are some companies showing strength and others falling off a cliff? There are multiple factors at play.

The first is easing of supply chain constraints and reduction of COVID-induced demand.

During the first couple years of the COVID era there was a lot of demand for computers for employees and students to use while working and being educated at home. There was also increased demand for at home entertainment. This resulted in increased sales of PCs (especially low-end laptops like Chromebooks), and gaming equipment (especially gaming consoles and graphics cards). Many data points indicate that these demand spikes have been met and with more people returning to in-person activities, it is not surprising that demand for these pandemic-related items would take a step down.

The net result is a decrease in demand for certain semiconductor products.

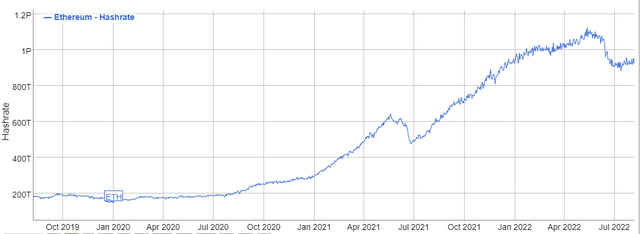

The second is the bursting of the GPU-powered cryptocurrency mining bubble.

As illustrated in my recent article, GPU-based cryptocurrency mining (primarily Ethereum) has consumed an enormous amount of computing resources over the past two years. The increase in Ethereum hashrate represents the millions of GPUs (primarily from Nvidia) that were purchased to use for crypto mining, along with systems to put the GPUs in, and memory to go into the systems. With Ethereum ending GPU-based mining permanently in the next few months, that is an enormous source of demand that is going away and not coming back. People thinking Nvidia’s earnings collapse is a cyclical dip are fooling themselves.

BitInfoCharts

(image source)

The net result is a dramatic decrease in demand for NVDA and AMD GPUs.

The third is a shift in market share from Intel and Nvidia to TSM and AMD.

Without going too far into the weeds, TSM has the world’s most advanced semiconductor manufacturing technology, so its customers (like AMD) have a significant competitive edge in product performance. Nvidia has started to shift its products more towards TSM’s foundries to better compete with AMD’s rapidly advancing GPU offerings. And as AMD takes more and more market share from Intel, it has in turn increased demand for TSM capacity.

The net result of these shifts is strong demand for AMD and TSM offerings at the expense of Intel and Nvidia.

Key Takeaways:

TSM is a strong buy as it continues to consolidate market share and has long term hard contractual commitments (including multibillion dollar prepayments) from its customers. TSM is shielded from much of the current market conditions we have observed. With TSM in a global monopoly position, growing earnings at something around 50% per year, the stock is stupidly cheap at approximately 13x 2022 earnings.

AMD is a strong buy as it continues to gain market share in high margin products and can continue to grow earnings despite the demand dip in the industry. The stock is also stupidly cheap at a mid- or upper-teens multiple of likely 2022 earnings given something around 50% per year earnings growth.

MU is a buy as the valuation is quite low relative to its prospects and the nature of the demand downturn.

INTC is a sell as its business (and profits) continues to flow to AMD (and TSM). The dividend is a risk. Intel needs a miracle (and a number of years) to turn itself around into an investable business.

NVDA is a strong sell as its valuation remains egregiously high at 47x TTM earnings despite earnings falling off a cliff now as the crypto mining demand ends.

Pair Trade Idea

AMD has fallen about 7% in the two days since Nvidia’s pre-announcement of disastrous earnings. Perhaps traders assume that NVDA’s GPU sales falling off a cliff is bad news for AMD. But the problem with this assumption is that AMD just announced their Q2 earnings *seven days ago*. At the time AMD gave an update on their GPU sales and guided for Q3. It is extremely unlikely that the entire GPU market suddenly cratered in the handful of days since AMD reported and guided.

Instead, what we are seeing is a result of cryptocurrency mining demand for GPUs falling off a cliff. Nvidia shrewdly capitalized on this temporary source of demand and sold many millions of GPUs – and at enormously inflated prices – to crypto miners (primarily for mining Ethereum). AMD also benefitted somewhat from increased GPU demand, but since AMD is a diversified business with several business lines besides discrete GPUs, it was not as reliant on GPU sales. All of AMD’s business lines have been supply constrained for a couple years, so AMD dedicated their production capacity primarily to other products and left the crypto-fueled GPU demand largely to Nvidia.

On the Q2 earnings call, AMD’s CEO Lisa Su indicated that they saw declining GPU sales, and that the declines would continue in Q3. AMD was well aware of the GPU marketplace demand situation when it delivered solid guidance for Q3.

AMD continues to be enormously undervalued relative to NVDA, despite AMD’s strong fundamentals and Nvidia’s shaky earnings future.

I suspect a lot of pain is ahead for Nvidia. The company’s revenues are almost entirely from GPU sales, and a huge portion of those sales are likely going away permanently as crypto mining demand falls off a cliff. A significant earnings drop is likely. NVDA is currently trading at 47x TTM earnings. If the stock price doesn’t fall significantly, the earnings multiple could easily approach triple digits in the coming quarters.

In contrast, AMD is showing continued strength, especially from the datacenter.

Q2 comparison

|

AMD |

Nvidia |

|

|

Revenues |

$6.55 billion |

$6.7 billion (estimate) |

|

Non-GAAP Gross Margins |

54% |

46% (estimate) |

|

YoY growth |

70% |

3% (estimate) |

|

Market Capitalization |

$160 billion |

$437 billion |

Both firms are now similar in size. AMD continues to grow at a fast rate, especially in the lucrative datacenter. AMD’s growing margins surpassed Nvidia’s newly cratered margins. And yet Nvidia’s valuation is almost 3x the size of AMD’s. I suspect this imbalance will be corrected over time as AMD continues to perform and Nvidia’s true underlying fundamentals become clear. In a reasonable market, AMD’s market cap should soon exceed Nvidia’s.

As AMD continues to grow market share, especially in the high-margin datacenter, earnings should grow quickly. I suspect we will see AMD earning at a $10+ per share rate sometime next year. The stock is trading at less than 10x that figure.

Nvidia is a great company, but the stock is wildly overpriced, especially given the deteriorating fundamentals. AMD is a great company with increasingly strong fundamentals and a lot of room to continue to take market share from Intel and Nvidia with very competitive products (and strong products in the pipeline). Why anyone would pay almost 3 times as much for Nvidia is beyond me.

Investors can consider a pair trade of long AMD and short NVDA. This trade would seek to capture the upside for AMD as its valuation moves up to a reasonable valuation reflecting its growing earnings power. The trade would also capture the downside for NVDA as the market realizes the hypergrowth narrative is broken and the multiple adjusts far downwards to appropriately reflect a company with declining earnings. The pair trade would attempt to hedge out macroeconomic fluctuations in the broader indexes and strength/weakness in the semiconductor industry.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Sui

Sui  Figure Heloc

Figure Heloc  Stellar

Stellar  Avalanche

Avalanche  Wrapped eETH

Wrapped eETH  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Hedera

Hedera  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  Ethena

Ethena  Mantle

Mantle  Monero

Monero  Aave

Aave  Bitget Token

Bitget Token  Pepe

Pepe  Dai

Dai  OKB

OKB  Ondo

Ondo  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor