klmax/iStock via Getty Images

A Quick Take On Mawson Infrastructure Group

Mawson Infrastructure Group (NASDAQ:MIGI) reported its Q2 2022 financial results on August 22, 2022, increasing its Bitcoin self-mining footprint.

The company provides a range of data center services and mines bitcoin for its own account.

While MIGI is not a low-risk stock, since I’m bullish over the longer term on the price of bitcoin and intrigued by its hosting colocation growth opportunity, I’m putting MIGI on a watch list for further consideration.

For now, my outlook is a Hold for MIGI.

Mawson Infrastructure Overview

North Sydney, Australia-based Mawson Infrastructure was founded to develop a range of crypto mining services in Australia and North America.

The firm is headed by founder and CEO James Manning, who was previously an Executive Director at Carrington Forsyth Investment Limited.

The company’s primary offerings include:

-

Data center colocation services

-

Infrastructure optimization

-

Bitcoin mining

-

Digital asset management

The firm acquires customers through its direct sales and marketing efforts and through partner referrals.

MIGI has five Bitcoin mining sites under operation in the US and Australia and has recently begun developing a ‘large scale hydropower Bitcoin mining facility in Tasmania and the Southern half of Australia.’

Mawson Infrastructure’s Market & Competition

The global market for bitcoin mining is currently in significant flux, with the recent bans on mining in China causing a large amount of that country’s hashpower to exit the network while those operators look for a more suitable location.

The market value for mining depends on the price of bitcoin, since the majority of value going to the miner is a function of the current Bitcoin reward rate of 6.25 Bitcoin per successfully mined block.

At a price of $25,000 per bitcoin, the annual mining rewards for the entire industry would be approximately $8.2 billion.

Major industry participants include:

-

Bitfarms (BITF) (BITF:CA)

-

Argo Blockchain (OTCQX:ARBKF) (ARBK)

-

DMG Blockchain (OTCQB:DMGGF) (DMGI:CA)

-

Hive Blockchain (HIVE) (HIVE:CA)

-

Hut 8 Mining (HUT) (HUT:CA)

-

HashChain Technology

-

DPW Holdings

-

Layer1 Technologies

-

Riot Blockchain (RIOT)

-

Marathon Patent Corp.

-

Others

Mawson’s Recent Financial Performance

-

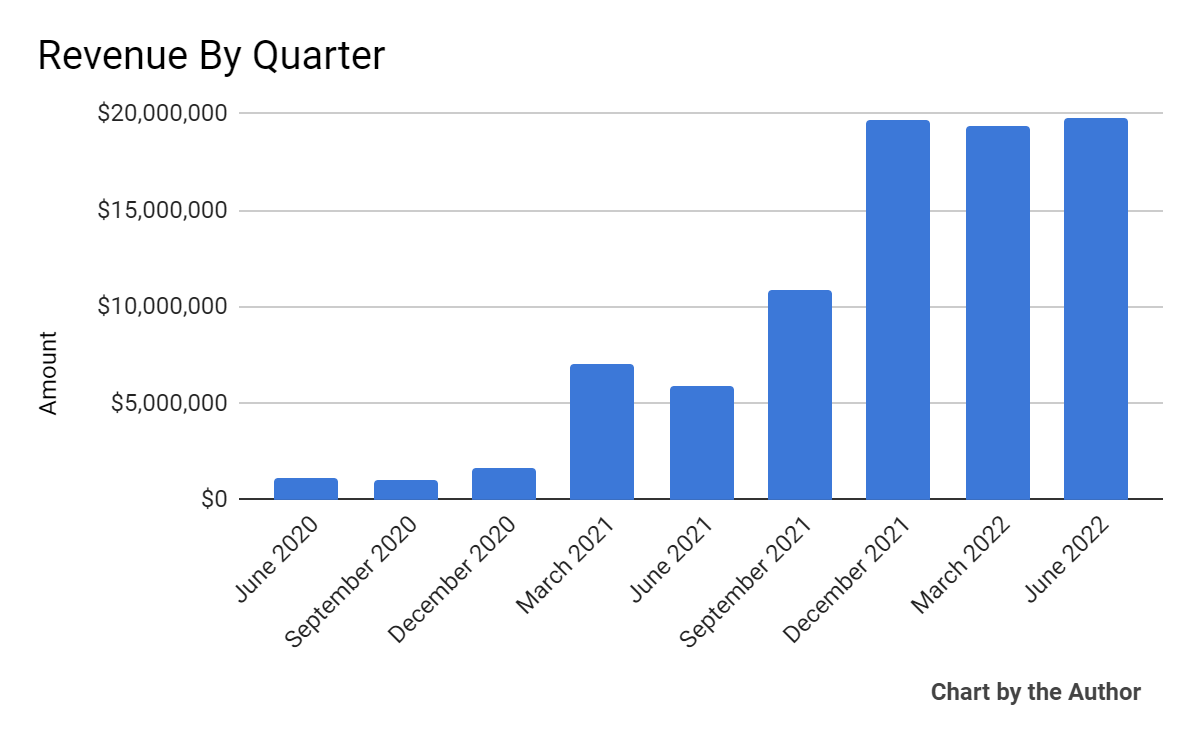

Total revenue by quarter has risen substantially in recent quarters as the firm has brought several thousand bitcoin miners online:

9 Quarter Total Revenue (Seeking Alpha)

-

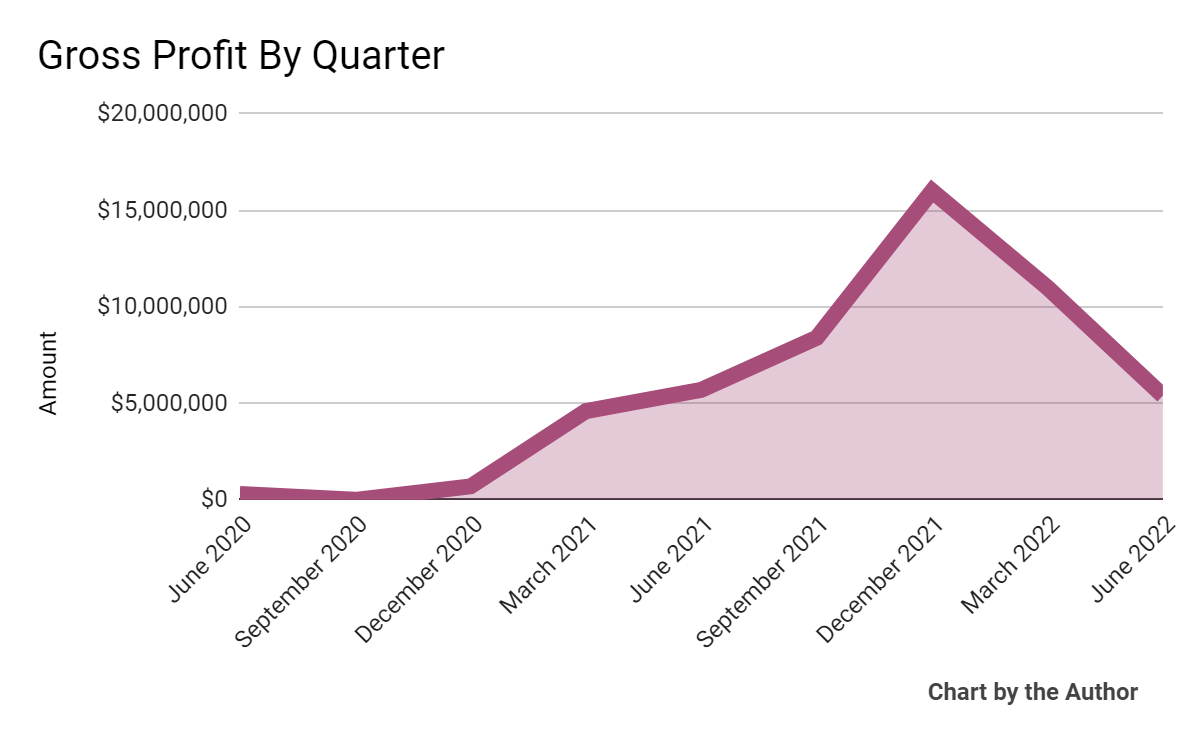

Gross profit by quarter has fallen in the most recent reporting periods:

9 Quarter Gross Profit (Seeking Alpha)

-

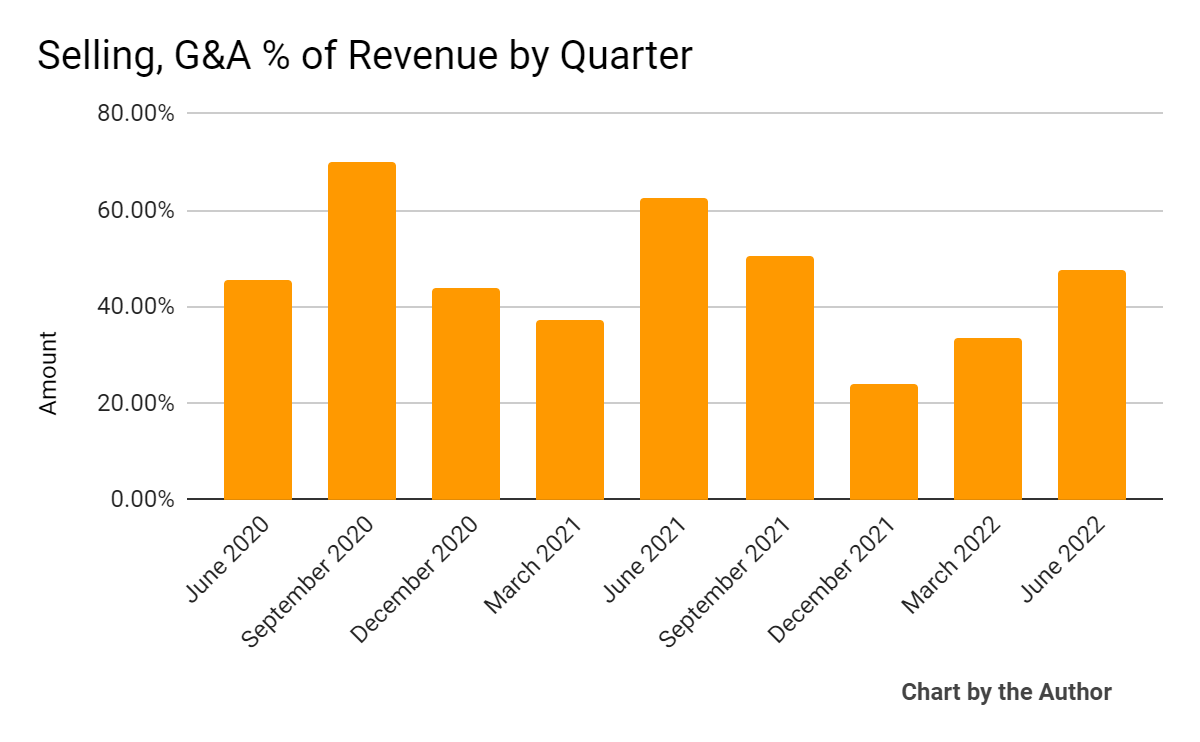

Selling, G&A expenses as a percentage of total revenue by quarter have varied according to the following chart:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

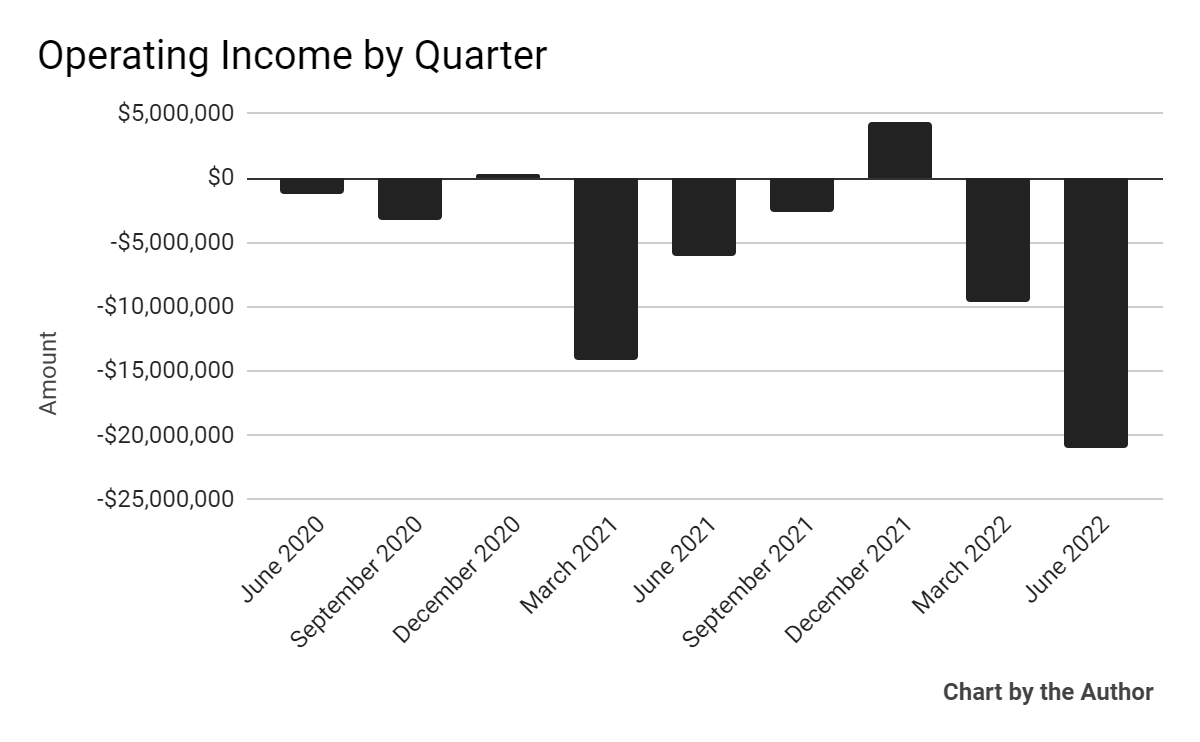

Operating income by quarter has dropped sharply in the two most recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

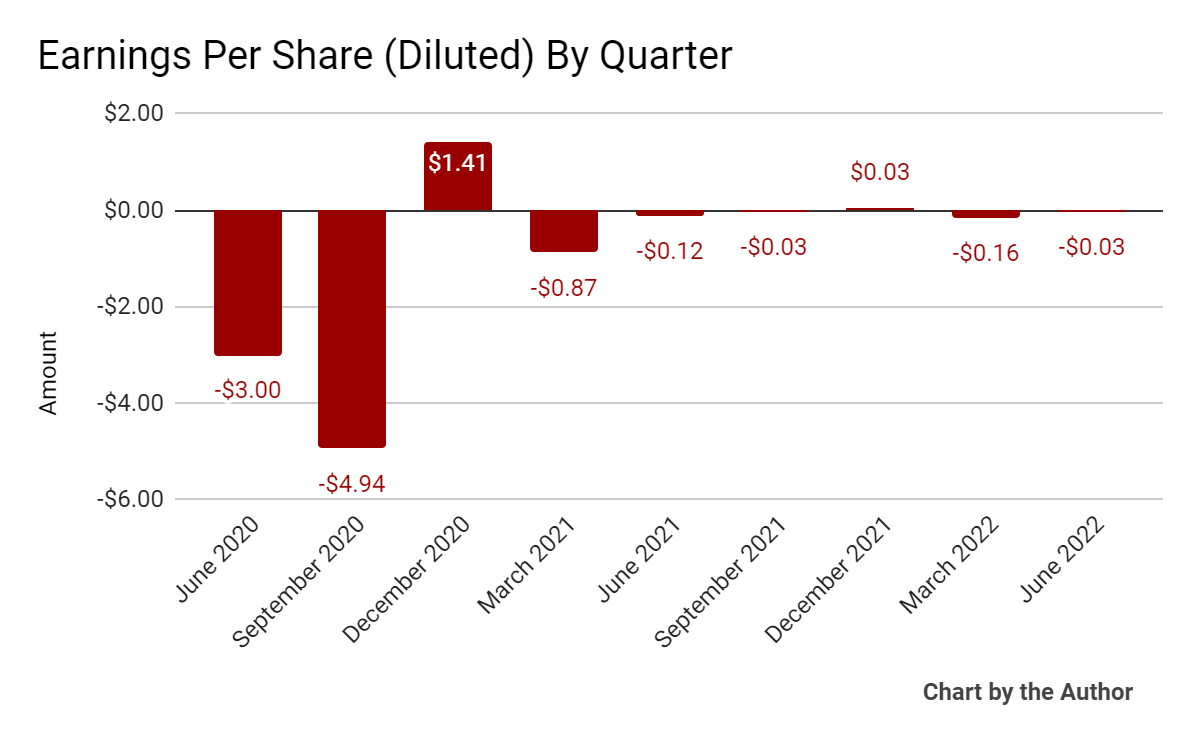

Earnings per share (Diluted) have largely remained negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

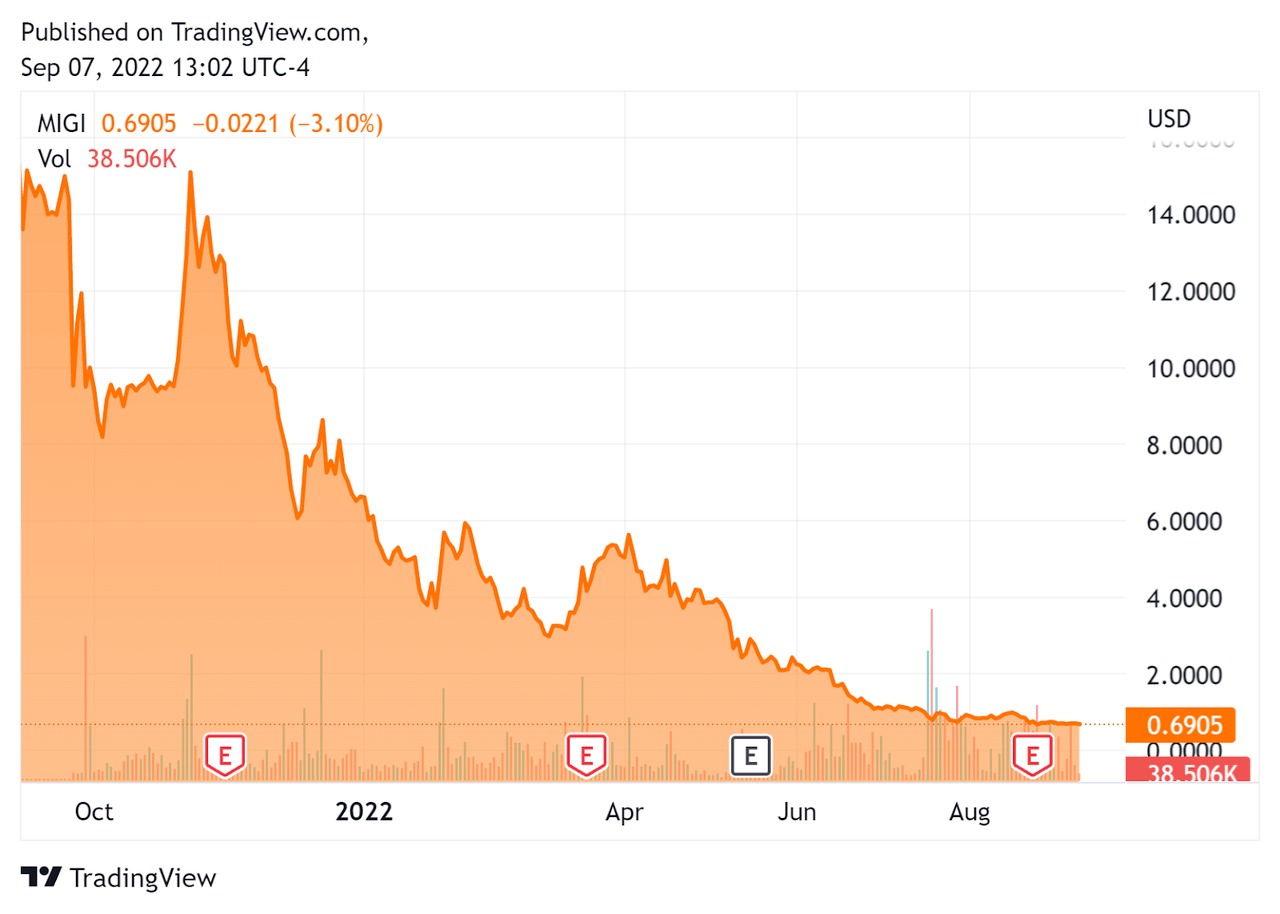

In the past 12 months, MIGI’s stock price has fallen 95.3% vs. the U.S. S&P 500 index’ drop of around 12.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Mawson Infrastructure

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.41 |

|

Revenue Growth Rate |

349.1% |

|

Net Income Margin |

-19.4% |

|

GAAP EBITDA % |

15.6% |

|

Market Capitalization |

$57,900,000 |

|

Enterprise Value |

$98,940,000 |

|

Operating Cash Flow |

$48,440,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.19 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Bitfarms (BITF); shown below is a comparison of their primary valuation metrics:

|

Metric |

Bitfarms |

Mawson Infrastructure |

Variance |

|

Enterprise Value / Sales |

1.68 |

1.41 |

-16.1% |

|

Revenue Growth Rate |

124.1% |

349.1% |

181.4% |

|

Net Income Margin |

-55.8% |

-19.4% |

65.1% |

|

Operating Cash Flow |

-$977,000 |

$48,440,000 |

–% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Mawson Infrastructure

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the expansion of its hosting colocation business, which now totals 54 megawatts in size and 1.8 exahash in mining capacity.

The firm’s self-mining capacity rose briefly to 1.85 exahash by quarter end until falling slightly to 1.7 exahash in July.

Mawson also signed a 120 megawatt infrastructure deal in Texas as part of its Energy Demand Response Program [EDRP]. This type of program enables grid operators to request that Bitcoin mining power down during peak energy use periods to free up energy capacity for critical needs.

The company also announced it will ‘become a 33% shareholder in Tasmania Data Infrastructure,’ where it will be developing a hydropower bitcoin mining operation in Tasmania and the southern region of Australia.

Also, the firm closed a $10 million PIPE in July to cover potential loss due to a major hosting customer Celsius entering bankruptcy.

As to its financial results, total revenue rose 236% year-over-year while gross profit was little changed over the same period in 2021.

However, GAAP operating losses worsened significantly during the quarter.

For the balance sheet, the company finished the quarter with $2.5 million in cash and equivalents while paying down its foundry digital debt facility which it expects to be paid off by the end of October 2022.

The company’s existing mining fleet is now fully paid for and all units have been delivered.

Looking ahead, management has deferred ‘all major forward capital expenditure until market conditions normalize,’ a prudent approach as the price of bitcoin continues to drop while mining hashrate remains high resulting in a profit squeeze for miners.

For its hosting colocation business, management sees ‘strong’ inbound interest and demand as it continues to expand this business segment from 100 megawatts of customer agreements in place to as high as 200 megawatts by the end of 2023.

Regarding valuation, the market has beaten down MIGI’s stock price as the company has doubled down on bitcoin mining despite a significant bear market in bitcoin’s price.

While it’s anyone’s guess where bitcoin’s price will track over the near term, management’s characterization of its hosting colocation business and growing demand is encouraging.

Also positive is the firm’s ability to tap private equity investment to cover its operational exposure to the Celsius bankruptcy filing.

The primary risk to the company’s outlook is a continued bear market for the price of bitcoin just as large investments in bitcoin mining equipment have been made by the firm and others in the space.

A potential upside catalyst would obviously be a bitcoin price rally but also a pause in the rise of cost of capital.

Essentially, MIGI is trading as a proxy to bitcoin, at least in the near term. While I am bullish on bitcoin in the longer term, it could take an extended period for price to rebound.

However, MIGI’s hosting colocation business is growing and should provide interested investors with potential revenue stream diversification over the medium term.

While MIGI is not a low-risk stock, since I’m bullish over the longer term on the price of bitcoin and intrigued by its hosting colocation growth opportunity, I’m putting MIGI on a watch list for further consideration.

For now, my outlook is a Hold for MIGI.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Sui

Sui  Figure Heloc

Figure Heloc  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  Mantle

Mantle  Ethena

Ethena  Monero

Monero  Aave

Aave  Bitget Token

Bitget Token  Dai

Dai  Pepe

Pepe  OKB

OKB  MemeCore

MemeCore  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  NEAR Protocol

NEAR Protocol