Antonio Bordunovi

Last month, Nvidia (NASDAQ:NASDAQ:NVDA) posted an ugly Q2 earnings and an even weaker Q3 guide. The biggest negative contribution was Nvidia’s “Gaming” and “Professional Visualization” sales guided to drop by 60% from Q1 to Q3.

This sharp decline has been attributed to Ethereum’s (ETH-USD) change to stop using GPUs to mine. If true, this would be a short-term and long-term bearish factor for the company, likely costing them something around $1.5 billion or more per quarter in high-margin revenue.

However, some observers have suggested that the sudden drop is mostly due to the weakness some parts of the semiconductor industry have reported. We have seen Intel (INTC), Micron (MU), and others report a weak Q2 and guide to a weak Q3. If Nvidia’s weakness is mostly due to general consumer spending trends and only a small amount of the reduction is from Ethereum mining elimination, then that would paint a less dour picture for Nvidia’s future than the market may be expecting.

Let’s look at some key data points and see whether a good case can be made that Nvidia’s cliff dive is primarily due to temporary consumer purchasing changes.

2021 China Ban

An interesting natural experiment took place in 2021 when China banned crypto mining in the country. Some people have observed that despite the ban, Nvidia’s “Gaming” sales continued to go up. After the Chinese ban, the Ethereum hash rate dipped, and Chinese miners sold many GPUs into the used market. Yet, Nvidia sales grew anyway. This is a good and important observation, but I believe misses the key forces at play.

When Chinese miners exited the market and the hash rate dropped, mining became more profitable everywhere in the world. Therefore, the payback period declined significantly for new mining GPU purchases. And the price of Ethereum continued to rise over time, making mining even more profitable and spurring even more GPU sales.

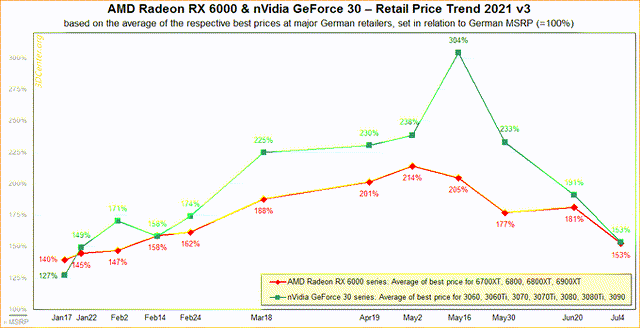

Given that GPU prices during this time continued to be well over MSRP – even 2x or 3x MSRP, the demand was likely driven by miners, since GPUs were a profitable investment even at such inflated prices. It is not likely that consumers were rushing out in droves to purchase GPUs at 3x MSRP (and spending thousands of dollars for an improved gaming experience). The image below shows retail price trends as a percent of MSRP in 2021 before and after China’s ban took effect.

Twitter/3D Center

This piece of evidence is consistent with Ethereum mining being a large portion of Nvidia’s sales.

Hash Rate

It is interesting to note that the Ethereum hash rate has levelled off, but not fallen off a cliff as we approach the end of GPU mining. Some might see this as a sign, that Nvidia’s sales drop can’t be due to Ethereum since there are so many miners still out there right up to the September 15th estimated cessation of mining date. But hash rate is a function of previously-purchased cards used to mine. So the fact that levelling off the hash rate has such a huge effect on Nvidia sales is actually a strong indication that Ethereum mining was driving GPU sales.

Miners have already paid for their current rigs and mining remains profitable until around September 15th when the TTD target is hit and mining ceases to be profitable. It can make financial sense to keep mining for now but doesn’t make sense to buy new cards to mine. Nvidia sales falling off a cliff align with mining driving demand.

This piece of evidence is consistent with Ethereum mining being a large portion of Nvidia’s sales.

Hash-Lite

Some have suggested that crypto mining can only be a small portion of Nvidia’s sales because, in recent years, Nvidia GPUs have a hash-lite feature that limits their effectiveness in mining, and therefore, makes their GPUs unattractive for mining. It is true that Nvidia GPUs ship with a limited mining effectiveness. However, as is common knowledge (and has even been pointed out by analysts on Nvidia earnings conference calls), it is very easy to bypass the feature and unlock the full mining power of Nvidia GPUs. Step-by-step tutorials for miners are available with a simple Google (GOOGL) search.

This piece of evidence is consistent with Ethereum mining being a large portion of Nvidia’s sales.

Semiconductor Slowdown

It’s possible that the slowdown we’ve seen in PCs, memory, and related markets is a sign of weaker consumer demand, and that’s actually what is driving Nvidia’s sales collapse. And this is likely a factor to some degree. It is likely that some portion of Nvidia’s sales collapse is related to a broader decline in demand we see as COVID-related demand goes away. PC purchases were elevated for the past couple of years as people needed to work and learn from home.

But I think it’s important not to get the causality backwards here. The drop in demand that Micron reported was sudden and caught management off guard. Why would there be a sudden drop in demand for a commodity like memory? Well, this drop in demand coincided with major advancements in Ethereum’s move to abandon GPU mining. Not only did people stop buying GPUs, they also stopped buying PCs to run the GPU software and memory to put in the PCs.

In the past couple of years of this crypto bull market, I recall seeing photos of mining rigs composed of gaming laptops. People literally bought entire laptop computers for the purpose of mining Ethereum. It should come as no surprise that demand for PCs, memory and related components should drop at the same time that miners stop purchasing new mining rigs and GPUs.

This piece of evidence opens the door for some portion of demand to come from weaker consumer demand generally but is also consistent with Ethereum mining being a large portion of Nvidia’s sales. It may also be that a lot of the general semiconductor industry weakness is a result of the drop in demand for Ethereum mining rigs.

Pent-Up Consumer Demand May Actually Be Helping Nvidia

Are Nvidia’s sales suddenly falling off a cliff (60% in 2 quarters!) primarily a result of weakened consumer demand? In contrast to this theory, we actually see some anecdotal reports that gamers are rushing out to buy GPUs now that prices have come down to MSRP, or even below MSRP in many cases. For years, many gamers were priced out of the market due to the strong demand from miners. And this pent-up demand is helping Nvidia to clear out their massive inventory.

YouTuber Classical Technology recently highlighted anecdotal reports that gamers are rushing to buy newly lower-priced GPUs.

YouTube

This piece of evidence is consistent with Ethereum mining being a large portion of Nvidia’s sales.

Conclusion

There appears to be ample evidence that a huge portion of Nvidia’s sales in recent years came from crypto mining. And the evidence does not appear to support a majority of the sales decline to be a result of a temporary drop in consumer demand.

If this is correct, then something like $1.5 billion to $2 billion per quarter in Nvidia Gaming and Professional Visualization sales was from Ethereum mining and is gone permanently.

But if this analysis is incorrect, then Nvidia Gaming and Professional Visualization sales should quickly jump back to prior highs when the PC market returns to growth in the coming quarters. And perhaps even sooner, since Nvidia is primed to release their new 4000 series cards in the coming weeks. We will know within a couple of quarters.

Nvidia faces multiple headwinds that will hamper Data Center as well as Gaming and Professional Visualization lines. I don’t believe that consumer demand is there to return gaming GPU demand to prior highs anytime soon.

With revenues and earnings falling off a cliff and such a high earnings multiple, I believe the stock is a strong sell.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Dai

Dai  USDT0

USDT0  Canton

Canton  Toncoin

Toncoin  PayPal USD

PayPal USD  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  USD1

USD1  Polkadot

Polkadot  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token