In January, Celsius Network boss Alex Mashinsky gathered his investment team to tell them he would be taking control of the crypto lender’s trading strategy ahead of an upcoming US Federal Reserve meeting.

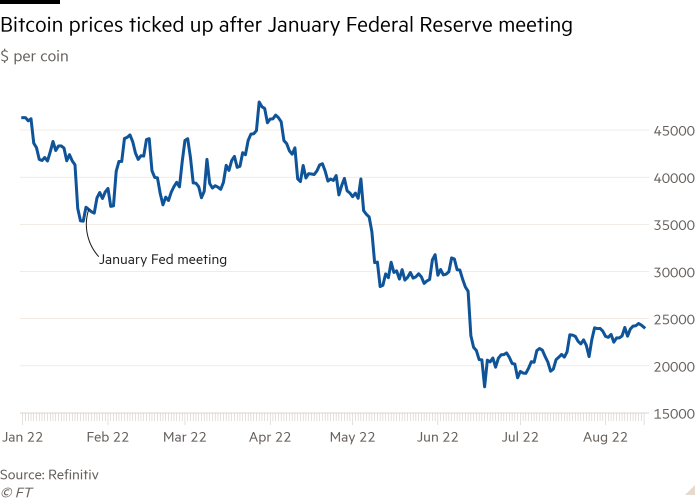

Prices of popular cryptocurrencies such as bitcoin and ether had fallen from their all-time highs and the former telecoms entrepreneur said Celsius needed to protect itself from further declines. A hawkish outcome, he was convinced, could crash crypto prices.

In the days before the Fed met, Mashinsky personally directed individual trades and overruled executives with decades of finance experience, according to multiple people familiar with the matter.

In one case, Mashinsky ordered the sale of hundreds of millions of dollars’ worth of bitcoin, refusing to wait to double check Celsius’s often unreliable information on its own holdings. Celsius — which at the time held $22bn of customer crypto assets — bought the bitcoin back a day later at a loss.

“He was ordering the traders to massively trade the book off of bad information,” one of the people said. “He was slugging around huge chunks of bitcoin.”

Another person familiar with the events said that while Mashinsky may have been making his views known based on his knowledge of crypto markets, they insisted “he was not running the trading desk”.

Mashinsky’s fears were not borne out in the short term. The Fed confirmed plans to raise rates and crypto markets shrugged. Celsius made $50mn of trading losses in January, some of the people said, though it is not clear how much was attributable to Mashinsky.

The previously unreported events highlight the fraught internal dynamics at Celsius in the months leading up to its July bankruptcy filing, including its weak systems for tracking assets, Mashinsky’s fears about a downturn, and his willingness to directly involve himself in trading decisions, unlike typical chief executives of large financial institutions.

Celsius built itself up by accepting crypto from its customers and promising them eye-popping returns it generated through deploying the tokens in digital asset markets. Its hundreds of thousands of clients now face significant losses on the crypto they entrusted to the company, which has a $1.2bn hole in its balance sheet.

Mashinsky and Celsius’s lawyers Kirkland & Ellis have told the court in New York that the company was pushed into bankruptcy not by mismanagement but by the broader collapse this year in crypto asset prices. Lawyers representing Celsius’s unsecured creditors, overwhelmingly its customers, have vowed to investigate Mashinsky’s conduct.

An attorney for Mashinsky declined to comment. Celsius and its lawyers at Kirkland did not respond to a request for comment. In a filing to the bankruptcy court last month, Mashinsky said Celsius’s assets had grown faster than its ability to invest them and acknowledged it “made what, in hindsight, proved to be certain poor asset deployment decisions”.

‘High conviction’ trade

At the start of the year, Celsius had the outward confidence of a business that had just completed a $600mn equity fundraising round led by two big investors, Canada’s second-largest pension fund Caisse de dépôt et placement du Québec and US investment group WestCap.

The funding round in December 2021 had valued Celsius at $3bn. The fast-growing lender, founded in 2017, boasted that it was hiring “traditional finance executives”. But problems were bubbling under the surface.

Though Mashinsky claimed Celsius’s business of taking in crypto deposits and lending them out was safe — he insisted publicly it did not trade customer assets — the company had suffered big losses of crypto tokens it had not disclosed to customers.

One incident involved a US-based lender called EquitiesFirst, which in July 2021 had been unable to immediately return $500mn worth of bitcoin Celsius had pledged to secure a loan, Mashinsky told the bankruptcy court last month.

Another, not previously reported, involved a sizeable investment in the Grayscale Bitcoin Trust, the world’s largest bitcoin fund whose GBTC units offered investors a tradeable product that tracked the digital token.

Celsius had bought into GBTC when it traded at a premium to the underlying bitcoin in the fund. By September 2021, Celsius held 11mn GBTC, then worth about $400mn but trading at a 15 per cent discount to the trust’s net asset value.

Celsius was offered a deal to exit the position that month that would have cut the company’s losses, but Mashinsky blocked the sale, arguing that the discount might narrow, according to two people familiar with the matter. Instead it worsened. Celsius would not completely unwind its position until half a year later in April, when the discount was 25 per cent.

The company’s total losses on its GBTC trade were about $100mn to $125mn, according to one of the people familiar with the matter.

Celsius had plugged its losses in part by borrowing from other crypto ventures. It pledged crypto tokens it held as security for loans of stablecoins — the equivalent of dollars in crypto — that it would use to buy crypto assets to replace those it had lost, several people familiar with the matter said.

These arrangements left Celsius vulnerable if crypto prices fell sharply. Customers might demand their crypto back at the same time that Celsius had to send more to its lenders as additional collateral for its stablecoin borrowings.

The company would have little of its own cash to fall back on in such a situation. Celsius had been paying out more in interest to customers on tokens such as bitcoin and ether than it generated through its investments, according to people familiar with the matter. And it invested much of the $600mn it raised from investors led by CDPQ and WestCap into its capital-intensive crypto mining business and the acquisition of an Israeli start-up, Kirkland told the bankruptcy court last month.

On Sunday, Celsius disclosed that its current monthly net cash flow was significantly negative. Between August and October, the company estimated it would lose $137mn, largely attributable to its mining business. The figures included $33mn of restructuring costs.

Balance sheet figures previously disclosed in the bankruptcy proceedings showed that as early as March this year Celsius’s liabilities were greater than its assets but for holdings of its own digital token CEL. Two people familiar with the matter said that had been the situation since 2021.

In January 2022, it seemed a moment of crisis had arrived. The company had been taking losses for much of the month with the downturn in crypto prices. On a call on January 21, the Friday preceding the Fed meeting, Mashinsky told his investment team that the coming week would be the most defining of their careers.

“He had a high conviction of how bad the market could move south. He wanted us to start cutting risk however Celsius could,” said one of the people familiar with the events. Not everyone agreed.

Over the coming days, Mashinsky clashed repeatedly with his then-chief investment officer, Frank van Etten, a former Nuveen and UBS executive, over what trades Celsius should make, but also over Mashinsky involving himself in such decisions.

Van Etten, who had joined in September 2021, left in February this year, according to his LinkedIn entry. Mashinsky in a January 14 press release cited his arrival at Celsius as an example of “top tier talent” joining the company. Van Etten said he was not in a position to comment at this time.

Cryptofinance

Critical intelligence on the digital asset industry. Explore the FT’s coverage here.

The sale and then buyback of bitcoin Mashinsky ordered came just a day or two before the Fed meeting. One reason he had been pushing for Celsius to sell was linked to the issue with EquitiesFirst in 2021.

EquitiesFirst owed Celsius bitcoin and Celsius had hedged that exposure by buying bitcoin ahead of repayment. Mashinsky argued that EquitiesFirst might pay back its bitcoin debt faster as prices fell.

If that happened, Celsius would have more bitcoin than it currently forecast. It usually tried to maintain a neutral position on its crypto holdings to balance assets and liabilities. By selling bitcoin now before prices dropped, Celsius could profit, Mashinsky reasoned.

“It was not an irrational thought,” another of the people familiar with the events said, but there simply wasn’t evidence EquitiesFirst would repay any faster. “There was a lot of speculation,’ they added.

EquitiesFirst said: “We entered into an agreement well before the January date mentioned. Any alteration to that agreement would have required consensus from all parties.” The company added it would satisfy all its obligations to Celsius.

Mashinsky’s fears about the market proved to be at least poorly timed. While the Fed confirmed plans to increase rates in March, there was no collapse in crypto prices until May. Indeed, the bitcoin price rallied in the weeks after the January Fed meeting.

An internal audit report was subsequently presented to the board and Celsius investors WestCap and CDPQ in February that recommended accelerating investments in the company’s technology. WestCap and CDPQ declined to comment.

The report noted the audit was requested by Mashinsky. It covered the period January 1 to January 21, according to two people familiar with the matter. It is unclear why the audit did not include the trading immediately before the Fed meeting.

The Celsius employee who led the internal audit, a former banker with almost two decades of internal audit and controls experience, was shortly after moved to work on new commercial product and partnership ideas.

Click here to visit Digital Assets dashboard

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  sUSDS

sUSDS  Canton

Canton  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor  Pepe

Pepe