da-kuk/E+ via Getty Images

Argo Blockchain (OTCQX:ARBKF) presented its first quarter results this week and is transforming rapidly. Meanwhile, current deterioration in the pricing of crypto poses heightened challenges to the company’s business model.

I have moved from a bearish stance in Argo last July and before to a neutral one last October and now to a “buy”. That reflects a dramatic improvement in the business fundamentals over the past year, as well as a shift in valuation as the Argo share price has fallen 54% since my last bearish piece in July 2021.

New Facility Should Increase Business Potential

The company has been focusing recently on building a big new facility in Texas. The facility became operational this month. Argo expects to increase its hashrate to 5.5 EH/s by the end of 2022, subject to machine deliveries. That compares to last year, which began at 645 petahash and increased to 1,605 petahash, i.e., 1.6EH/s. So last year saw capacity more than double and this year ought to see it more than triple.

But that is only part of the plan for the new facility. In its final results, the company said that hashrate is expected to grow significantly to more than 20 EH/s over the next few years.

With the company trumpeting high mining profitability (a margin of 76% in the first quarter) that ought to be positive for the investment case. However, there are some questions about the costs that building, equipping and operating the new Texas facility will involve. In November, for example, in a stock market release titled “Disclosure of inside information”, the company revealed that

Argo representatives disclosed in a forward-looking statement that the total cost to build and kit out an 800 megawatt mining facility in Texas could be US$1.5-2.0 billion.

As it went on to point out, a number of factors will be material to the total cost, not least the extent to which the company decides to develop the facility ultimately (although if it can operate on the margins the company has been reporting, why not develop it completely?) But that is a lot of expenditure for a company with a current market cap of $300m. The company did raise cash by issuing senior notes in November but that was only $40m and even that was at what I regard as the punitive rate of 8.75%. So there is a bit of a conundrum as to what the ultimate contribution of the Texas facility will be.

Bearish notes from Boatman Capital (reported here) reckon that the company overpaid for the Texas site and also point out the share dilution Argo has subjected its shareholders to. On dilution, arguably that is a smart way for the company to capitalise on the large run-up in its share price over the past couple of years. If it can raise funds and put them into a profitable model on a much larger scale, share price appreciation could more than mitigate the dilution seen so far. But that’s a big if in the constantly shifting world of crypto mining, and it’s also worth bearing in mind that if it wants to raise anything like the total of $1.5-2bn mooted as a possible total cost, either a lot more debt needs to be issued and/or more shareholder dilution is inevitable.

From a risk perspective, I also think that seems like there is an awful lot relying on one facility in the company’s plans. That can be a massive risk if for some reason that facility is destroyed, put out of action or unexpectedly shut down.

Profitability Has Slipped Sharply

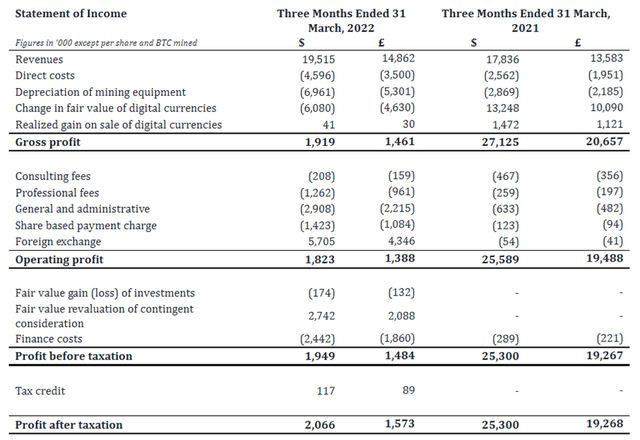

In the first quarter, the company saw its profitably slide dramatically compared to the equivalent period last year. That was largely driven by a change in crypto valuations. It is worth noting, too, that professional fees and general and administrative costs increasing also contributed to the slide. I see that as part of the costs of expansion. The key thing to watch here, in my view, is the impact of crypto pricing on reported profits.

Company announcement

However, the impact of swings in crypto pricing only crystallise for the company if it sells some of its holding. In its statement, the company had nothing to say about crypto price swings. At the end of March, it had 2,700 bitcoin and equivalents and what it described as ample liquidity.

I am not sure “ample liquidity” is fully instructive: while I do not doubt liquidity, scaling back expansion plans would change how one sees this. A cash balance of around $11 million does not seem enough to me to execute all of the company’s plans for its Texas facility without raising more cash, whether by selling coins, issuing more equity or tapping the debt markets.

Valuation Looks Attractive

Argo shares have fallen 56% over the past year, against a 32% slide in Bitcoin valuations.

I think the risks and costs associated with the new facility will continue to weigh on investor sentiment. But the current market cap of $300m looks like good value to me given the company’s proven mining capability and increased mining potential thanks to the new facility.

A lot of the valuation clearly depends on bitcoin pricing and unless that recovers, Argo will likely continue to trade cheaply. But last year’s mining profit was $74m. Even the more standard measure of income came in at $46m. The ramp-up in mining capacity ought to mean the company mines a lot more crypto this year (and beyond), at an attractive mining margin.

How much that is worth depends on crypto pricing, but if that gets back to last year’s level then the current P/E is in mid-single digits even without considering the positive impact on mining haul from the new facility. If crypto pricing not only recovers to last year’s level but surpasses it, the prospective P/E is even lower.

Crypto pricing is obviously a large risk. But if one accepts that risk, I think the Argo valuation currently looks attractive.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  sUSDS

sUSDS  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Uniswap

Uniswap  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Pepe

Pepe