Bitcoin mining stocks like Marathon Digital and Riot Platforms rose by over 4% on Monday as cryptocurrencies bounced back.

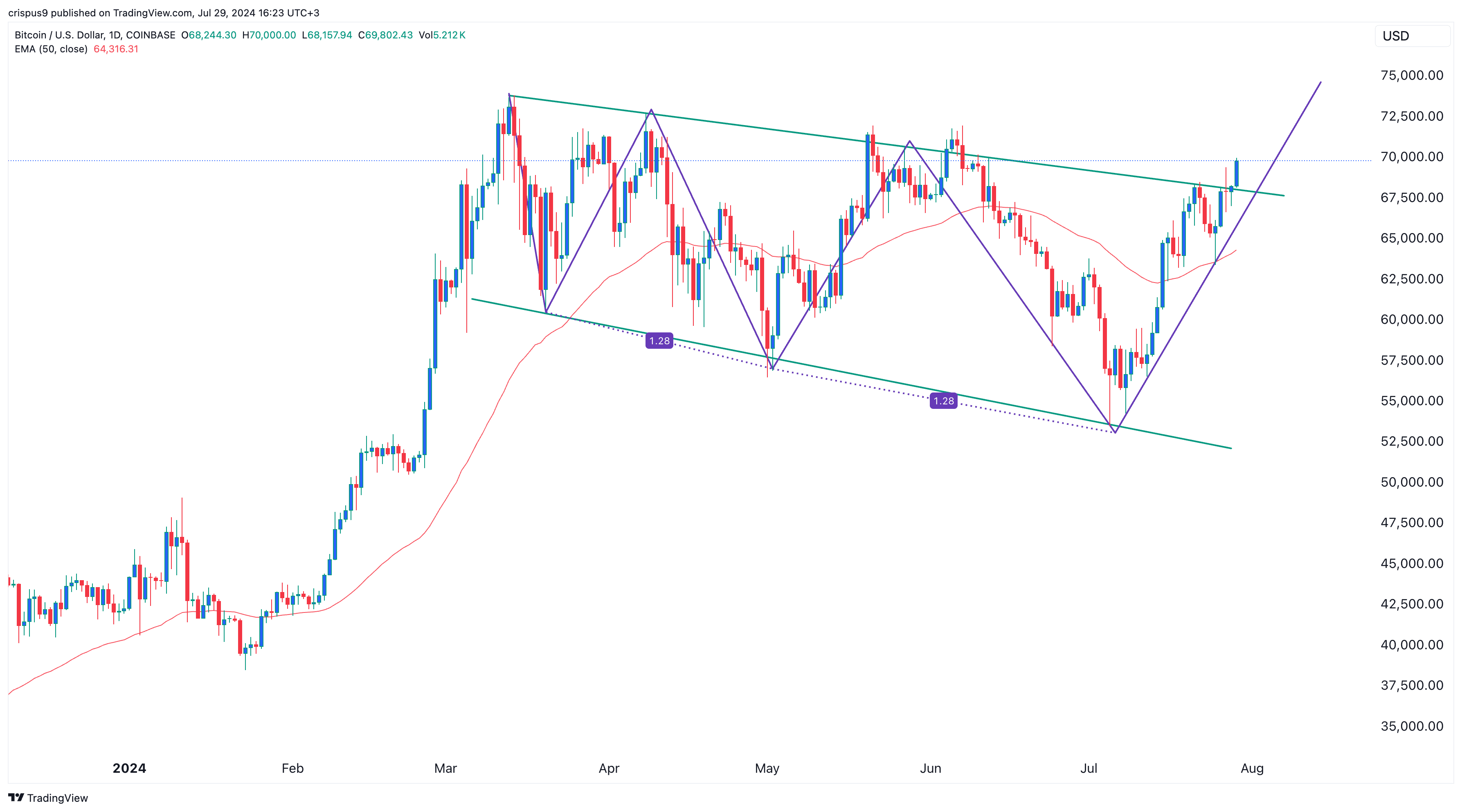

Bitcoin price made a bullish breakout

Marathon Digital (MARA) shares rose to $22.45 while RIOT jumped to $11.7. Other Bitcoin (BTC) mining companies like CleanSpark, Bitfarms, and Core Scientific also rose.

This rebound happened as Bitcoin rose above $70,000 for the first time since June 10. It has moved into a local bull market, rising by almost 30% from its lowest point in July.

Bitcoin’s rally was notable because it flipped the falling broadening wedge pattern, a popular bullish sign. That rebound implies that Bitcoin could continue rising as buyers target the key point at $72,000, where it formed a double-top pattern in May and June.

Bitcoin mining stocks thrive when the coin is rising because they are among the biggest holders. Data shows that Marathon Holdings holds 20,000 Bitcoins on its balance sheet. Just last week, the company bought more coins worth $100 million.

Riot Platforms is the fifth biggest holder after MicroStrategy, Marathon, Tesla, and Coinbase. It has 89,000 coins while Hut 8 Mining holds 89,100.

These companies also benefit when they sell their mined coins. For example, Marathon Digital’s annual revenue rose from $117 million in 2022 to $387 million as Bitcoin rose to almost $50,000 in 2023.

Riot Platforms (RIOT) and Marathon Digital (MARA) earnings

RIOT and MARA stocks could find some resistance when they publish their second-quarter financial results on Wednesday and Thursday, respectively.

These will be important results because they are the first ones since the recent halving event in April. Bitcoin price also remained in a consolidation phase during the quarter.

Since then, most mining companies have reported weak mining data. Marathon mined 590 Bitcoins in June, down from 979 in June 2023 and down from 616 in May.

Similarly, Riot Platforms mined 255 coins in June, a big drop from the 460 it mined in June 2023.

The average estimate is that Marathon Digitals’ revenue rose by 93% YoY in Q2 to $157 million. That increase will be because of higher Bitcoin prices. It made $165 million in the first quarter. Riot Blockchain made $79.3 million in Q1 and is expected to have made $72.2 million in Q2.

Historically, quarterly earnings have an impact on stocks. For example, Tesla stock retreated last week after releasing weaker-than-expected Q2 numbers.

Fortunately for Bitcoin mining stocks, industry insiders remain upbeat that Bitcoin will continue rising. MicroStrategy’s Michael Saylor expects BTC to rise to $13 million while Michael van de Poppe believes that it has more upside as long as it stays above $62,000. Plan B expects Bitcoin to double in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  sUSDS

sUSDS  Canton

Canton  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor  Pepe

Pepe