- Traders are euphoric and anticipate a rebound in Bitcoin, Binance Coin, XRP and Cardano, showing massive bullish sentiment.

- Outlook on Ethereum remains bearish despite the recent rally in top cryptocurrencies.

- Whales have started accumulating Bitcoin on Binance and Coinbase, indicating a rally in the asset.

Trader sentiment on Bitcoin and top altcoins like Binance Coin, XRP and Cardano has turned bullish. Crypto intelligence tracker Santiment considers that the crowd is currently euphoric on these cryptocurrencies, indicating the possibility of a November rally.

Also read: Will crypto adoption skyrocket in Japan with relaxed crypto rules and easy listing

Crypto crowd sentiment on altcoins turns bullish

Analysts noted a persistent negative sentiment and bearishness among traders towards Bitcoin and top altcoins in the last two months. Based on data from crypto intelligence tracker Santiment, traders have turned bullish on Bitcoin, Binance coin, XRP and Cardano. The sentiment towards the largest altcoin Ethereum is just slightly bearish.

Crowd sentiment on Bitcoin, XRP, Cardano and Binance Coin

Though the strength of the USD has kept risk assets like cryptocurrencies under check, crowd sentiment is considered a catalyst for asset’s price rally. Bitcoin is stuck inside a tight range, awaiting an explosive breakout. The longer Bitcoin price trends within the range, the higher the eventual breakout.

Short-term uncertainty and lack of volatility has not deterred institutional investors. Based on a survey by BNY Mellon, 91% of institutional investors are keen on investing in tokenized assets over the next few years.

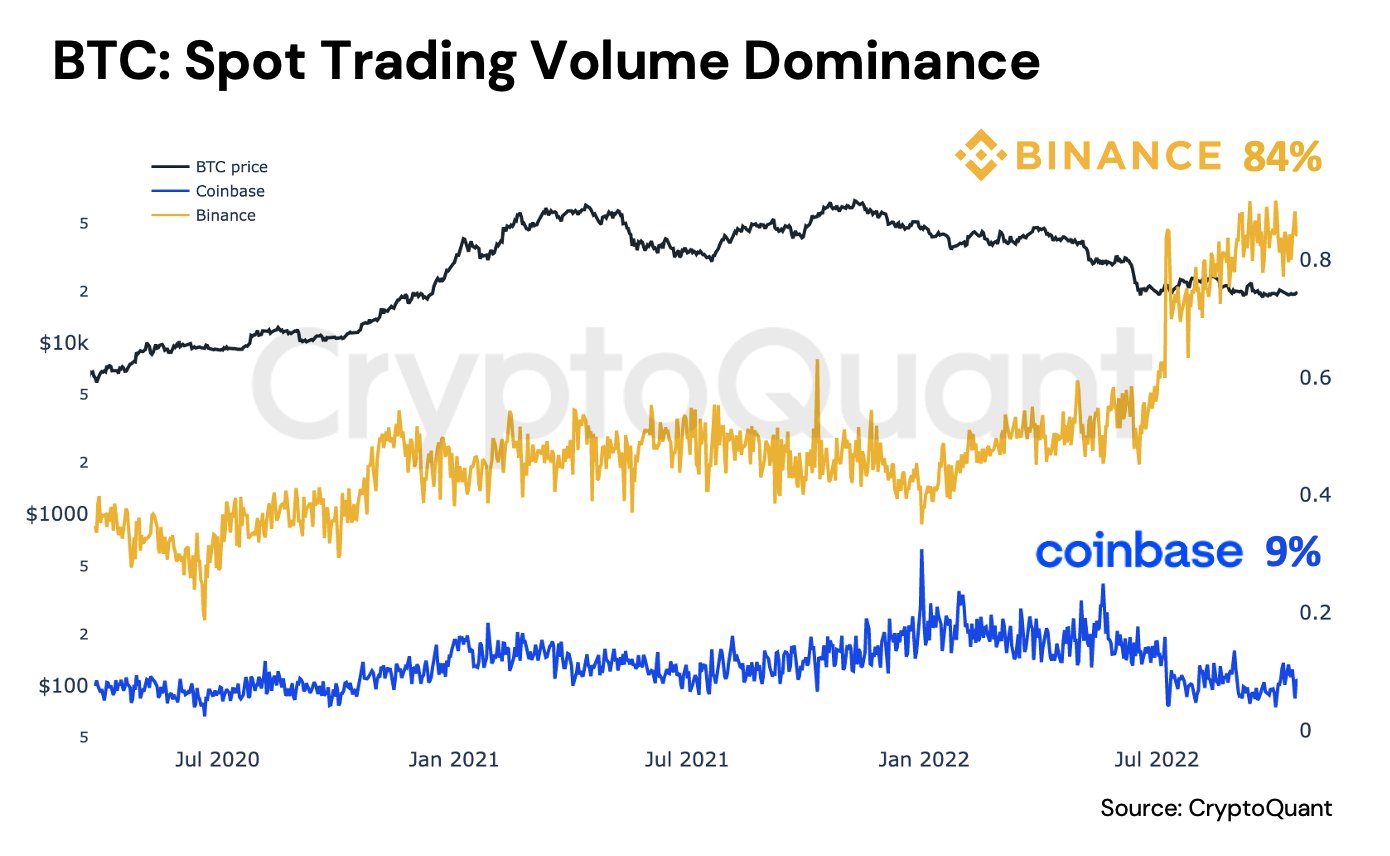

Bitcoin accumulation signals price rally

Large wallet investors are accumulating Bitcoin on centralized exchanges Binance and Coinbase. Based on data from CryptoQuant, accumulation started when BTC price hit the $20,000 level. Bitcoin spot trading volume dominance skyrocketed, hitting 84%. Typically, accumulation by whales and spot trading volume dominance are bullish signals for Bitcoin price.

BTC spot trading volume dominance

Bitcoin spot trading volume for all exchanges has increased twenty times over the past six months. The volume renewed a year-high in September 2022, however since then there has been no significant change in the daily closed price, indicating someone is buying all the sell-side liquidity.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Ethena USDe

Ethena USDe  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Sui

Sui  WETH

WETH  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Dai

Dai  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  Bitget Token

Bitget Token  OKB

OKB  USD1

USD1  Ethena

Ethena  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund