petesphotography/iStock Unreleased via Getty Images

Bitcoin (BTC-USD), ethereum (ETH-USD) and a slew of cryptocurrencies are trading in the red Wednesday morning, as U.S. Treasury yields spike ahead of the Federal Open Market Committee’s meeting scheduled at 2:00 p.m. ET.

Specifically, bitcoin (BTC-USD -4.2%) is sliding back under its $45K key level, recently changing hands at $44.7K, though still elevated by 15.5% M/M. Ethereum (ETH-USD -5.7%) is drifting down to $3.3K per token but +30% M/M.

U.S. stocks are also experiencing selling pressure in premarket trading, with all three major stock market index futures pointing to a weaker open. Meanwhile, the 10-year U.S. Treasury yield (TLT) is extending massive gains to 2.62%, the highest since mid-2019. This comes as the Fed minutes are expected to reveal details on balance sheet runoff; Fed Governor Lael Brainard on Tuesday pivoted to a more hawkish stance, saying the balance sheet reduction could start “at a rapid pace as soon as” the FOMC’s May meeting.

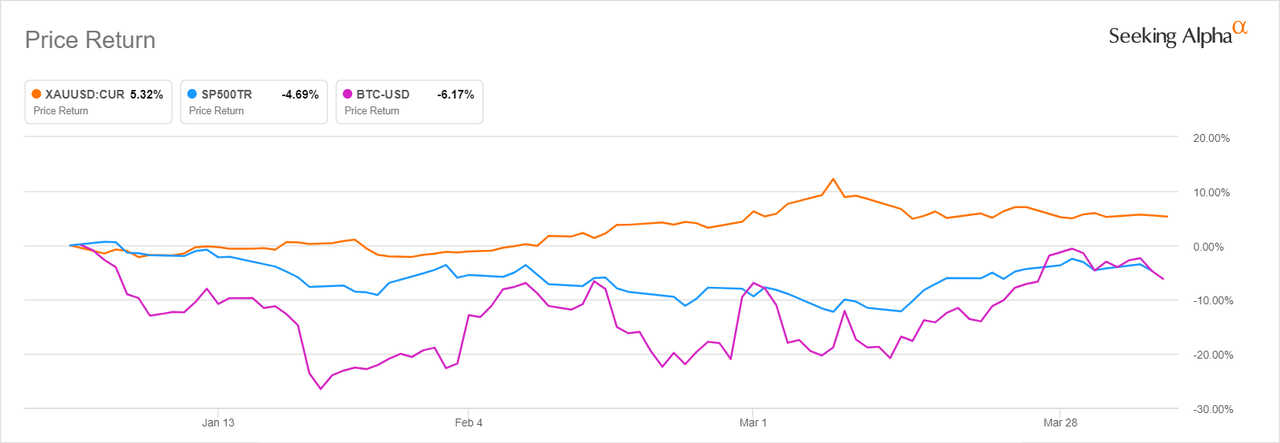

“Another big leg up for #gold and #bitcoin will likely occur when real yields stop rising,” Jeroan Blokland, founder and head of research at True Insights, wrote in a Twitter post, adding “we are not there yet.” Amid Fed tightening, geopolitical tensions and inflationary pressures, Gold (XAUUSD:CUR) is clearly outpacing both BTC and the stock market (SP500) YTD as seen in the chart below.

For company-specific news, Worldpay from Fidelity National Information Services (FIS) will offer merchants the ability to receive settlement directly in USD Coin (USDC-USD), the second largest stablecoin by market cap. Note that stablecoins are digital tokens pegged to a more stable asset, such as the U.S. dollar, and can be redeemed one-to-one.

“Cryptocurrencies, for the most part, tend to be quite volatile and lack the ability to redeem at a predictable exchange rate in large quantities. That is why USDC is so popular among consumers who use crypto exchanges, and why it is so appealing to traditional merchants and other corporates,” said Nabil Manji, SVP, head of Crypto and Web3 at Worldpay from FIS. “By making it easier and more efficient for crypto-native companies and other corporates to receive and manage stablecoins, this will further drive corporate innovation in payments and benefit the consumer ecosystem.”

More cryptos: binance coin (BNB-USD -4.7%), solana (SOL-USD -9.5%), ripple (XRP-USD -4.3%), cardano (ADA-USD -7.9%), avalanche (AVAX-USD -9.4%), polkadot (DOT-USD -8.7%), dogecoin (DOGE-USD -2.5%), shiba inu (SHIB-USD -4.6%), wrapped bitcoin (WBTC-USD -4.2%), polygon (MATIC-USD -8.0%), NEAR protocol (NEAR-USD -3.3%) and litecoin (LTC-USD -6.1%).

On Tuesday, Georgia’s central bank planned to regulate cryptos.

Credit: Source link