Bitcoin Analysis

Bitcoin’s price saw a late afternoon rally on Sunday from bullish traders but they fell just short of getting BTC’s price back in positive figures for Sunday’s trading session. BTC’s price closed its daily candle -$140.

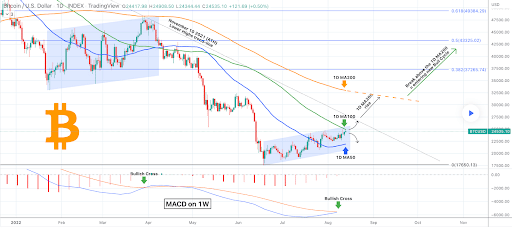

The first project we’re analyzing today is bitcoin and the BTC/USD 1D chart below from Ronya63. BTC’s price is trading between the 0 fibonacci level [$17,879.38] and 0.236 [$25,062.72], at the time of writing.

Traders seeking higher prices have targets above on BTC of 0.236, 0.382 [$29,506.65], and 0.5 [$33,098.32].

Traders that are short the BTC market are looking for a retracement back down to the 0 fibonacci level to retest its 12-month low on the BITSTAMP chart.

We can see on the chart above from TradingShot, BTC’s price again touched the 1D MA 100 over the weekend for the first time since April.

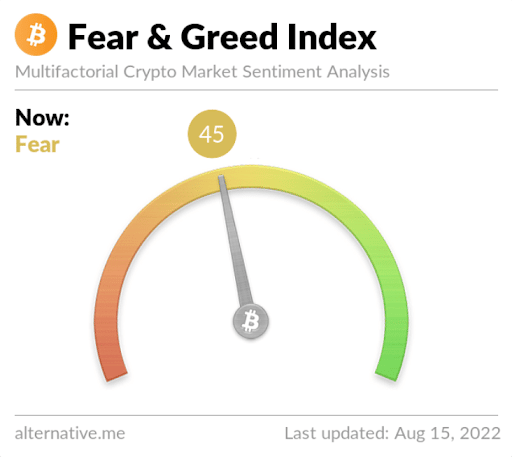

The Fear and Greed Index is 45 Fear and is -2 from Sunday’s reading of 47 Neutral.

Bitcoin’s Moving Averages: 5-Day [$23,912.45], 20-Day [$23,109.34], 50-Day [$22,612.67], 100-Day [$29,728.68], 200-Day [$37,995.26], Year to Date [$33,947.93].

BTC’s 24 hour price range is $24,144-$25,047.6 and its 7 day price range is $22,826.07-$25,047.6. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of bitcoin on this date last year was $47,031.

The average price of BTC for the last 30 days is $22,888.6 and its +19.9% over the same time frame.

Bitcoin’s price [-0.57%] closed its daily candle worth $24,301.3 and in red figures for the first time since August 11th.

Ethereum Analysis

Ether’s price also traded lower at Sunday’s session close than at its open and when Ether market participants settled-up on Sunday ETH’s price was -$48.51.

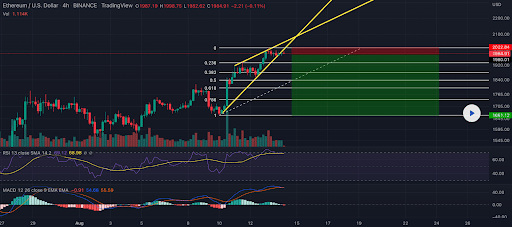

The second chart we’re looking at today is the ETH/USD 4HR chart below by MarketAnalyzerFX. ETH’s price is trading between 0.382 [$1,880.44] and 0.236 [$1,934.46], at the time of writing.

Bullish traders are looking to again test the $2k level with a full retracement overhead at 0 [$2,020.45].

Bearish ETH traders have given up a lot of ground over the last month and would like to draw their line in the sand at the $2k level. If they can stop bullish ETH traders from regaining that level again, their targets to the downside are 0.382, 0.5 [$1,840.92], and 0.618 [$1,796.77]

Ether’s Moving Averages: 5-Day [$1,833.91], 20-Day [$1,651.03], 50-Day [$1,412.57], 100-Day [$2,024.32], 200-Day [$2,727.68], Year to Date [$2,355.99].

ETH’s 24 hour price range is $1,906-$2,030 and its 7 day price range is $1,671.64-$2,030. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,308.41.

The average price of ETH for the last 30 days is $1,627.32 and its +72.96% over the same duration.

Ether’s price [-2.45%] closed its daily candle on Sunday worth $1,935.03 and in red figures for the first time in five days.

Shiba Inu Analysis

Shiba Inu’s price was the top performer of today’s projects and Shiba bulls closed out Sunday’s session +$0.00000429.

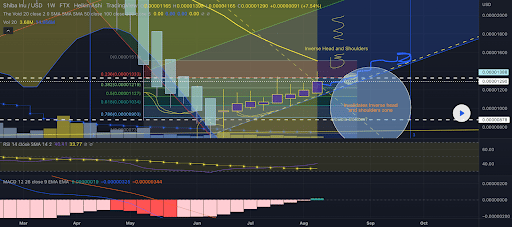

The third chart for this Monday is the SHIB/USD 1W chart below from Metaframe.

Shiba Inu’s price had a clear breakout over the weekend and that carried over onto the weekly time frame as well. As traders can see Shib’s price eclipsed a full retracement at the 0 fibonacci level [$0.00001518] and bulls now have a primary target of $0.00001800.

Bearish SHIB market participants are again looking to retest the 0 fib level with a secondary target of 0.236 [$0.00001333]. The third target to the downside for bearish SHIB traders is 0.382 [$0.00001219].

Shiba Inu’s 24 hour price range is $0.0000126-$0.000018 and its 7 day price range is $0.00000998-$0.00001700. SHIB’s 52 week price range is $0.00000513-$0.0000884.

SHIB’s price is +106.8% against The U.S. Dollar for the last 12 months, +300.5% against BTC, and +248.7% against ETH, over the same duration.

Shiba Inu’s price on this date last year was $0.00000855.

The average price of SHIB over the last 30 days is $0.00001190 and it’s +54.93% over the same timespan.

Shiba Inu’s price [+33.97%] closed its daily trading session on Sunday worth $0.00001692 and SHIB’s alternated between green and red candles on the daily time frame for the last week.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  Canton

Canton  Shiba Inu

Shiba Inu  USDT0

USDT0  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  PayPal USD

PayPal USD  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  USD1

USD1  Polkadot

Polkadot  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token