The Bitcoin price has surged by 9.4% over the last seven days, with a single-day spike of 9.65% between April 21 and 22. This rally comes amid a notable shift in on-chain behavior—one that echoes patterns seen before Bitcoin’s historic 2017 bull run.

Fewer BTC Sent to Exchanges — A Bullish Signal?

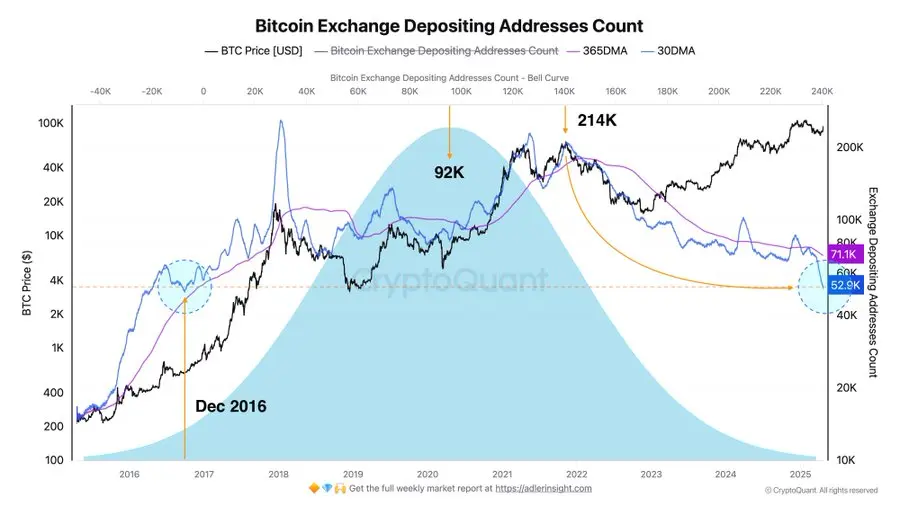

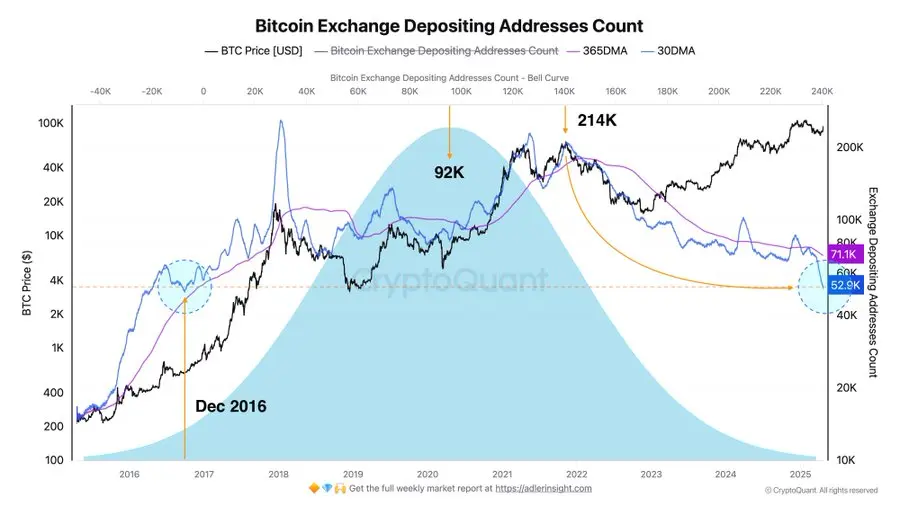

According to crypto analyst Axel Adler Jr, the number of Bitcoin addresses depositing BTC to exchanges is steadily declining—a trend that’s been in motion since 2022. His analysis, based on the Bitcoin Exchange Depositing Addresses Count chart, shows:

- 30-day average: ~52,000 addresses

- Yearly average: ~71,000 addresses

- 10-year average: ~92,000 addresses

This significant drop suggests a cooling in selling pressure. Typically, when investors move BTC to exchanges, it signals an intent to sell, so fewer deposits imply growing confidence in holding.

Chart Flashback: December 2016

The current address count mirrors levels not seen since December 2016. Back then, Bitcoin recorded a monthly gain of 29.2%, followed by an explosive 1,369% price rally in 2017. Could history be repeating?

Adler believes so. He interprets the decline in exchange deposits as a sign of rising HODL sentiment—investors choosing to hold rather than sell.

- Also Read :

- Investors Still Skeptical About the BTC Price Rally-—Is This a Calm Before the Storm or a Reversal Incoming?

- ,

What It Means for Bitcoin Price

With fewer coins moving to exchanges and recent gains of 13.3% in the past two weeks, the Bitcoin price appears primed for further upside. If the pattern follows that of late 2016, this could mark the early stages of a substantial bull run.

As HODLing gains momentum and selling pressure wanes, Bitcoin’s path to new all-time highs might be closer than it seems.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per Coinpedia’s BTC price prediction, 1 BTC could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of 1 Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  Monero

Monero  WETH

WETH  Stellar

Stellar  LEO Token

LEO Token  Zcash

Zcash  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  sUSDS

sUSDS  Hedera

Hedera  Dai

Dai  Shiba Inu

Shiba Inu  USDT0

USDT0  PayPal USD

PayPal USD  Mantle

Mantle  Toncoin

Toncoin  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  Canton

Canton  USD1

USD1  MemeCore

MemeCore  Aave

Aave  Rain

Rain