The crypto market endured its most dramatic setback yet, as total market capitalization nosedived by 8.92% overnight to $3.76 trillion. Successively, CoinMarketCap’s CMC20 index mirrored this plunge, setting at $239.42 as panic swept the industry.

The Crypto Fear & Greed Index is slumping to a fear-driven 35, and the average crypto RSI is falling into an oversold region at 25.97. As a result, the investor confidence faded almost instantly. At the center of this storm, the Bitcoin price crashed steeply, facing intense selling pressure. Further amplifying the sense of crisis and fueling a wave of heavy liquidations that left both traders and long-term holders reeling.

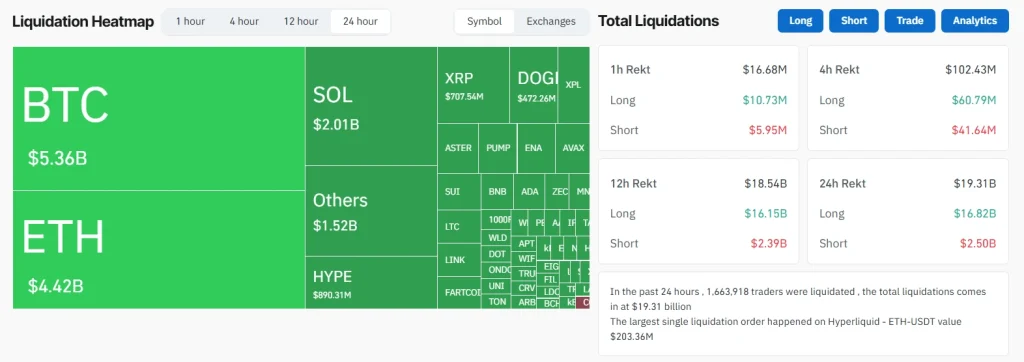

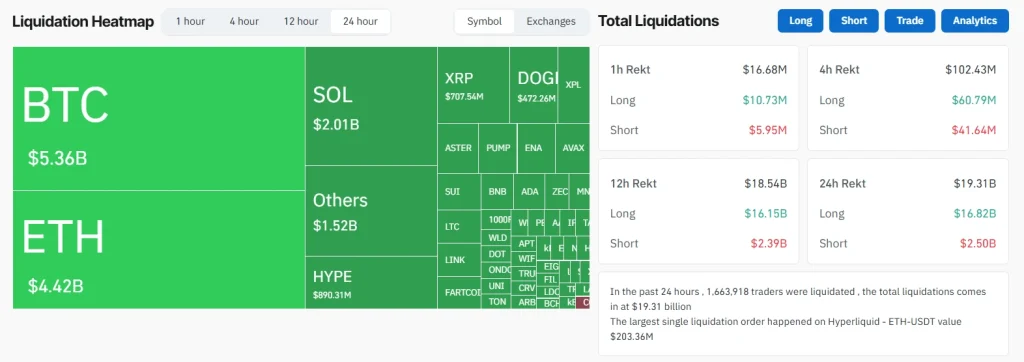

Liquidations Surge Past $19.31 Billion

In what marketers are calling the largest crash in crypto history, a staggering $19.31 billion in positions were liquidated within 24 hours. As per CoinGlass, Bitcoin led the tally with $5.36 billion shed, followed closely by Ethereum at $4.42 billion. Over 1.66 million traders were wiped out as the market underwent a historic leverage flush.

What set this event apart was the convergence of macroeconomic panic and overleveraged derivatives exposure. The catalyst? President Trump’s aggressive stance on Chinese tariffs sent shockwaves across global markets. Including stocks and digital assets.

Bitcoin Price Analysis:

Bitcoin price tumbled 6.91% in a single day to $112,759.64, marking an 8.02% loss over the past week. The market cap dipped by 6.85% to $2.24 trillion, although trading volume soared 141% to $179.86 billion. BTC’s price action saw a dramatic drop below critical moving averages, breaching the psychologically key $113K level and touching a 24-hour low of $104,582.

Technically, watch for price defenses around $109,200, the 78.6% Fibonacci retracement. Consequently, an oversold RSI at 24.85 suggests relief might be due. But the overall backdrop remains clearly risk-off until macro uncertainty fades and ETF inflows broaden beyond a single provider.

FAQs

The primary drivers were U.S.-China tariffs, record derivatives liquidations, and a sharp swing in investor sentiment, with Bitcoin’s correlation with stocks exposing it to broader market panic.

While the RSI signals an oversold setup and some institutions are buying, overall fear remains high. Risk is elevated until support at $109,208 holds.

Key signals include U.S. economic data clarity, stabilization in ETF flows, and Bitcoin holding the $109,208 support.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Dai

Dai  Cronos

Cronos  PayPal USD

PayPal USD  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Pepe

Pepe