Bitcoin (BTC) price has gradually lost its initial July bullish momentum during the past three weeks. The flagship coin has consolidated in a choppy fashion during the past three weeks below $120k amid robust fundamentals, which ordinarily favors bullish sentiment.

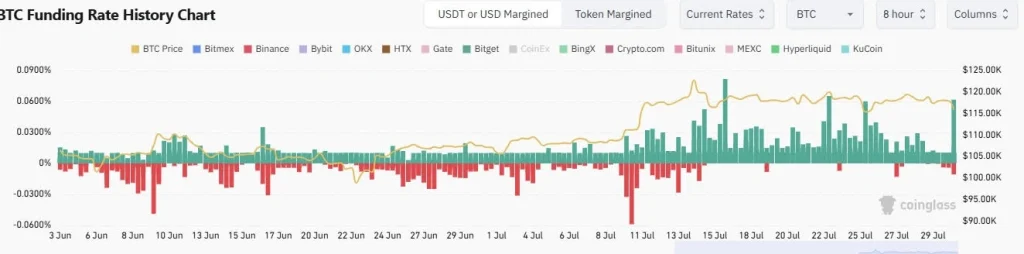

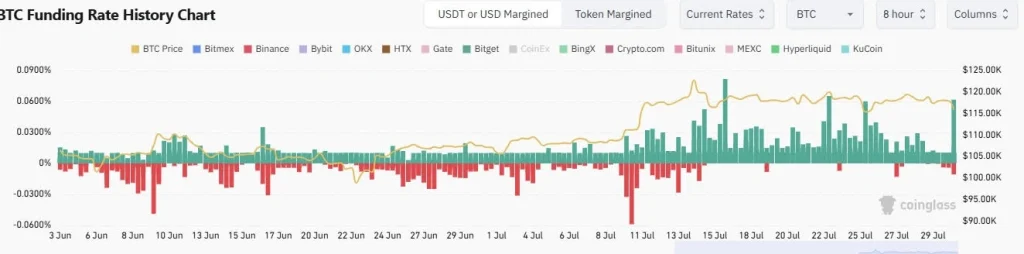

According to market aggregate data from TradingView, BTC price slipped below $117k on Wednesday, resulting in the liquidation of long traders. However, Bitcoin’s OI-weighted funding rate has remained positive in the past 30 days, signaling the existence of macro bullish speculative trading.

Source: Coinglass

Bitcoin Price Falters on Uncertainty in Monetary Policy

Wednesday’s 1.4 percent Bitcoin price drop to trade at about $116,246 during the mid-North American session was influenced by the high-impact news from major central banks. As Coinpedia reported, the Fed held its benchmark interest rate at 4.5 percent.

Earlier on Wednesday, the Bank of Canada held its key interest rate at 2.75 percent. As a result, the Bank of Japan (BoJ) is expected to hold its uncollateralized overnight call rate at 0.5 percent on Thursday.

The crypto market weakened on Wednesday after the Fed confirmed that it will continue to reduce holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The anticipated Quantitative Easing (QE) may not begin potentially until the fourth quarter of 2025, whereby President Donald Trump highlighted that a rate cut could happen.

Bigger Picture

The BTC/USD pair in the daily timeframe has signaled bullish sentiment in the long haul despite the midterm capitulation fears. From a technical analysis standpoint, BTC price has formed a bullish flag pattern, which could lead to a breakout towards $130k soon.

The macro bullish sentiment is bolstered by the rising demand from corporate investors led by Strategy (NASDAQ: MSTR). Additionally, the favorable regulatory outlook in the United States, as observed in the recent approval of in-kind creation and redemption of crypto assets ETPs by the SEC.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  Zcash

Zcash  Shiba Inu

Shiba Inu  Dai

Dai  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Aave

Aave  USD1

USD1  Bittensor

Bittensor  Bitget Token

Bitget Token  MemeCore

MemeCore