Bitcoin (BTC) price faces a midterm risk of dropping below $100,000 soon, Standard Chartered’s Geoff Kendrick says. According to the bank’s market analyst, the Bitcoin price may briefly fall below $100k amid trade war worries.

However, Geoff noted that the potential Bitcoin price drop below $100k may be short-lived. As such, Geoff noted that such a Bitcoin move would be a buying opportunity, for as long as the asset remains above the 50-week Moving Average (MA).

Standard Chartered Relates Bitcoin and Gold Moves

According to the bank’s analyst, Bitcoin price recently briefly rebounded after gold recorded its worst two consecutive days since mid-August 2025. Geoff noted that BTC price briefly rebounded as capital rotation from gold to the flagship coin escalated.

As such, if the Gold price continues with its weakness in the midterm, the Bitcoin price may experience a parabolic rally. The Bitcoin buying opportunity will continue for as long as the fear and greed index continues to hover in the fear zone of below 30.

Other Key BTC Opinions to Consider

According to Mike Novogratz, CEO of Galaxy, the Bitcoin price is likely to hold above the support level around $100k in the midterm. In an interview on Wednesday, Novogratz noted that the Bitcoin price will likely rally if President Donald Trump makes a move on the Federal Reserve amid the anticipated rate cuts.

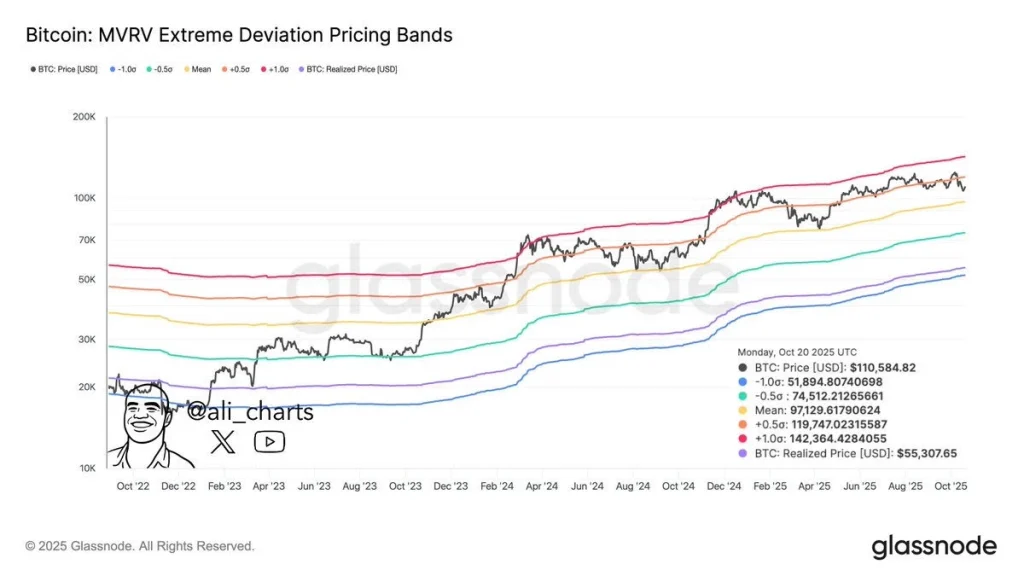

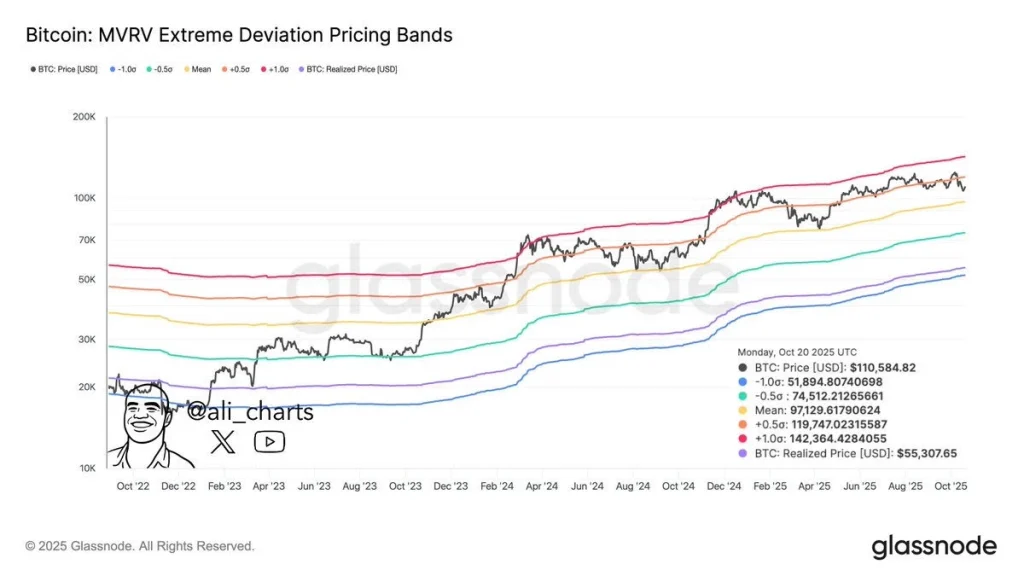

Meanwhile, the Bitcoin MVRV Extreme Deviation Pricing Bands from Glassnode show that the flagship coin has lost a crucial support level above $120k. Consequently, BTC price must consistently rally above $120k to invalidate a capitulation towards $97k or even $74.5k in the worst-case scenario.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Canton

Canton  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Toncoin

Toncoin  Dai

Dai  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Uniswap

Uniswap  Cronos

Cronos  PayPal USD

PayPal USD  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Pepe

Pepe  Aave

Aave