The Solana price has continued its remarkable climb into Q4 2025, as network performance, ETF inflows, and on-chain activity are superbly aligning to reinforce its dominance among smart-contract platforms.

With soaring transaction volumes, record TVL, and expanding institutional interest, Solana crypto appears poised for another defining moment in this market cycle.

Wall Street’s New Favorite Blockchain

Over the past week, growing confidence in Solana’s fundamentals has taken center stage in financial circles. Industry leaders have described Solana as “the new Wall Street,” highlighting how its speed, efficiency, and scalability make it an ideal foundation for tokenization, stablecoin settlements, and digital asset trading.

Unlike slower blockchains, Solana’s lightning-fast throughput allows financial assets to move and settle in seconds, giving it a clear edge as tokenized finance accelerates.

Solana Network Metrics at Record Highs

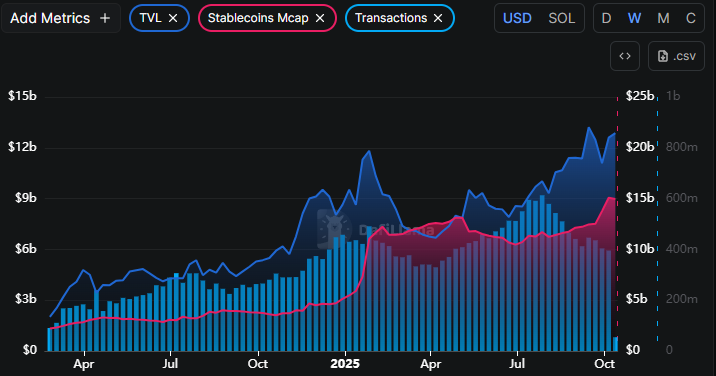

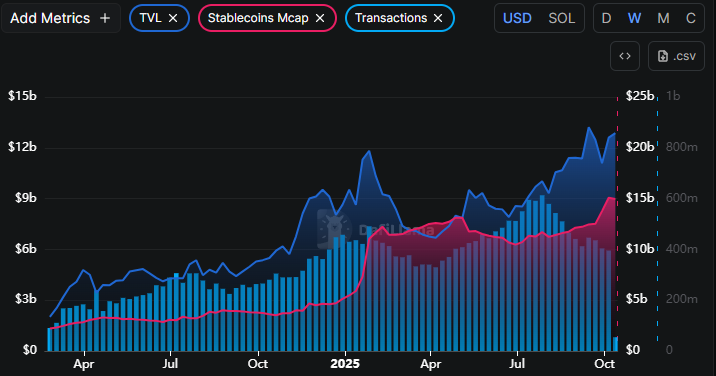

According to DefiLlama, Solana’s total value locked (TVL) has reached $12.86 billion, nearing a new all-time high.

Meanwhile, its stablecoin market cap has already climbed to $14.96 billion, confirming massive liquidity inflows across the ecosystem.

Weekly transactions have also surged, surpassing 395 million in early October, which is a sign of increasing network adoption and utility.

These onchain numbers are not for show; in fact, the Solana price chart reflects this robust growth. SOL price today trades around $234, marking an impressive rebound from April lows of $95 and extending a multi-quarter uptrend.

Bulls are now eyeing a breakout above the key supply zone, which could open the path toward $300 in October and potentially $500 later this year, according to market momentum trends visible in the SOL price trajectory in USD.

Solana ETFs Gain Strong Momentum

Parallel to its on-chain expansion, Solana ETF products have seen rising inflows, despite only a handful of products being live, with many pending SEC approvals.

The three leading products, SOLT, SSK, and SOLZ, have recorded weekly gains of 32.28%, 16.09%, and 15.34%, respectively. These positive performances signal institutional optimism around Solana’s long-term value and resilience.

Adding to the excitement, the list of live ETF products has another entrant, as Grayscale Solana Trust (GSOL) announced today that it has enabled staking, offering investors access to on-chain yields through regulated channels.

Ecosystem Expansion Fuels the SOL Price

Beyond ETFs, Solana’s native protocols are also thriving. Projects like Jupiter, Meteora, and PUMP have gained significant traction, with PUMP alone generating $20.62 million in fees this week.

Such activity highlights the ecosystem’s strength and its ability to generate consistent revenue through real user engagement.

At the same time, performance comparisons show Solana leading the pack in network throughput. A recent data snapshot revealed that Solana is processing up to 1,000 TPS, while other blockchains remain below 250 TPS, cementing its reputation as the speed leader in crypto infrastructure.

With so many factors working in its favor, the Solana price forecast narrative remains bullish. As interest in Solana continues, with many viewing SOL as the backbone of tokenized finance, signaling a potentially historic phase for Solana crypto, before transitioning into the new year.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Zcash

Zcash  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Monero

Monero  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Cronos

Cronos  Uniswap

Uniswap  sUSDS

sUSDS  Polkadot

Polkadot  Toncoin

Toncoin  PayPal USD

PayPal USD  MemeCore

MemeCore  Mantle

Mantle  Canton

Canton  Bittensor

Bittensor  USD1

USD1  Aave

Aave  Currency One USD

Currency One USD