According to CryptoQuant CEO Ki Young Ju, Bitcoin whale inflows are decreasing. The drop in whale activity suggests high-net-worth investors are not currently selling large amounts of BTC. For decentralized finance (DeFi) tokens that have been underperforming, it could serve as a lifeline.

In the past week, both major and small-cap DeFi tokens have struggled to recover.

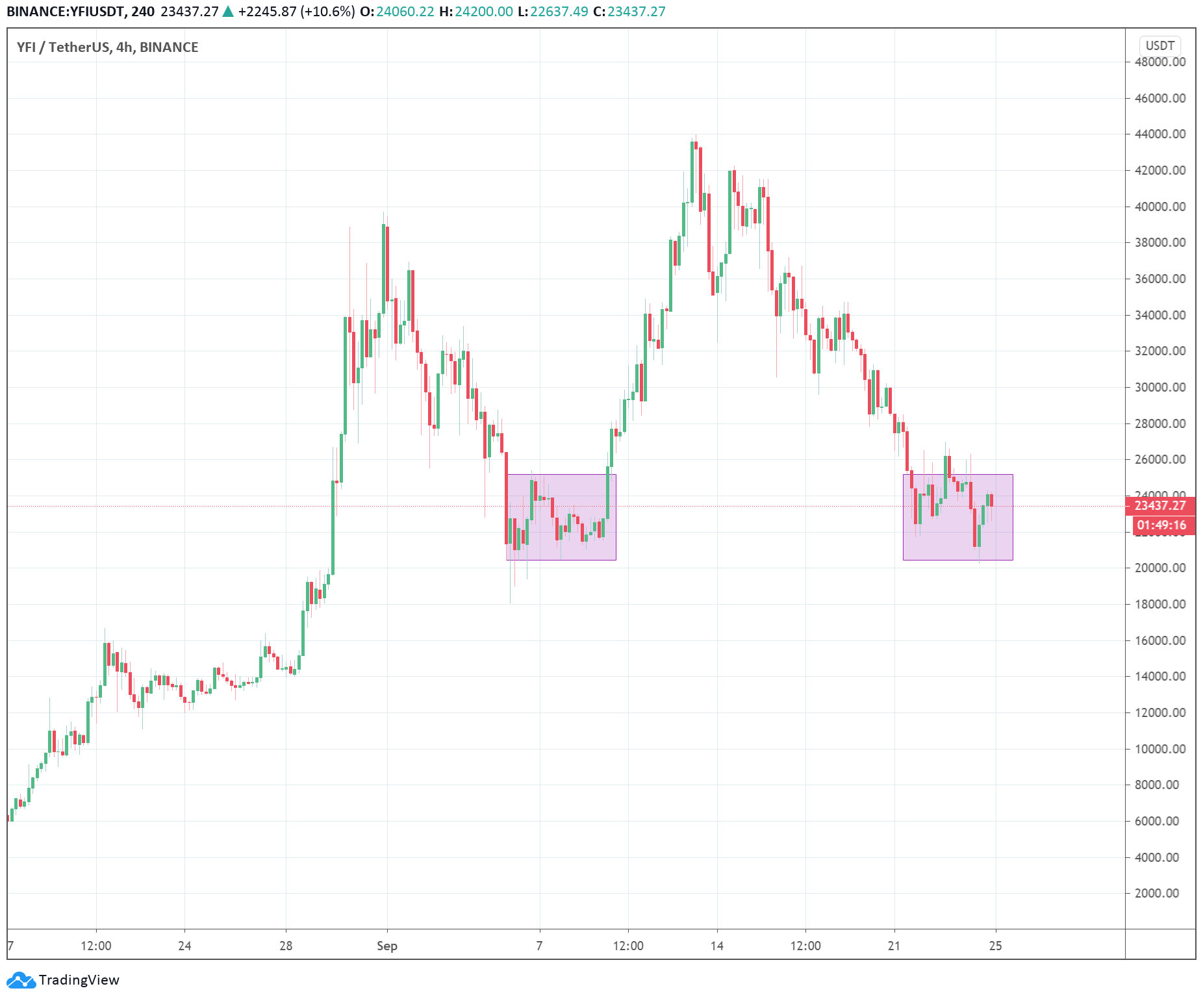

Yearn.finance (YFI), for instance, the $700 million DeFi giant, fell from $43,966 and has stabilized above $23,000. It posted a 47% drop since September 12, within merely two weeks.

The sharp pullback of the DeFi market coincided with brutal Bitcoin and Ethereum (ETH) rejections at key resistance levels.

If the Bitcoin price stabilizes due to slowing the whale activity, it could buoy the Defi market towards recovery.

Could improving Bitcoin whale activity offset short-term bearishness?

On September 21, Ki said Bitcoin would likely face short-term bearishness. He cited the data from on-chain analysis firm CryptoQuant to suggest that whales are seemingly moving to sell BTC.

“I think BTC will face short-term bearish tho. Hourly data of Exchange Whale Ratio has been increasing ever since I posted this tweet, but I’m still long-term bullish,” said Ki.

Since then, in four days, the price of Bitcoin dropped by 7.2% from $10,988 to $10,190 on Binance.

The simultaneous drop of BTC and ETH caused the DeFi market to plummet, causing most DeFi tokens to drop 40%.

But according to Ki, fewer whales are seemingly selling BTC across major exchanges. In the near-term, that could lower the selling pressure on BTC. The executive said:

“Fortunately, whale inflows seem to be decreasing. It seems the $BTC price follows the traditional market lately. I think the only thing we can do with on-chain data at this moment is to watch whale moving. Most of the fundamental on-chain indicators are healthy.”

Other fundamental factors, including the Bitcoin blockchain network’s hashrate, show that the overall sentiment around the BTC market remains positive.

Bitcoin miners sold substantial amounts of BTC from July to August. The selling pressure from miners appears to have subsided in the past week, which could serve as another potential catalyst for recovery.

DeFi tokens show signs of recovery

Although the DeFi market remains down by 40% to 50% on average, major DeFi tokens are showing signs of stabilizing.

YFI appears to be repeating a similar accumulation phase as early September. At the time, BTC dropped to sub-$10,000, causing YFI to briefly drop below $20,000.

In the week that followed, YFI consolidated in the $20,000 to $23,000 range, eventually breaking out.

As long as Bitcoin avoids a drop below $10,000 as some technical analysts suggest, historical cycles show DeFi tokens are likely to rebound.

YFI, which has led the performance of other Y tokens and small-cap DeFi tokens, is defending a crucial support level with strength.

Bitcoin, currently ranked #1 by market cap, is down 0.33% over the past 24 hours. BTC has a market cap of $193.33B with a 24 hour volume of $24.12B.

Bitcoin Price Chart

BTCUSD Chart by TradingView

Like what you see? Subscribe for daily updates.