Ethiopia, which allowed bitcoin mining starting in 2022 even though it still bans cryptocurrency trading, has bolstered ties with China over the past decade, and several Chinese companies helped build the US$4.8 billion dam the miners plan to draw their power from.

Ethiopia has emerged as a rare opportunity for all firms that mine the original cryptocurrency, as climate change and power scarcity fuel a backlash against the US$16 billion-a-year industry (at bitcoin’s current price) elsewhere.

It is also a risky gamble, for the companies and Ethiopia alike.

A succession of developing countries like Kazakhstan and Iran initially embraced bitcoin mining, only to turn on the sector when its energy use threatened to fuel domestic discontent.

“Firstly, countries can run out of available electricity, leaving no room for miners to expand,” said Jaran Mellerud, chief executive of Hashlabs Mining. “Secondly, miners can suddenly be deemed unwelcome by the government and be forced to pack up and leave.”

Ethiopian officials are wary of the controversy that accompanies bitcoin mining, according to industry executives who spoke on condition of anonymity to avoid jeopardising government relations.

Even after new generation capacity came online, almost half the population live without access to electricity, making mining a delicate topic. At the same time, it represents a potentially lucrative source of foreign-exchange earnings.

Ethiopia has already risen to become one of the world’s top recipients of bitcoin mining machines, according to an estimate from mining services provider Luxor Technology. That is even as Luxor’s first major deals to ship equipment there came in September, said chief operations officer Ethan Vera.

The state power monopoly says it has struck power supply deals with 21 bitcoin miners. All but two of them are Chinese.

“Ethiopia will become one of the most popular destinations for Chinese miners,” said Nuo Xu, founder of China Digital Mining Association, which organises exhibitions and facilitates trading in mining machines. He is arranging a trip to Ethiopia for a group of Chinese mining executives to tour potential sites.

That bitcoin miners are willing to ship equipment worth tens of millions of dollars to a country that just two years ago emerged from a civil war in its north is a testament to the fraught political and economic environment in which they exist.

The companies play a crucial role maintaining the bitcoin network by using powerful computers, or “rigs” in industry argot, to solve mathematical puzzles and validate encrypted transactions on the blockchain. In return, they receive rewards in bitcoin released from the network.

It is a volatile business, with revenues tracking the token’s rise and fall. Miner Core Scientific plunged into bankruptcy in December 2022 as cryptocurrency markets crashed; 13 months later it won court approval to exit Chapter 11 after the price of bitcoin jumped almost 150 per cent.

The rigs use vast amounts of power, so access to cheap electricity is a critical competitive advantage. Bitcoin mining consumed 121 terawatt-hours of power in 2023, the Cambridge Centre for Alternative Finance estimates – similar to Argentina’s use. Electricity can account for as much as 80 per cent of miners’ operating costs, according to Mellerud.

This explains why low-cost power has largely dictated where miners put much of their equipment in the past few years: First in China, then in places like Iran, Kazakhstan, Russia and northern Sweden, and most recently Texas. What those places have in common is relatively cheap energy.

The reliance on abundant power is also a major vulnerability because it can put miners in competition for electricity with factories and households, exposing them to political backlash.

When Kazakhstan imposed fresh curbs and taxes on miners, “it basically killed the industry”, said Hashlabs co-founder Alen Makhmetov. Two years after the clampdown, his 10-megawatt facility there is still sitting idle.

And in an era when rising temperatures wreak havoc around the world, bitcoin mining is increasingly seen as a contributor to global warming that does not serve any productive purpose – even though miners have claimed they are increasingly tapping clean energy.

A study by United Nations University published in October estimated that two-thirds of the electricity used for bitcoin mining in 2020 and 2021 was generated using fossil fuels.

The Ethiopian government permitted bitcoin mining mainly because the companies pay in foreign currency for the electricity they consume, Yodahe A. Zemichael, deputy director at the Information Network Security Administration, said in a response to questions from Bloomberg News.

In the written reply, he used terms like “high-performance computing” and “data mining” instead of bitcoin mining.

“Ethiopia is heavily regulated,” said Nemo Semret, CEO of local miner QRB Labs, who helped lobby officials to permit bitcoin mining. “Introducing a new sector like this has been a big challenge, and we’ve been working for the last two years to get all the necessary permissions from the government.”

The government has adopted a directive to regulate “cryptographic products” including mining, according to Yodahe. He added that issuing licences “is being done in a sandbox and it’s in an early stage”, declining to say how many permits have been granted so far.

Semret said uncertainty persists among miners about how authorities will oversee them longer term, and Yodahe declined to say whether the directive has been shared with industry participants.

Yet for bitcoin miners – especially Chinese ones – Ethiopia represents a unique blend of economic and political advantages. Some executives even speak of it as a possible rival to Texas, which represents as much as a quarter of the global capacity to create bitcoin.

Ideal Climate Conditions

The African country’s capacity to supply electricity for creating bitcoin may rival that of Texas in a few years, according to a senior executive at Bitmain, the Beijing-based firm that is the dominant supplier of rigs. The opening of the GERD project increased Ethiopia’s installed generation capacity to 5.3 gigawatt, 92 per cent of which comes from hydropower, a renewable energy source.

Once GERD is fully completed, Ethiopia’s generation capacity will double, according to Ethiopian Electric Power (EEP). It charges bitcoin miners a fixed rate of 3.14 US cents per kilowatt hour for electricity drawn from substations, marketing and business development director Hiwot Eshetu said in an interview.

While that is similar to the average in Texas, rates in the Lone Star State can swing wildly, Luxor’s Vera said, making profits there less predictable. In Ethiopia, the price will fall once miners connect directly to power plants, according to Hiwot. He added that EEP has paused signing new contracts “to ensure a well-controlled and managed process”.

BWP, which hosts machines operated by miners from China and other countries, started shipping equipment to Ethiopia early last year. In December, the company announced on X that it was opening a 120-megawatt data centre for mining equipment – sizeable even by Texas standards – in Addis Ababa, the capital.

CEO Vitaliy Borshenko said Ethiopia’s advantages go beyond cheap, renewable power.

“The ideal temperature for the miners is 5 to 25 degrees” Celsius (41 to 77 Fahrenheit), he said, citing recommendations from rig maker Bitmain. “That is right in the average range of temperature in Ethiopia.” Addis Ababa is almost 2,400 metres above sea level, far higher than most Alpine ski-resort towns.

Such is the lure that some Chinese firms are not waiting for an official green light before starting operations, said Xu of the China Digital Mining Association.

“Miners present themselves as factories or agriculture companies” to get electricity rather than seek government approval to create bitcoin, he said without naming them. Yodahe did not respond to a request for comment on such practices.

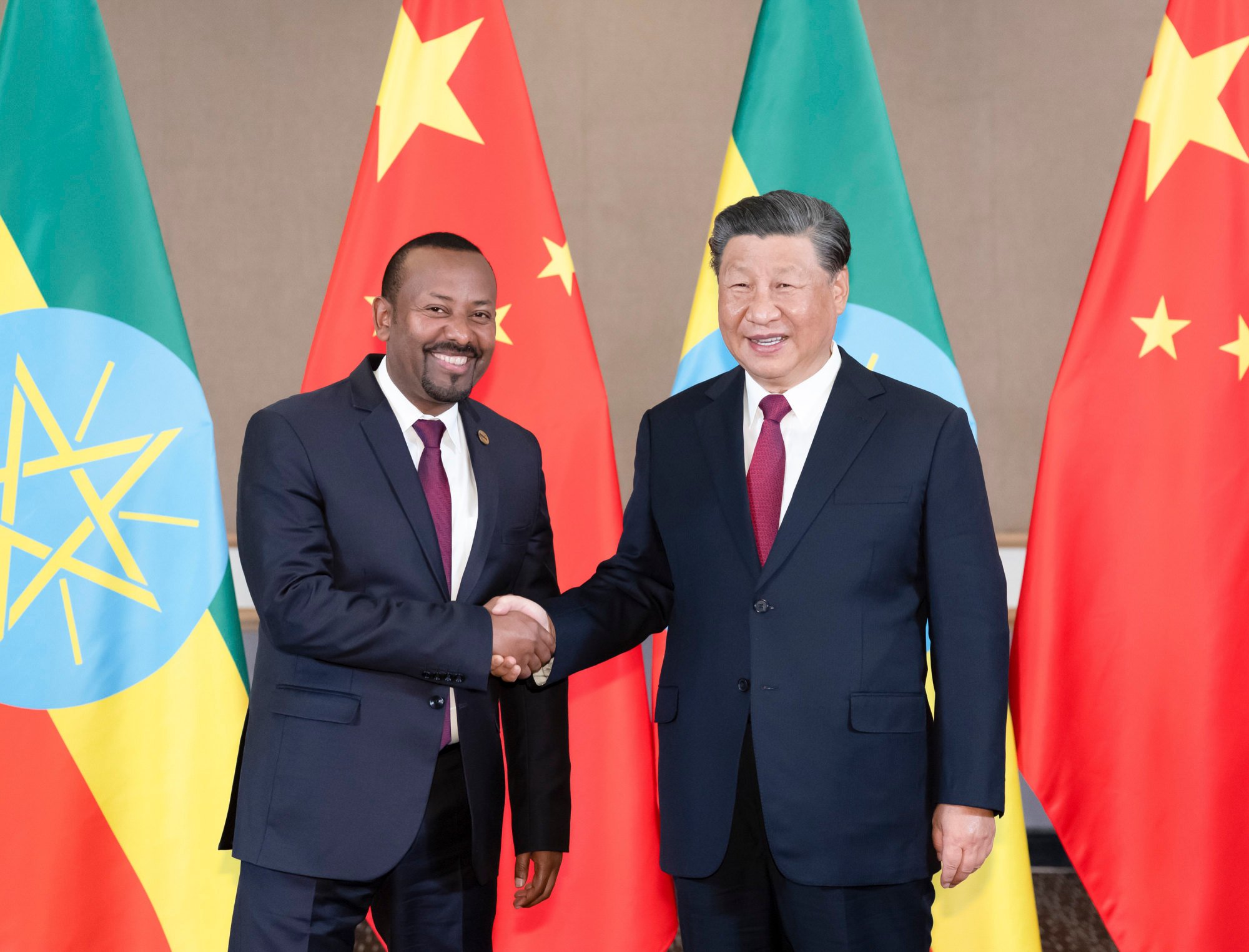

Their confidence is underpinned by geopolitics. China is the biggest source of foreign direct investment in Ethiopia as well as its top bilateral creditor. The Chinese government and financial institutions lent almost US$15 billion for 70 “mega projects” in the African nation from 2006 to 2018, Ethiopia’s finance ministry said in December.

The Horn of Africa country desperately needs foreign-currency inflows. It is in negotiations for a bailout from the International Monetary Fund after defaulting on an interest payment to private creditors in December. The month before, it reached an agreement with bilateral creditors to suspend payments.

Encouraged by China’s rising stature in Africa, Chinese bitcoin miners are also starting to look at countries like Angola and Nigeria, said Xu.

“The Chinese miners don’t have any problems building sites in Africa,” he said. “It is like another Chinese province.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  WETH

WETH  Monero

Monero  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Sui

Sui  Canton

Canton  Hedera

Hedera  USDT0

USDT0  Shiba Inu

Shiba Inu  Dai

Dai  sUSDS

sUSDS  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  PayPal USD

PayPal USD  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Polkadot

Polkadot  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token