Douglas Rissing/iStock Unreleased via Getty Images

Crypto market capitalization is down 40 percent from its high last autumn.

So writes Joshua Oliver in his recent article in the Financial Times.

Mr. Oliver has been covering a cryptocurrency conference in the Bahamas called “Crypto Bahamas.”

The party was joyous and the guest list was top-drawer.

“The message of the event was that crypto’s disruption of the financial sector can’t be stopped, so it’s time to get with the program.”

But, apparently, that was a different view than was presented in the undercurrent.

During the four-day event, the crypto market capitalization was down 5 percent.

There apparently was an undercurrent of concern that leaner times may be coming:

“There will be a wash out,” said a venture capital partner. He pointed out that most of the ventures that raised funds in the last two years, often at very generous valuations, took in enough capital to sustain themselves for 18-24 months. Soon, they will need to seek new funding in a much tougher environment, especially if they have failed to live up to ambitions.

Two years.

Hmmmmmm…….

Two years ago was 2020.

Wasn’t that the time when the Federal Reserve, concerned with the evolving financial market breakdown, was developing the plans for avoiding a market collapse?

And, didn’t this effort result in the greatest injection of bank reserves into the commercial banking system that even occurred.

And, didn’t this result in a major recovery in asset prices, like stock prices, commodity prices, real estate prices, as well as the prices of many other assets?

(For more detail on what was happening inside the Fed and the consequences of the Fed’s responses, see the newly published book written by Nick Timiraos, chief economics correspondent for the Wall Street Journal titled “Trillion Dollar Triage.” It is well worth the reading.

Let’s take a look at that period.

Federal Reserve Actions

The Federal Reserve responded with a whole bunch of programs to help small businesses and households. These played their role in the “prevention” package but are not really the main story of the Fed’s overall effort.

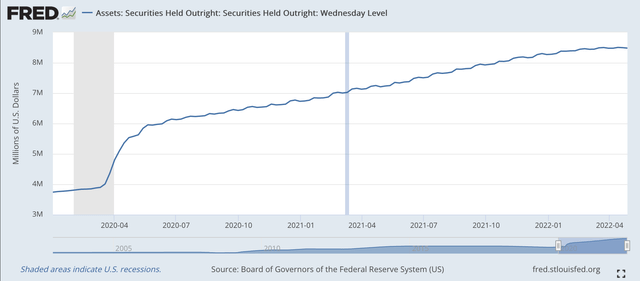

We will concentrate on the buildup of the Fed’s holdings of securities purchased outright.

First of all, the Fed committed to buying $120.0 billion in securities purchased outright every month. The purchases began in April 2020.

Federal Reserve: Securities Bought Outright (Federal Reserve)

You can see how the securities portfolio increased readily as the Fed acquired the securities on a very regular basis.

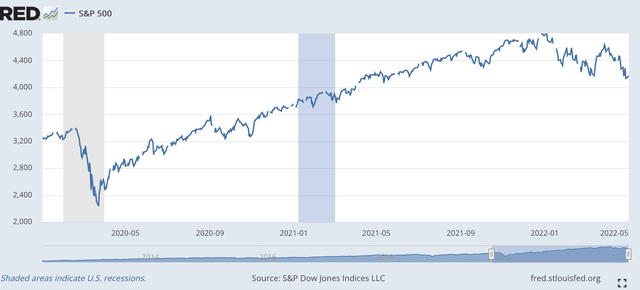

Securities prices follow the Fed’s actions very closely. Below is the performance of the S&P 500 Stock Index for the same period of time.

S&P 500 Stock Index (Federal Reserve)

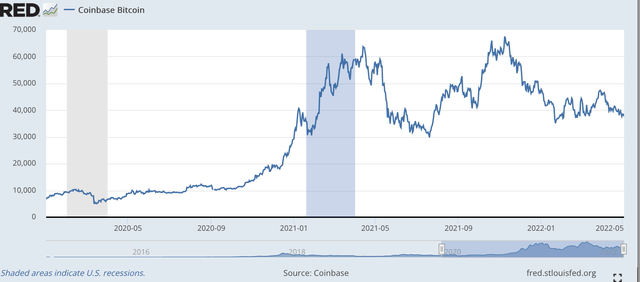

Now, also note the behavior of the Bitcoin price.

Bitcoin price (Federal Reserve)

Although the price of Bitcoin did not rise as rapidly as stock prices right away, it can be seen that the price did respond to all of the liquidity being pumped into the economy by the end of 2020 and then really took off in early 2021.

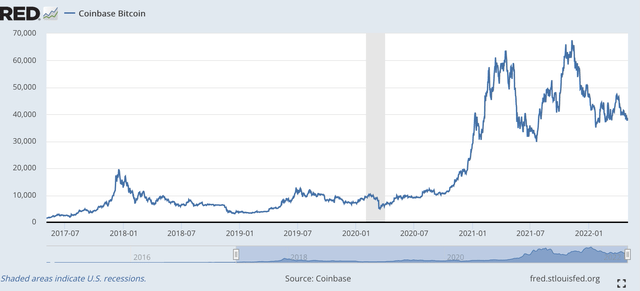

Let’s take a little longer look at the Bitcoin price.

Bitcoin Price (Federal Reserve)

Note that the price of Bitcoin did rise from the time of its inception up until the beginning of 2020. But, the price rise was nothing like that which took place after the Federal Reserve began pumping money into the economy.

It sure looks like a bubble to me.

The Peak

Note that the peak price for Bitcoin came on November 10, 2021.

The peak in the S&P 500 Stock Index came on January 3, 2022.

The Federal Reserve raised its policy rate of interest on March 16, 2022.

All fall, Federal Reserve officials had been talking about the need to tighten up on monetary policy. The talk got more serious as the fall progressed.

The price of Bitcoin topped out in early November.

The Fed kept talking and indicated that it was going to begin to taper its purchases of securities in December, which it did.

Stock prices peaked in early January.

The Fed raised its policy rate in March. And, then it raised its policy rate of interest again in May.

The Fed’s intention to reduce the size of its securities portfolio will be announced soon.

So, the explosion of bank reserves is over and the effort to restrain inflation has really begun.

The expectation is that stock prices will drop significantly.

And, the expectation is that the price of Bitcoin will drop significantly.

The Consequence

So, the future.

Mr. Oliver in his Financial Times piece writes,

“Everyone is a long-term investor until they have short-term losses.”

So, is there a “shake-out” on the way?

Is there a replay of the dot-com bust coming?

If so, how will this impact the investment in the crypto world in the near future?

And, how will such a shake-out impact the evolution of the financial system going forward?

Furthermore, how will a collapse in the crypto bubble impact the Federal Reserve and how will this impact the fight against rising inflation?

This is a problem the Fed creates for itself. Building bubbles in the past tends to raise the issue of what happens when the bubbles go away?

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Zcash

Zcash  LEO Token

LEO Token  WETH

WETH  Monero

Monero  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Litecoin

Litecoin  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Canton

Canton  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Uniswap

Uniswap  PayPal USD

PayPal USD  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  USD1

USD1  Pepe

Pepe  MemeCore

MemeCore  Rain

Rain  Bittensor

Bittensor