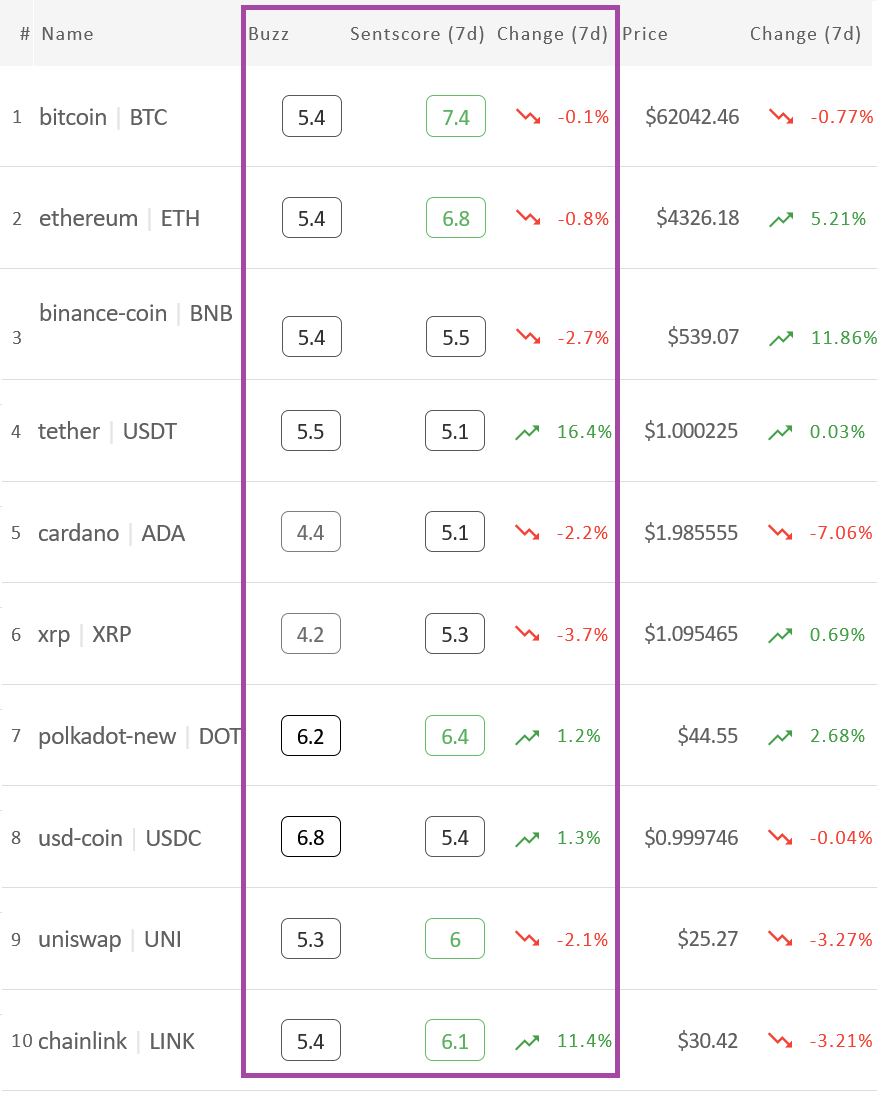

The average 7-day moving crypto market sentiment score (sentscore) for ten major cryptoassets by market capitalization continues to move towards a somewhat positive zone and stands at 5.91 today – another increase from 5.85 last Monday.

According to Omenics, a crypto market sentiment analysis service, most of the top coins haven’t experienced much of a shift in their sentiment since last Monday but the ones that did had significant moves towards the upside. Tether (USDT) had the greatest improvement in sentiment as it rose to 5.1 – a 16% increase. It was followed by chainlink (LINK), whose sentiment entered the somewhat positive zone at 6.1, up by 11% in the last 7 days.

The rest of the top 10 cryptoassets have gone through a lesser than 4% sentiment shift. XRP has experienced a -3.7% drop in sentiment and is now within the neutral zone. Similarly, the sentiment of binance coin (BNB), cardano (ADA), and uniswap (UNI) coins declined by more than 2%.

Bitcoin (BTC) still leads the list with a positive sentiment of 7.4. Ethereum (ETH) is also deep in the somewhat positive sentiment at 6.8, followed by polkadot (DOT) with 6.4, LINK with 6.1, and UNI at 6. Currently, none of the ten major cryptoassets are in the negative zone.

Zooming into daily sentiment fluctuations, most of the top coins are in the red and only three coins are in the somewhat positive zone today – BTC (7.4), ETH (6.4), and DOT (6.2). USDT is recording yet another sentiment increase today at 5.6, a market-leading 7% daily increase. At the opposite end of the table we find USDT’s competitor USD Coin (USDC) which stands at 5.4 – a 5% decline over the past 24 hours. It’s not a positive sentiment day for ethereum, too, as it is following USDC with a -4.5% daily reduction in sentscore.

Zooming out and looking at all 35 crypto assets tracked by Omenics during the last seven days, iota (MIOTA) has managed to outperform weekly leader USDT with a 20% sentscore increase, although its 7-day moving average of 5.8 does not push it in the somewhat positive zone yet. Other coins that had a great week are compound’s COMP, monero’s XMR, and cosmos (ATOM), all of whom improved their sentscore by more than 10%. The worst performer in terms of market sentiment last week was Maker’s MKR, which lost 8% of its last week’s sentscore.

____

* – Methodology:

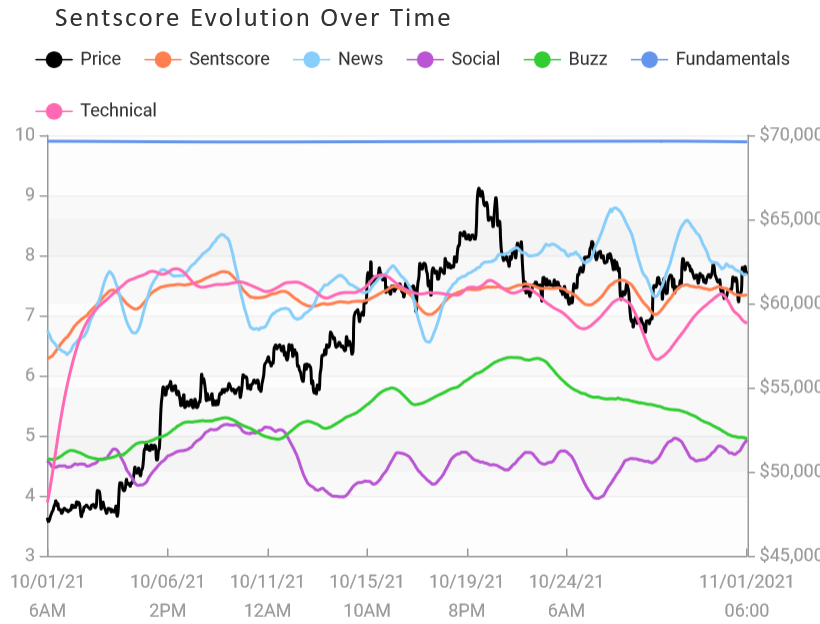

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptoassets.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Ethena USDe

Ethena USDe  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Sui

Sui  WETH

WETH  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Litecoin

Litecoin  WhiteBIT Coin

WhiteBIT Coin  Zcash

Zcash  Monero

Monero  USDT0

USDT0  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Dai

Dai  Polkadot

Polkadot  MemeCore

MemeCore  Bittensor

Bittensor  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  Bitget Token

Bitget Token  Figure Heloc

Figure Heloc  OKB

OKB  USD1

USD1  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund