Introduction

Digital Currency Statistics: Digital currency, also known as cryptocurrency, is a type of virtual money based on blockchain technology, offering decentralization, cryptographic security, and various forms like cryptocurrencies (e.g., Bitcoin, Ethereum), central bank digital currencies (CBDCs), stablecoins, and tokenized assets. Transactions are secured through cryptography, and ownership is verified using private and public keys.

Digital currencies have use cases in online transactions, remittances, investments, and cross-border transfers but are characterized by price volatility and face regulatory scrutiny. They rely on consensus mechanisms like mining or proof-of-stake for transaction validation.

Despite challenges, they continue to innovate, attracting investment and reshaping the financial landscape with applications like decentralized finance (DeFi) and non-fungible tokens (NFTs) while undergoing varying degrees of global adoption.

Editor’s Choice

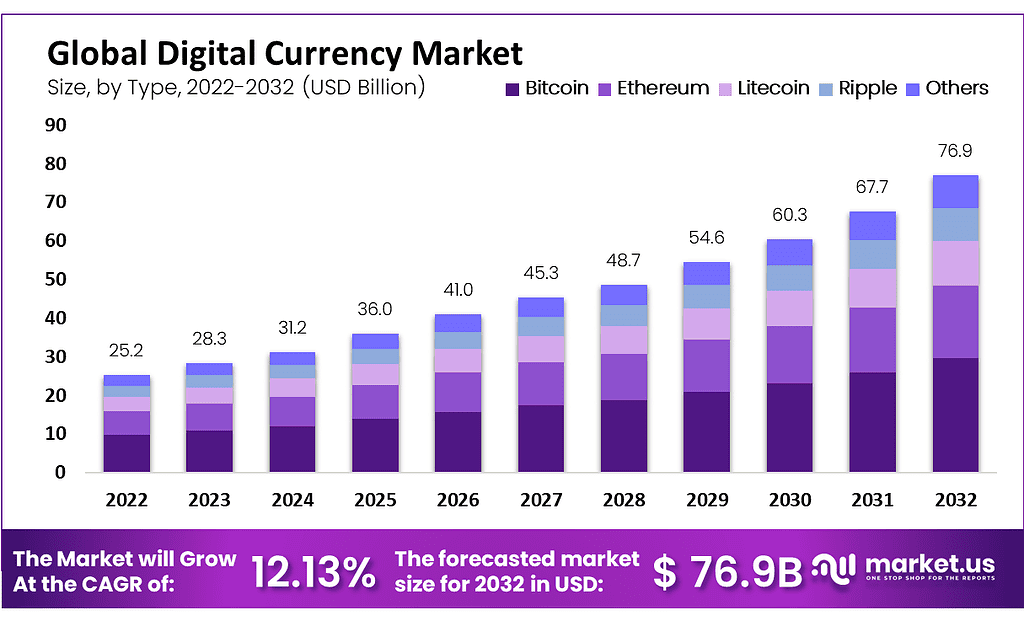

- In 2022, the Digital Currency market revenue stood at USD 25.2 billion and was projected to rise to USD 76.9 billion in 2032, reflecting a positive upward trend.

- Bitcoin maintains its dominant position, contributing substantially to the market’s revenue, followed by Ethereum, Litecoin, Ripple, and other cryptocurrencies.

- As of the end of 2021, it’s estimated that nearly 300 million people worldwide have become cryptocurrency owners, indicating the widespread adoption of digital assets.

- The total market capitalization of stablecoins has taken a notable hit, shrinking by $29.5 billion since January 2022.

- Industry experts are making ambitious predictions, estimating that tokenized digital securities issuing could reach a staggering $4 trillion to $5 trillion by 2030.

- As of August 2023, Ethereum processed over one million daily on-chain transactions, surpassing Bitcoin, which handled 550,000 transactions that month. Other major cryptocurrencies had lower transaction activity.

- Cryptocurrency mining has seen a consistent rise in revenue, reaching a peak of $63 million in a single day in 2021.

Global Digital Currency Market Statistics

Global Digital Currency Market Size Statistics

- The digital currency market has been experiencing remarkable growth in recent years, with a steady increase in market revenue at a CAGR of 12.13%.

- In 2022, the market revenue stood at USD 25.2 billion, and this figure is projected to rise to USD 28.3 billion in 2023, reflecting a positive upward trend.

- The growth trajectory continues into the foreseeable future, with estimates of USD 31.2 billion in 2024, USD 36.0 billion in 2025, and USD 41.0 billion in 2026.

- As we move further into the late 2020s, the digital currency market shows no signs of slowing down, with anticipated revenues of USD 45.3 billion in 2027, USD 48.7 billion in 2028, and a substantial jump to USD 54.6 billion in 2029.

- Looking ahead to the year 2030, market revenue is expected to reach USD 60.3 billion, and the growth trend continues through 2031 and 2032, with projected revenues of USD 67.7 billion and USD 76.9 billion, respectively.

- These figures underscore digital currencies’ increasing significance and adoption in the global financial landscape.

(Source: Market.us)

Digital Currency Market Revenue – By Type Statistics

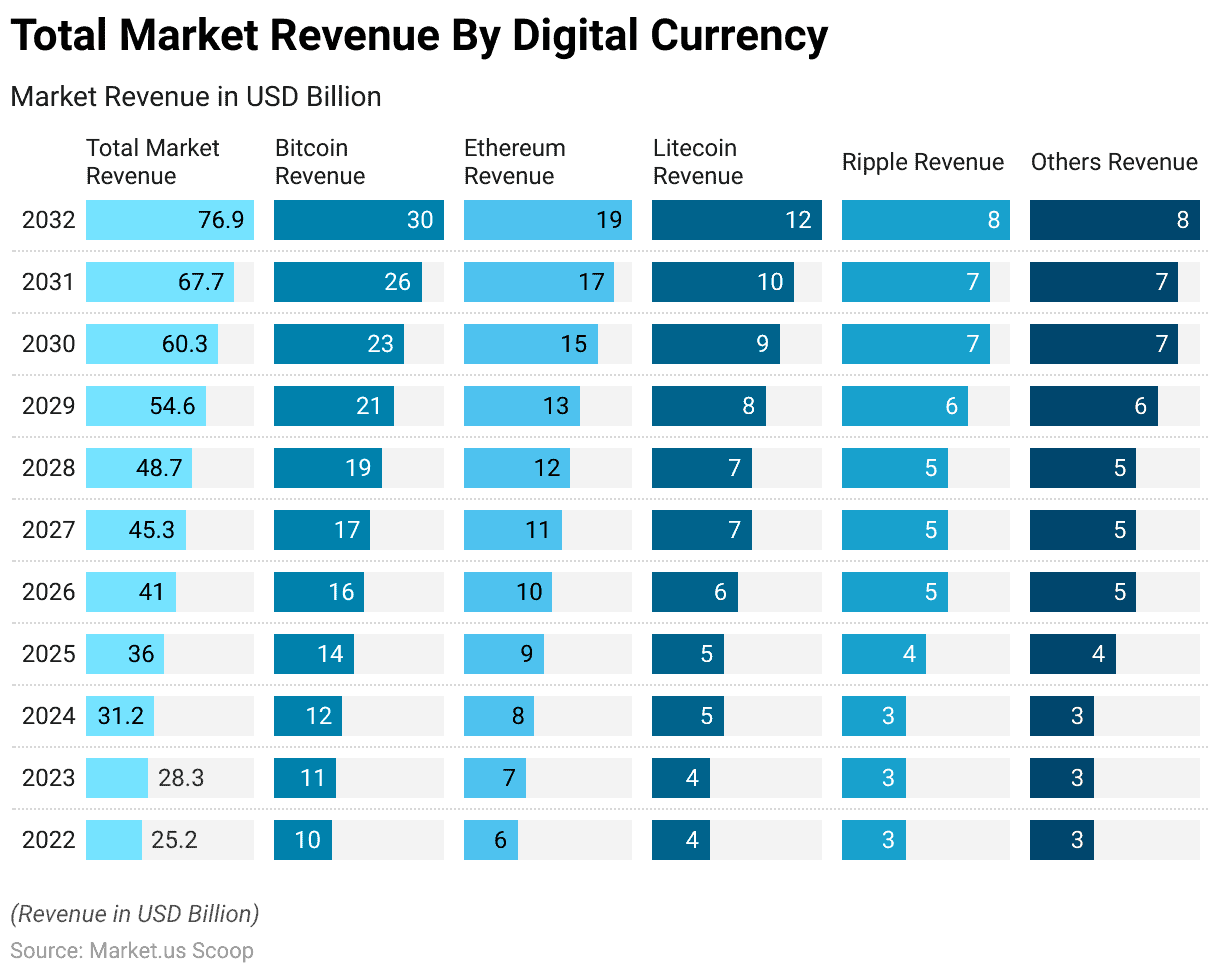

- The global digital currency market exhibits a dynamic landscape with revenue streams from various cryptocurrency types.

- In 2022, the total market revenue was recorded at USD 25.2 billion, with Bitcoin contributing USD 10 billion, Ethereum with USD 6 billion, Litecoin with USD 4 billion, Ripple with USD 3 billion, and other cryptocurrencies collectively accounting for an additional USD 3 billion.

- As we look ahead, the market is poised for steady growth, with anticipated figures of USD 28.3 billion in 2023, USD 31.2 billion in 2024, and USD 36.0 billion in 2025.

- Bitcoin maintains its dominant position, contributing substantially to the market’s revenue, followed by Ethereum, Litecoin, Ripple, and other cryptocurrencies.

- By 2032, the digital currency market is projected to reach a substantial USD 76.9 billion, reflecting the increasing global adoption and diversification of cryptocurrencies within this rapidly evolving financial ecosystem.

(Source: Market.us)

Digital Currency Market Share – By End-use Industry Statistics

- The global digital currency market is distributed across various end-use industries, each contributing to its unique market share.

- The latest data shows that trading activities hold the largest share, accounting for 32% of the market.

- Retail and e-commerce follow closely, representing 27% of the market share, indicating the growing acceptance of digital currencies in everyday consumer transactions.

- Government entities also play a noteworthy role, with an 11% market share, reflecting their increasing exploration of digital currencies for various applications.

- The banking sector, a pivotal player in the financial landscape, contributes 18% to the market share.

- The remaining 13% is attributed to other diverse industries, underlining digital currencies’ versatility and expanding influence across a broad spectrum of use cases and sectors.

- This diversified market presence underscores the evolving and maturing nature of the digital currency ecosystem on a global scale.

(Source: Market.us)

Types of Digital Currency Statistics

Cryptocurrencies

- As of the end of 2021, it’s estimated that nearly 300 million people worldwide have become cryptocurrency owners, indicating the widespread adoption of digital assets.

- The global cryptocurrency market reached a substantial capitalization of £621 billion in 2022.

- Looking ahead to 2030, experts anticipate a significant 12.5% compound annual growth rate for the worldwide cryptocurrency market.

- A survey conducted by Forbes Advisor reveals that 65% of the investing public has invested in cryptocurrencies, highlighting the increasing interest in this asset class.

- When we focus on the UK population specifically, a separate Forbes Advisor survey found that 9% of individuals in the UK currently hold cryptocurrency investments.

- This aligns with research from the Financial Conduct Authority (FCA), which reports that nearly 4.97 million people in the UK, nearly 10% of the population, own some form of cryptocurrency.

- Projections suggest that the UK’s cryptocurrency user base is set to expand significantly, reaching 22.23 million users by 2027.

- Additionally, the age factor plays a role, with those aged 18-34 being twice as likely to own cryptocurrency compared to those aged 35-54, indicating a generational divide in cryptocurrency adoption.

- These trends underscore the growing significance of cryptocurrencies in the global financial landscape and within specific demographics.

(Source: Forbes)

Central Bank Digital Currencies (CBDCs)

- CBDCs have garnered increased attention due to shifts in payment methods, financial practices, technological advancements, and the disruptions brought about by the COVID-19 pandemic.

- A survey conducted in 2021 by the Bank for International Settlements (BIS) involving central banks discovered that 86% of them are actively engaged in exploring the possibilities of CBDCs.

- Additionally, 60% of these central banks were in the experimental phase with the technology, while 14% had initiated pilot projects to test its implementation. (Source: BIS Innovation)

- In early 2023, a remarkable projection suggests an extraordinary 260,000 percent increase in the value of transactions facilitated by central bank digital currencies (CBDCs) between 2023 and 2030.

- It’s important to acknowledge that information about CBDCs remains somewhat limited at this point, primarily because numerous countries were actively developing their digital currencies in 2023.

- Among the 105 countries participating in CBDC initiatives, only Nigeria, the Bahamas, Jamaica, and the Eastern Caribbean Currency Union, which includes Anguilla, Dominica, Grenada, Antigua and Barbuda, Montserrat, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines, had successfully launched operational CBDCs by that time.

- It’s noteworthy that CBDCs, unlike cryptocurrencies or stablecoins, are centralized and directly issued by central banks.

- They are intended to serve as digital equivalents of traditional fiat currencies.

(Source: Statista)

Stablecoins

- The market capitalization of stablecoins has taken a notable hit, shrinking by $29.5 billion since January 2022.

- In perspective, the stablecoins market began the year with a capitalization of $167.9 billion on January 1, 2022, but by January 31, 2023, it had reduced to $138.4 billion. This contraction represents a significant 17.6% decline in the overall market capitalization.

- In this period, all stablecoins faced a decline in their market capitalization, except for two standout performers, USD Coin (USDC) and Binance USD (BUSD).

- Tether (USDT) experienced a 13.5% drop, Dai (DAI) declined by 42.7%, and Frax (FRAX) decreased by 43.5%. In contrast, USDC and BUSD saw growth in their absolute market capitalization, with USDC expanding by 1.2% and BUSD leading the way with an impressive 8.9% increase.

- The remaining ten stablecoins, on average, shrank by a substantial 67.5%. Tether (USDT) maintained its leading position, growing its market share by 2.3% to reach a dominant 49.0% by the end of January 2023.

- USDC and BUSD also exhibited growth in their market shares, with USDC increasing by 5.7% to reach a market share of 30.9% and BUSD growing by 2.8% to secure an 11.4% market share.

- As of the end of January 2023, Ethereum is the dominant force in the stablecoin market, commanding an impressive 59.9% share. Tron comes in second with a substantial 26.5% share across all stablecoins.

- Looking at the top 5 blockchain platforms, both Ethereum and Tron have gained market share, with Ethereum increasing by 5.5% and Tron by 5.6%, reinforcing their positions.

- Most experienced a contraction in market capitalization, except for Tron, which saw growth, marking a 2.1% increase from May 2022 to January 2023.

- There were significant double-digit losses, with Solana suffering the most substantial decline, with a staggering 69.1% drop in its stablecoin market cap.

(Source: CoinGecko)

Tokenized Assets

- Industry experts are making ambitious predictions, estimating that tokenized digital securities issuing could reach a staggering $4 trillion to $5 trillion by 2030.

- Although these figures are essentially educated guesses, real-world examples of large-scale implementation are starting to emerge.

- For instance, Broadridge, a fintech infrastructure firm based in the United States, is actively facilitating monthly transactions worth over $1 trillion in tokenized repurchase agreements through its Distributed Ledger Repo (DLR) platform.

- This tangible demonstration underscores tokenized digital securities’ growing traction and potential within the financial landscape.

- The market for tokenized assets is poised for substantial growth in the coming years, with projections indicating a remarkable expansion.

- In 2023, the market size is estimated at USD 0.4 trillion, expected to increase to USD 0.6 trillion in 2024.

- The momentum continues to build, reaching USD 1.0 trillion in 2025 and a significant USD 1.7 trillion in 2026.

- As we move into the late 2020s, the market experiences exponential growth, with anticipated sizes of USD 2.7 trillion in 2027, USD 4.2 trillion in 2028, and a substantial USD 6.8 trillion in 2029.

- By 2030, the market is projected to reach a remarkable USD 10.9 trillion, underlining the increasing prominence and adoption of tokenized assets in the global financial landscape.

(Source: McKinsey Insights, Roland Berger)

Digital Currency Adoption and Usage

- In 2023, a notable trend emerged as consumers in various African, Asian, and South American countries showed a growing interest in cryptocurrencies, particularly Bitcoin.

- For instance, Nigeria had nearly one in three survey participants reporting cryptocurrency ownership or usage. At the same time, in the United States, this figure was much lower, with only six out of every 100 respondents involved in crypto.

- This shift in ownership patterns contrasted with a ranking of Bitcoin trading volumes across 44 countries, where Russia and the United States led in trading activity.

- Notably, African and Latin American nations also made significant strides.

- Certain countries displayed a greater readiness to use digital currencies for everyday transactions. Nigeria, for example, embraced mobile money for in-store purchases and remittances to family members, while Poland allowed consumers to buy products with cryptocurrencies as early as 2019.

- In contrast, Vietnam imposed strict regulations against using cryptocurrencies for payments but permitted ownership for investment.

- Regarding professional investors seeking cryptocurrency-themed ETFs, Europe emerged as a preferred destination over the United States and China, as indicated by a 2020 survey.

- Furthermore, in 2020, many of the largest crypto hedge fund managers were based in Switzerland or the United Kingdom, with Switzerland boasting the highest cryptocurrency adoption rate in Europe.

- These developments offer valuable insights into the evolving landscape of cryptocurrency adoption and investment across diverse global regions.

(Source: Statista)

Transaction Volume of Digital Currency Statistics

- As of August 2023, Ethereum processed over one million daily on-chain transactions, surpassing Bitcoin, which handled 550,000 transactions that month. Other major cryptocurrencies had lower transaction activity.

- The 24-hour trading volume in the crypto market decreased throughout 2023, falling to one-third of its 2022 levels.

- This decline was influenced by legal actions against two major crypto exchanges, Binance, and Coins, in the United States.

- Furthermore, the crypto market became quieter after April, lacking the strong narrative that characterized 2021 and 2022 when cryptocurrencies drew significant attention.

- Despite earlier growth, Bitcoin’s trading volume slowed in the second quarter of 2023.

- Nevertheless, Bitcoin outperformed most of the market during this period. Some credit this performance to BlackRock’s June 2023 filing announcement for a Bitcoin ETF.

- The iShares Bitcoin Trust, planning to use Coinbase Custody as its custodian, marked a significant development as U.S. regulators had yet to approve any spot ETFs for Bitcoin.

(Source: Statista)

Mining of Digital Currency Statistics

- Cryptocurrency mining has seen a consistent rise in revenue, reaching a peak of $63 million in a single day in 2021.

- Bitcoin mining is an investment strategy that involves calculating energy and hardware costs against the anticipated profits.

- In 2021, most Bitcoin mining activity was traced back to the United States, as indicated by IP addresses associated with miners who participated in specific Bitcoin mining pools.

- This shift can be attributed to global energy pricing disparities, with Germany, for instance, having electricity costs more than ten times higher than countries like China.

- China had long held the position of the world’s largest crypto-mining hub until late 2021.

(Source: Statista)

Regulatory Aspects of Digital Mining

- The first mention of cryptocurrency in federal law occurred in late 2021 through the Infrastructure Investment and Jobs Act.

- This legislation primarily focused on the tax aspects of cryptocurrency exchanges, although it won’t take effect until 2024.

- However, there’s a growing demand for more comprehensive regulations.

- In 2022, President Biden issued an executive order and proposed a framework for overseeing cryptocurrency.

- Much emphasis is on combating criminal activities within the crypto industry, which is crucial, given that cryptocurrency scams have resulted in losses exceeding $1 billion since 2021.

- The Financial Stability Oversight Council (FSOC) has urged Congress to pass legislation to regulate cryptocurrencies, focusing on stablecoins, crypto spot markets, and regulatory gaps.

- One potential outcome is establishing a U.S. central bank digital currency (CBDC).

(Source: CNBC, Reuters)

Conclusion

Digital Currency Statistics – In recent years, the digital currency world has seen remarkable growth, with cryptocurrencies like Bitcoin and Ethereum gaining widespread recognition and usage. Central banks and governments are exploring the potential of central bank digital currencies (CBDCs), reflecting the ongoing transformation of traditional monetary systems.

Despite regulatory hurdles and market fluctuations, the digital currency market has shown resilience, attracting diverse investors. However, challenges such as regulatory concerns, security issues, and the rise of complex assets like stablecoins and NFTs highlight the need for continued vigilance and innovation in this evolving financial landscape. The role of digital currencies is set to expand, and the actions of governments, central banks, and industry stakeholders will shape their future development.

FAQs

Digital currency is a type of currency that exists only in digital form, without a physical counterpart like paper money or coins. It is stored electronically and typically relies on cryptographic techniques for security. Cryptocurrencies like Bitcoin and Ethereum are well-known examples of digital currencies.

A digital wallet is a software or hardware tool that securely stores, sends, and receives digital currency. It typically consists of a public address (like an account number) for receiving funds and a private key (a secret code) for authorizing transactions. Different types of wallets include software, hardware, and mobile wallets.

Digital currencies use cryptographic techniques to secure transactions and control the creation of new units. While they are considered secure, the security of your digital currency depends on how you manage your private keys and use reputable wallets and exchanges. It’s essential to be cautious of phishing scams and ensure you’re using reliable platforms.

The blockchain is a decentralized and distributed ledger technology that underlies most digital currencies. It records all transactions across a network of computers (nodes) transparently and tamper-resistantly. The blockchain ensures the integrity and transparency of digital currency transactions.

The legal status of digital currencies varies from country to country. Some countries have embraced digital currencies and have regulations in place, while others have banned or restricted their use. It’s essential to be aware of the legal framework in your jurisdiction regarding digital currency.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  WETH

WETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Canton

Canton  Avalanche

Avalanche  Sui

Sui  Hedera

Hedera  USDT0

USDT0  Dai

Dai  Shiba Inu

Shiba Inu  sUSDS

sUSDS  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Mantle

Mantle  Polkadot

Polkadot  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token