Ethereum (ETH) price has fallen to retest a crucial support level of above $3,700. The large-cap altcoin, with a fully diluted valuation of approximately $453 billion, dropped 5% over the past 24 hours to trade at around $3,754 on Thursday during the mid-North American session.

The ETH price drop coincided with Bitcoin (BTC), which retraced 4% to hover about $107.5k at press time. Following the sudden ETH price drop today, more than $218 million was liquidated from the Ethereum leveraged market, with the majority involving long traders.

Is Ethereum Price Ready for New ATH?

Technical Tailwinds Amid Low Bullish Sentiment Signal Market Rebound

From a technical analysis standpoint, the ETH/USD pair has been retesting a crucial support level around $3,700. Since the October 11 crypto crash, the ETH/USD pair has rebounded from this support level three times, thus signaling potential market reversal ahead.

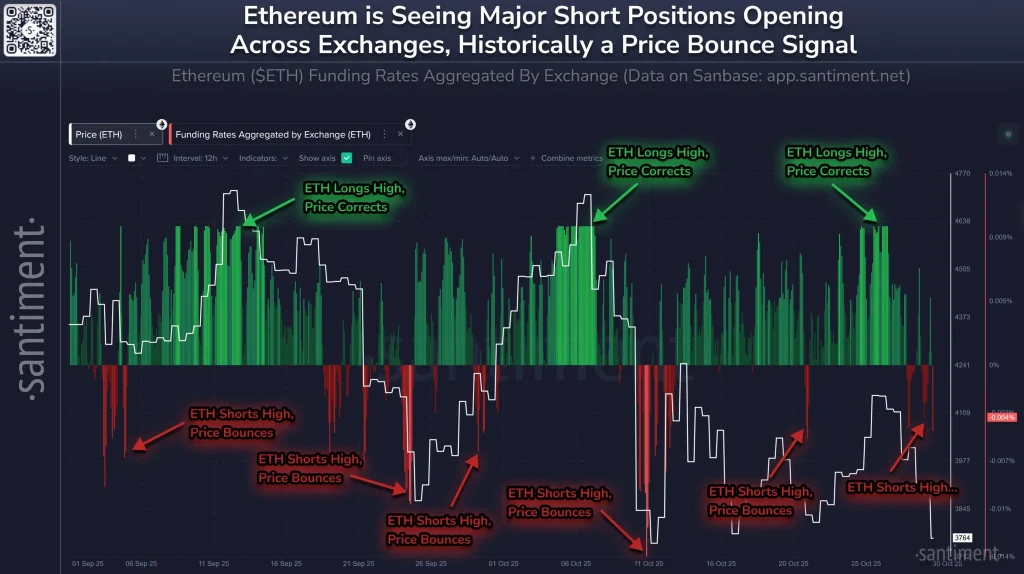

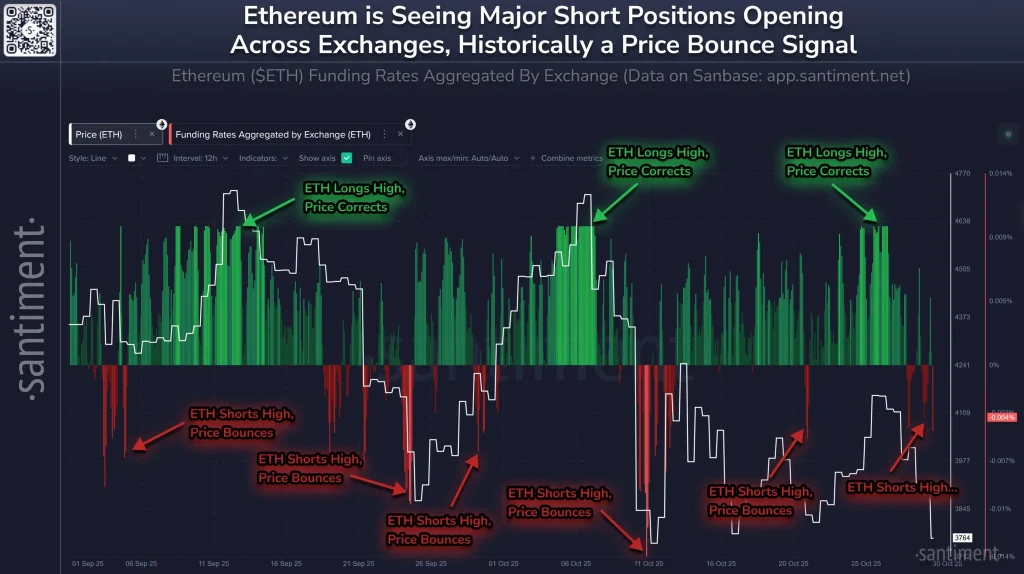

According to market data analysis from Santiment, Ethereum has attracted a significant number of short positions, which historically coincides with market reversal.

Ongoing Capital Rotation from Bitcoin Bolsters Ether’s Bullish Outlook

The possibilities of Ethereum price hitting a new all-time high soon has been bolstered by the notable capital rotation from Bitcoin. Notably, the ETH/BTC pair has signaled a market reversal after years of downtrend.

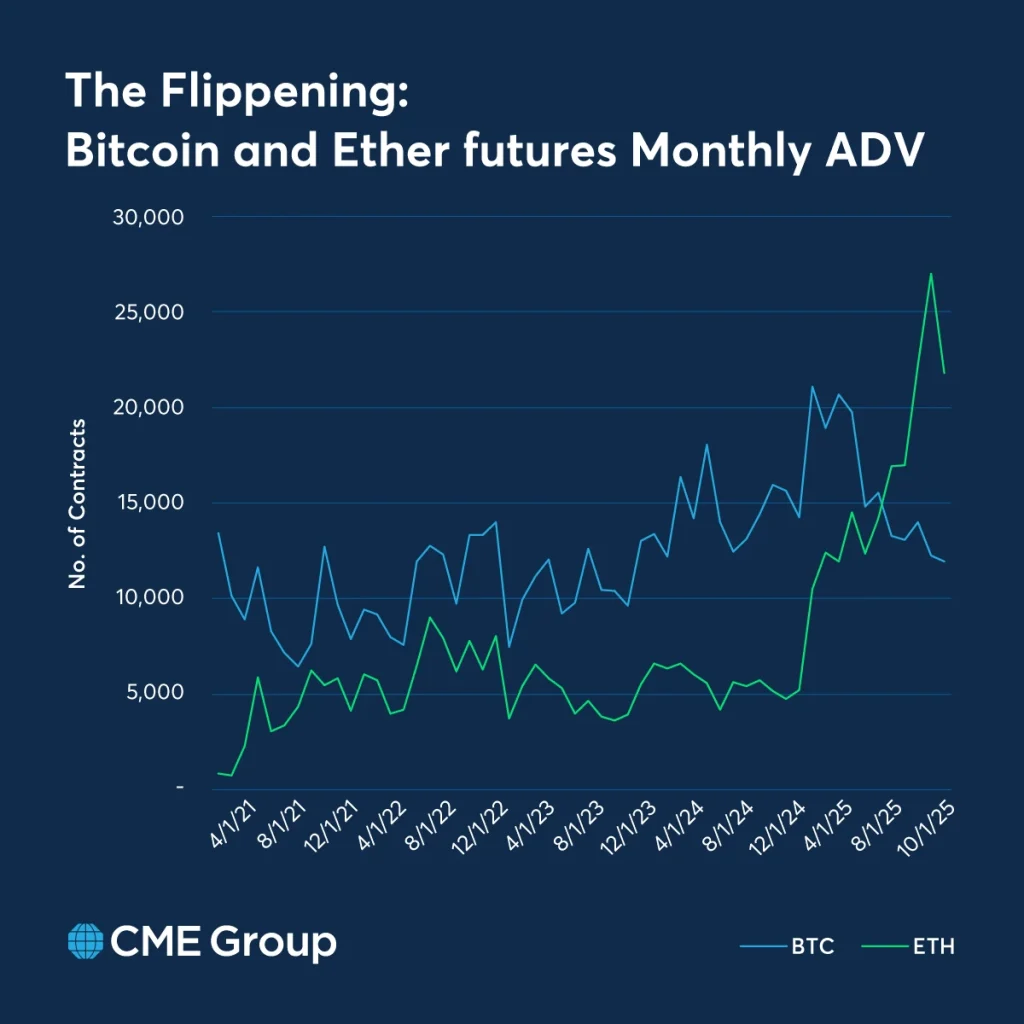

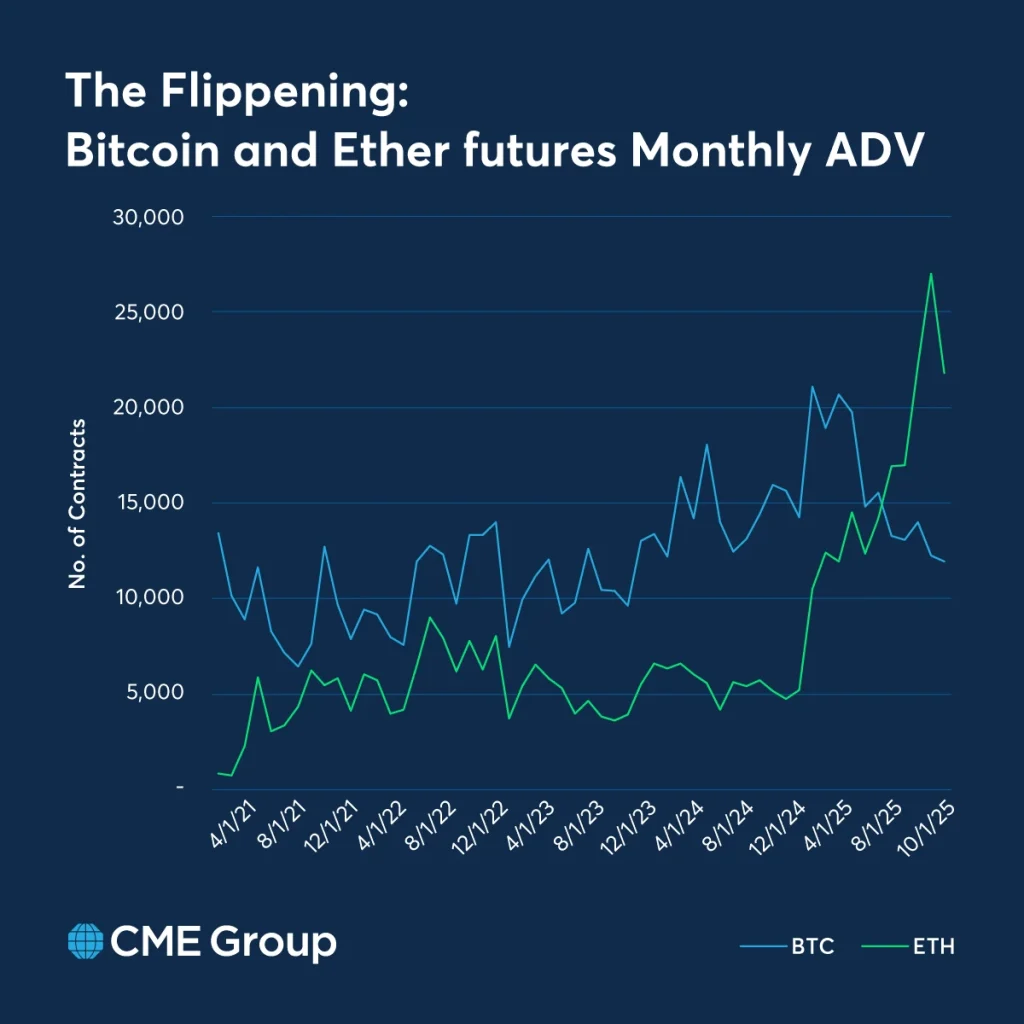

The notable capital rotation from Bitcoin to Ethereum is also observable through their futures market. According to market data from CME Group, the number of Ethereum futures contract significantly compared to Bitcoin’s.

As such, the ETH/USD pair is well positioned for further upsides in the coming weeks, especially if the bulls hold above $3.7k.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Chainlink

Chainlink  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Hyperliquid

Hyperliquid  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  sUSDS

sUSDS  USDT0

USDT0  Dai

Dai  Mantle

Mantle  PayPal USD

PayPal USD  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Polkadot

Polkadot  MemeCore

MemeCore  Aave

Aave  USD1

USD1  Rain

Rain  Bittensor

Bittensor  Canton

Canton