luza studios

MARA Far Inferior to BTC and GBTC

While I wrote previously on my bullishness on Bitcoin (BTC-USD) at this point in the cycle, I would not buy Marathon Digital Holdings (NASDAQ:MARA). Marathon Digital Holdings is a Bitcoin mining company that provides investors with indirect Bitcoin exposure. I do not believe that MARA has any value as a mining business, and there is no underlying asset play at hand with its market price far in excess of its net asset value (NAV). While I think the stock will likely go up alongside BTC as it did in 2020 and 2021, I don’t think there’s a logical case for outperformance versus Bitcoin or Grayscale Bitcoin Trust (OTC:GBTC).

Negative Value as a Mining Business

The value of a mining business would generally be derived by applying a multiple on the profit the company generates by mining at a cost below the market price of the commodity it mines.

A mining company that mines gold at an operational cost of $1700 an ounce, with a market price of $1950 an ounce, would have a profit of $250 an ounce mined. Now, if I had a mining company that mines gold at a cost of $2,200 an ounce, how much would you pay for my company? You wouldn’t even take it for free. In fact, I would have to pay you to take such a cash-burning business off my hands.

Even if you’re the biggest gold bull in the world and think gold is going to $10,000 an ounce, you still wouldn’t buy my gold mining business from me. You’d just buy gold directly. Why pay anything for a business that effectively buys the commodity you’re looking to buy for more than what it’s trading at? You’d be overpaying for a business that overpays for the commodity.

The same applies to MARA for its Bitcoin mining operation. Even if you are bullish on Bitcoin, the mining business is worthless if it does not mine Bitcoin for less than Bitcoin’s market price.

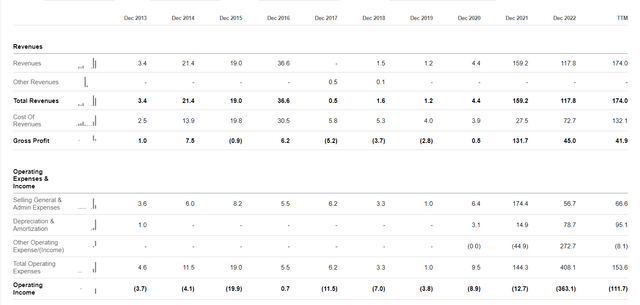

No Profits from Mining Operations

As seen in the operating income below, the company consistently fails to mine Bitcoin at a price below its market price. We know this because the spot price of Bitcoin at the time of the block reward is used to measure revenue on the income statement, meaning operating income is representative of the profit the company would make if it sold the Bitcoin it mined immediately upon mining it. With operating income being consistently negative, we can conclude that MARA has historically mined Bitcoin for more than its prevailing market price.

MARA Income Statement Seeking Alpha

Q2 BTC production stood at 2,926 BTC while production costs were $113M, consisting of $92.5M in cost of revenues and $20.5M in General & Administrative expenses. This translates to a mining cost per Bitcoin of $38,615, which is 48% above the current market price $26,130. Since the price of Bitcoin is substantially below the company’s mining cost per BTC, the mining business has negative value today.

One could say that the stock will go up because it holds and mines Bitcoin, and the price of Bitcoin will go up over time. I would not disagree with that statement, but there is currently no reason to own MARA over BTC directly.

Stock Trades at Large Premium to Net Asset Value

The company currently has 17,307 BTC, $128M in cash, $99.8M in investments, $784M in equipment, and $734.6M in debt, giving it a net asset value of $713.6M or $4.09 per share at today’s BTC market price.

| 17,307 BTC at $26,130 | $452.3M |

| Cash and restricted cash | $128M |

| Property & Equipment, Net | $783.9M |

| Investments | $99.8M |

| Total Tangible Assets | $1.464B |

| Debt | $734.6M |

| Preferred stock |

$15.7M |

| Net Asset Value |

$713.6M |

| NAV per share |

$4.09 |

| Downside to NAV |

61% |

Source: MARA Q2 2023 10-Q

With the stock trading at $10.55, the stock is trading at a 158% premium to NAV, so there is clearly no play to be made on the underlying asset value. Compare this GBTC, which I previously wrote an bullish article on, trading at a 25% discount to NAV.

Bitcoin Price Sensitivity Analysis

At $128M in cash remaining, MARA has 1 quarter of production left before it has to either start selling Bitcoin to continue mining operations or issue shares to raise cash. If they deplete their cash and generate another 3,000 BTC in Q3, this would lead to 20,307 BTC on their balance sheet. Their assets would be as follows. To be generous, I’ve ignored depreciation on their mining equipment.

| $100,000 BTC | $150,000 BTC | $200,000 BTC | |

| 20,307 BTC Value | $2.03B | $3.05B | $4.06B |

| Equipment & other assets | $883.7M | $883.7M | $883.7M |

| Total Assets | $2.91B | $3.93B | $4.94B |

|

Debt |

$734.6M | $734.6M | $734.6M |

| NAV | $2.18B | $3.2B | $4.21B |

| NAV per share | $12.51 | $18.36 | $24.15 |

For simplicity, I have also ignored the effects of share dilution. In reality, what is likely to happen is that they will issue more shares and continue to mine Bitcoin beyond Q3. Any forecast of the effects of this path would be highly inaccurate because it would depend on the market price at the time of share issuances, as well as the number of shares issued. In any case, the positive impact of accumulating more BTC through mining would likely be offset by the dilutive issuances needed to continue operations. Therefore, the above approach would give a decent approximation of net asset value per share at different BTC prices.

While some upside could be achieved if BTC runs past previous all-time highs, the gains on an investment in MARA would lag far behind the gains on an investment in BTC directly, assuming MARA tracks its NAV.

| $100,000 BTC | $150,000 BTC | $200,000 BTC | |

| MARA Upside | 19% | 74% | 129% |

| BTC Upside | 283% | 474% | 665% |

Trend in Mining Costs

The only rationale for an investment in MARA over BTC would be the assumption that mining costs would end up being substantially and sustainably below the future price of BTC. However, it looks like MARA’s cost per BTC are highly correlated with the price of BTC, and that MARA is consistently mining between 26 and 78% above the BTC price in any given year.

| 2020 | 2021 | 2022 | Q2’23 | |

| BTC Mined | 947 | 3,197 | 4,144 | 2,926 |

| Operational Cost | $13.3M | $216.8M | $208.2M | $113M |

| Cost per BTC | $14,044 | $67,813 | $50,241 | $38,615 |

| Average Daily Close | $11,116 | $47,437 | $28,198 | $28,062 |

| % overpayment | 26% | 43% | 78% | 38% |

Sources: SEC Filings and Yahoo Finance

With the upcoming halving that will increase mining difficulty and block rewards, I do not see any rationale for a future reversal of this correlation or a future decreased cost of mining relative to BTC.

MARA Not Worth Shorting

At this point in the cycle, I would not recommend shorting MARA because of its price correlation with BTC. It could likely continue to trade a sustained premium to its NAV despite its substantially unprofitable mining operations.

I am long BTC and other Trusts that hold BTC and other cryptocurrencies at substantial discounts to NAV, which I far prefer to an investment vehicle like MARA. I will write about these Trusts in future articles.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Zcash

Zcash  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave