urfinguss/iStock via Getty Images

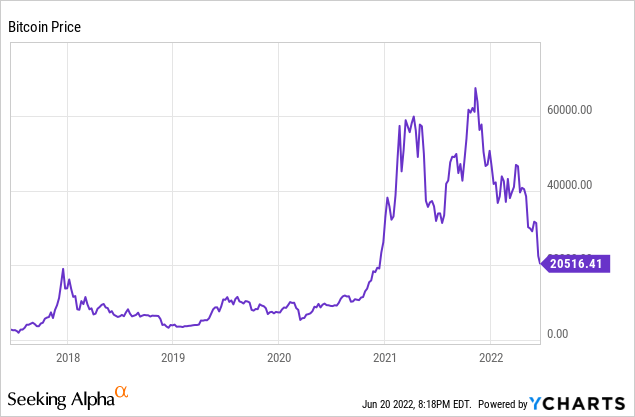

Bitcoin (BTC-USD) has been on a downward spiral for the past few weeks. The selloff has been hurting crypto mining stocks. Marathon Digital (NASDAQ:MARA), which is a company that specializes in cryptocurrency mining, has seen its stock price drop by more than 50% since the beginning of the year.

Marathon Digital is not the only company that has been affected by Bitcoin’s selloff. Other companies like Nvidia (NVDA) and Riot Blockchain (RIOT) have also seen their stocks drop as well.

Bitcoin & Increasing Difficulty

With Bitcoin prices falling and mining expected to continue, investors should be aware of increasing difficulty rates. Although Marathon Digital is actively improving its hashrate in response to the difficulty increase, a lot of this is out of necessity. There can be a maximum of 21 million Bitcoin tokens, and the 19 millionth token was recently mined. With time, more coins have been mined and the difficulty of solving cryptographic problems becomes harder. The increasing difficulty can be tracked in multiple ways, but by far the most popular is the “halving.” The increase should line up with the halved reward every 210,000 blocks.

Basically, as blocks are solved the difficulty increases, and at these 210000 block milestones, the reward is half of that in the prior milestone. This forces Bitcoin miners to constantly increase their mining power which creates a mining arms race due to the limited supply of Bitcoins and relative availability of mining hardware.

Some companies offer hosting services to bitcoin miners. These companies provide the infrastructure for bitcoin mining, which includes hardware, software, electricity, and internet connectivity. They also offer other services like cooling systems to keep the hardware from overheating and fire suppression systems to protect against damage from power surges or fires. Marathon is one such company.

Immersion Cooling Possibilities

Immersion cooling is an old process, but it is new to the crypto industry and is providing some interesting new possibilities. The process uses liquid to cool the hardware. It is an efficient way of cooling the hardware, and it can be used for other purposes as well. It involves submerging computer components in a bath of dielectric liquid, which has a much higher heat capacity than air or water, and then pumping in cold liquid to bring down the temperature. Marathon estimates that immersion cooling can allow it to overclock its miners by roughly 40% allowing for greater efficiency. It is important to note that there is a somewhat linear increase in energy costs, and the cooling system can run into the thousands for each miner. It definitely isn’t free, but over the long term, it seems like a promising option as the costs are front-loaded for the most part.

Marathon Now Dominates Bitcoin Mining

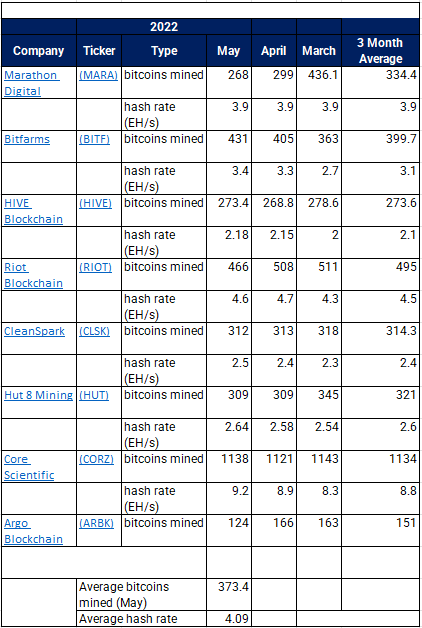

The company produced a record 1,259 bitcoin, which represented a 15% increase over the 1,098 bitcoin in the previous quarter. We can see that the company is on the high end compared to its peers below.

Adapted from Seeking Alpha

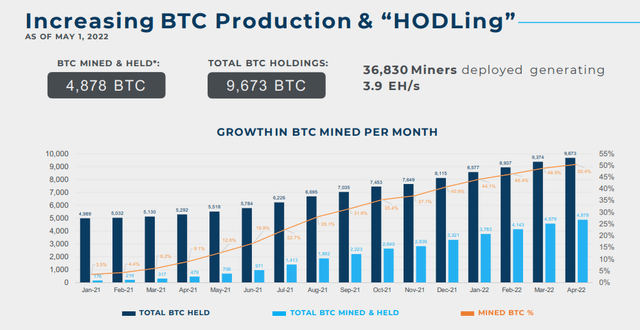

The company has been building out on its promise for hashrate improvements. It has managed to increase its overall hash rate by 449% YoY. The company also increased the total number of miners deployed to 36,830 miners, good for roughly 3.9 EH/s, at the end of May. It estimates that it has another 1.9 EH/s waiting to be deployed.

Marathon Digital Holdings

The company has executed well on hashrate growth, but with Bitcoin being its only product, the company was always predisposed to risks associated with a sharp crypto selloff. This is now adversely impacting valuation and compressing multiples.

Analysis and Forward-Looking Commentary

Bitcoin is in the midst of a massive selloff. This is due in no small part to the newly hawkish Fed hiking rates to address rampant inflation.

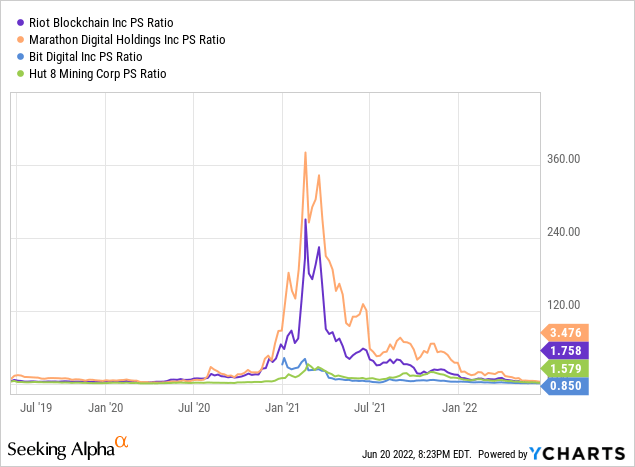

In some circles, Bitcoin was pitched as the millennial’s hedge against inflation – meant to replace antiquated gold bullions which supposedly had no utility. It is not lost on the writer how ironic it is that in times of rampant inflation Bitcoin has proverbially ‘kicked the bucket’. Nevertheless, crypto bulls remain and must now contend with compressed multiples on some of their favorite crypto mining names. This phenomenon has been broad-based in the industry.

This makes sense when you consider Bitcoin’s massive selloff means that the crypto war chests most of the mining companies tend to hold in their treasuries are quite literally being devalued as the token slams lower. The multiples tend to expand and contract as the sentiment around the broader crypto market cycles. With this approach, we can look at some cases.

Bitcoin is Marathon Digital’s main product, which simplifies the analysis. The company produced roughly 1259 BTC in Q1 2022. The company is still working at fully deploying its fleet, but the company is bullish that Q3 will be the most promising with respect to hash rate and fleet growth. As our guide for the worst case, we will take a total treasury value of 14,000 BTC for 2022. For the best case, we will take 17500 BTC. I expect the actual number to come in between the base (15500) and the best case. For BTC’s prices, we will take $12k as the worst case, the current price, and $45k as the best case. Below are the rough revenue estimates for the different cases.

| Cases | Bitcoin Price | ||

| Bitcoin Production | Low | Base (current) | Best |

| $12,000.00 | $19,750.00 | $45,000.00 | |

| 14000 | $168,000,000.00 | $276,500,000.00 | $630,000,000.00 |

| 15500 | $186,000,000.00 | $306,125,000.00 | $697,500,000.00 |

| 17500 | $210,000,000.00 | $345,625,000.00 | $787,500,000.00 |

Source: Author’s Estimates

We will use a P/S ratio due to the variable revenue. If we apply the current 3.5 ratio, we get the following prices as targets:

| P/S | 3.5 | Forecasted Price | |

| Cases | Bitcoin Price | ||

| Bitcoin Production | Low | Base (current) | Best |

| $12,000.00 | $19,750.00 | $45,000.00 | |

| 14000 | $5.71 | $9.40 | $21.41 |

| 15500 | $6.32 | $10.40 | $23.70 |

| 17500 | $7.14 | $11.74 | $26.76 |

Source: Author’s Estimates

This is consistent with the expected decline in revenue due to the selloff. It is important to note that this assumes the P/S ratio remains compressed. As price action improves, the multiple should begin to expand again. If the P/S multiples can get back to 8 this is how the story looks:

| P/S | 8 | Forecasted Price | |

| Cases | Bitcoin Price | ||

| Bitcoin Production | Low | Base (current) | Best |

| $12,000.00 | $19,750.00 | $45,000.00 | |

| 14000 | $13.05 | $21.48 | $48.93 |

| 15500 | $14.45 | $23.78 | $54.17 |

| 17500 | $16.31 | $26.84 | $61.17 |

Source: Author’s Estimates

These estimates do not account for the effects of future dilution or token sales in the next year and assume that cash on hand will cover expenses.

The Takeaway

This one is not too complicated. The main questions are, can Marathon Digital make it to the other side of a crypto bear market, and will the recovery lift crypto prices to prior highs? Bear markets aren’t a new thing for crypto, but it’s not a forgone conclusion that prices will fully rebound. I would opt for caution in the short term, but Marathon Digital is probably the best option in the Bitcoin mining space.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Monero

Monero  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Zcash

Zcash  Sui

Sui  Hedera

Hedera  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Dai

Dai  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Cronos

Cronos  Toncoin

Toncoin  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Polkadot

Polkadot  Uniswap

Uniswap  Aave

Aave  USD1

USD1  Bittensor

Bittensor  Bitget Token

Bitget Token  MemeCore

MemeCore