Devonyu/iStock via Getty Images

Introduction

In our previous coverage, we cautioned investors against Marathon Digital Holdings (NASDAQ:MARA) due to its outsized management stock-based compensation (‘SBC’) expenses. In this article, we turn our attention to another undercovered risk that could render MARA’s impressive 2024 23 EH/s expansion efforts unmeaningful.

The one-off event (a huge storm) in Montana caused a 50% decline in its Q2 and Q3 Bitcoin (BTC-USD) production and prompted us to reconsider one of MARA’s major operation risks. That risk is its largely centralized operations in Texas.

Potential Future Mining Woes In Texas

According to Table 1, Texas will become one of MARA’s primary Bitcoin mining locations. By the end of the MARA’s 23 EH/s expansion plans, 4 out of 8 sites will be positioned in Texas where 62% of MARA’s targeted 23 EH/s capacity will be situated in Texas. This decision may prove to be problematic for MARA given Texas’ past power grid woes.

According to a recent report, Texas offers low-cost power and relatively mining-friendly regulations which resulted in the rapid rise of Bitcoin mining in the state. The report also stated that Texas has excess renewable energy that can power 500,000 Texas homes for a year. The excess energy was caused by Federal price guarantees and tax breaks that only targeted the construction of renewable energy production facilities but not transmission lines. This problem is known as local transmission constraints:

Curtailment of renewable energy refers to renewable energy generators not operating at 100% capacity. Curtailment happens for 2 main reasons, system-wide oversupply, and local transmission constraints.

Local transmission refers to the lack of infrastructure to deliver electricity from the location of production to the location of demand.

Hence, Bitcoin mining offers an escape route for these facilities.

According to the North American Electric Reliability Corp, Texas’ power grid risks blackouts for not accounting for the extreme summer heat. As a result, Bitcoin miners had to shut down mining operations to prevent blackouts during such extreme temperatures. Therefore, although the slump in MARA’s 2022 Q2 and Q3 Bitcoin production was caused by one-off damages from a huge storm in Montana, MARA’s Texas sites risk periodic shutdowns or even blackouts in the future given extreme weather events are becoming increasingly common.

Moreover, crypto mining activities in Texas have received renewed scrutiny from lawmakers where mining activities are accused of putting unnecessary strain on the power grid. For now, only application approvals are slowed down but this scrutiny could snowball into something more substantial.

Therefore, MARA’s impressive 23 EH/s capacity growth could be undone by external uncontrollable events such as weather, grid integrity, and compliance.

Table 1. Texas Site Expansion Plan

| Site | State | MW | MW % | Capacity (EH/s) | Capacity % |

| MCCAMEY | TX | 200 | 27% | 7 | 30% |

| GRANBURY | TX | 80 | 11% | 3.2 | 14% |

| GARDEN CITY | TX | 180 | 24% | 4.2 | 18% |

| PLANO | TX | 2 | 0% | 0.08 | 0% |

| KEARNEY | NE | 8 | 1% | 0.2 | 1% |

| NORTH SIOUX CITY | SD | 2 | 0% | 0.07 | 0% |

| ELLENDALE | ND | 180 | 24% | 8 | 35% |

| COSHOCTON | OH | 90 | 12% | 0.33 | 1% |

Source: MARA

Fig 1. Bitcoin Mining in Texas (Texas Blockchain Council)

Bitcoin Mining Expected To Continue Under Immediate Worst-Case Scenario

Q4 Bitcoin production is expected to recover past Q1 levels as MARA has relocated from its Montana mining operations. Although a bulk of MARA’s operations are hosted by Compute North (who filed for bankruptcy), MARA does not expect the bankruptcy proceedings to affect its operations. Hence, we should expect MARA to continue its Bitcoin production as usual.

We also expect MARA to continue Bitcoin mining operations under our Bitcoin worst-case scenario. We reiterate that we still see Bitcoin hitting $10,000 before the end of 2023. Under this scenario, MARA is the only miner not expected to halt mining operations. This is because MARA’s cost of revenue per BTC (excluding depreciation) is well below $10,000. In fact, MARA’s cost of revenue (excluding depreciation) is one of MARA’s competitive advantages and is unrivaled in the industry (Table 2).

Furthermore, MARA’s recent business cost (aside from the one-off event affecting Q2 and Q3) has remained relatively stable and the lowest (Table 3). This means that MARA can weather Bitcoin’s bear market better than other mining companies.

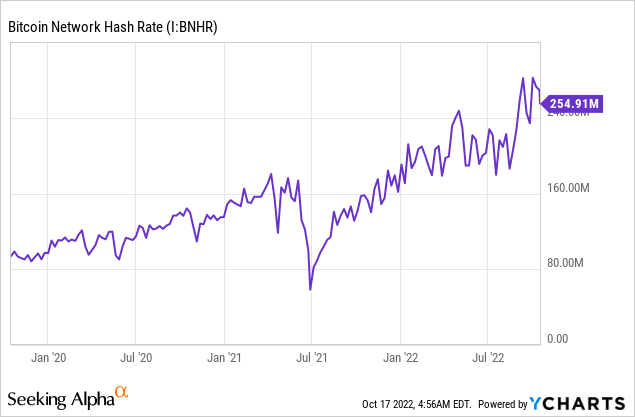

Lastly, MARA has the highest targeted self-mining capacity in the near-term (Table 4). We previously argued that MARA and Riot Blockchain’s (RIOT) average capacity growth is about 0.4 EH/s QoQ. We perceive this as the mining rig manufacturing bottleneck such that the delivery of mining rigs could not keep up with orders placed. This perception changed after Ethereum (ETH-USD) transitioned to Proof-of-Stake (‘PoS’) where there is less competition for the rigs. Therefore, we should continue to see an uptick in capacity QoQ growth rate.

The expected uptick in capacity growth rate is especially significant to MARA. As of 2022Q2, MARA has over $800mil in deposits for the mining rigs. Although CleanSpark (CLSK) also has a similar capacity target as MARA, CLSK only has $32mil in deposits. This means that MARA is more certain to achieve the 23 EH/s capacity target during a time when the cost and barrier to raising funds are getting higher.

Table 2. Cost of Revenue (Excl. Depreciation) Comps

| Miners | Cost of Revenue (CoR, Excl. Depreciation) |

| MARA | 2022Q2: Invalid due to Montana One-Off Disruption2022Q1: $6,240 = $7.86mil CoR / 1,259 BTC mined2021Q4: $6,500 = $7.1mil CoR / 1,098 BTC mined |

| BITF | $12,000 |

| HUT | Q2: $20,200 = $19.1mil CoR / 946 BTC minedQ1: $13,800 = $13mil CoR / 942 BTC mined |

| RIOT | Q2: $12,900 = $18mil CoR / 1,395 BTC mined Q1: $13,500 = $19mil CoR / 1,405 BTC mined |

| CLSK | Q2: $9,600 = $10.3mil CoR / 964 BTC mined |

Table 3. All-in Business Cost per BTC Comps

| Miners | All-in Business Costs per BTC |

| MARA | 2022Q2: Not valid2022Q1: $31,700 = $40mil all-in costs / 1,259 BTC mined2021Q4: $32,240 = $28.57mil all-in costs / 1,098 BTC mined |

| BITF | 2022Q2: $36,700 = $34.3mil (excl. Financial Gains) / 1,257 2022Q1: $34,340 = $33mil / 961 BTC mined |

| HUT | 2022Q2: $49,500 = $46.8mil all-in costs / 946 BTC mined 2022Q1: $40,750 = $38.4mil all-in costs / 942 BTC mined2021Q4: $40,200 = $31.7mil all-in costs / 789 BTC mined |

| RIOT | 2022Q2: $35,300 = $49.3mil all-in costs / 1,395 BTC mined2022Q1: $30,800 = $43.25mil all-in costs / 1,405 BTC mined |

| CLSK | 2022Q2: $37,800 = $36.4mil all-in costs / 964 BTC mined |

Table 4. Near-term Expected Capacity Comps

Source: Author

Valuation

There are only so many ways that Bitcoin mining companies can cover operating costs. Some mining companies like Hut 8 adopt a 100% HODL strategy and dilute shareholders to cover expansion and operating costs; some companies like CleanSpark sell the Bitcoins mined to cover operating costs while maintaining low shareholder dilution and low leverage; MARA, on the other hand, also HODLs Bitcoins but turns to leverage to cover expansion and operating expenses. The majority of MARA’s liability was contributed from the $745mil convertible note offered in 2021Q4.

MARA’s high leverage is detrimental to its valuation when Bitcoin is trading lower than the all-in business costs. This is because we had to switch from a profitability valuation model to an equity valuation model. Under the equity valuation model, companies like HUT perform particularly well because the large Bitcoin reserve and low liability add to the shareholder equity.

MARA’s adjusted shareholder equity (or adjusted net asset value less total liability) stands at $0.685bn (=$86.4mil cash + 10,670 BTC x $20,000 + $315.4mil PP&E + $830.2mil deposits – $760mil total liabilities) or 57% of its market cap ($1.2bn). Comparatively, HUT’s adjusted shareholder equity stands at $405mil or 112% of its market cap, implying investors are getting its Bitcoin mining operations for free.

If we’re willing to ignore the current market conditions, a $36,200 Bitcoin is required to justify its current valuation based on the following assumption:

- P/E ratio of 5

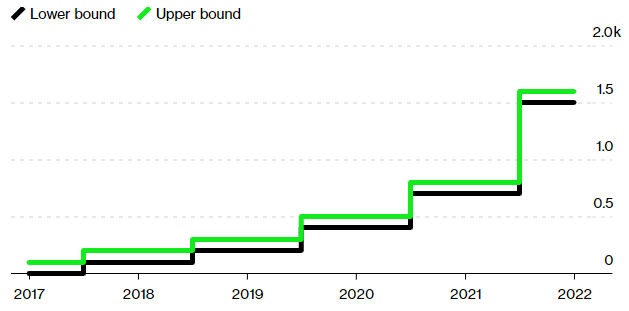

- 422 EH/s Bitcoin network hash rate by end of 2023 based on 2021 and 2022 growth rates.

- MARA has 23 EH/s by end of 2023

- MARA maintains its $32,000 all-in business cost per BTC

- Assets and liabilities as of Q2 remain constant.

Based on the Bitcoin halving cycle, we expect Bitcoin to recover past $36,000 by the end of 2023. That’s just 1 year from now.

Using the same assumption, a $70,000 Bitcoin can justify a $4.5bn market cap. This provides investors with a 275% upside. However, investors can also earn a 250% return without additional operation/business risks by investing directly in Bitcoin. Therefore, we continue to iterate our stance to invest directly in Bitcoin.

Fig 2. Bitcoin Network Hash Rate (YCharts)

Verdict

Compared to comps, MARA has several advantages such as the lowest mining cost and low uncertainty to achieve the most targeted capacity. However, MARA also presents severe operation risks by locating 62% of its mining operations in one state should an extreme natural event, grid energization issues, or adverse change in state policy occur.

Our valuation model suggests that MARA has a 275% upside should Bitcoin reclaim ATH. However, investors will have to decide whether the additional operation and business risks can justify the additional 25% upside. For us, we’re willing to forgo the 25% upside by investing in Bitcoin directly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Zcash

Zcash  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Canton

Canton  Shiba Inu

Shiba Inu  Hedera

Hedera  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  USD1

USD1  Polkadot

Polkadot  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave