The crypto space has taken a slide downwards with intensifying bearish pressure, as investor sentiment continues to dip. In this context, the PI price has not followed the decline, but it seems it is facing its own unique selling pressure.

Even technical tools paint a grim picture for PI crypto, while another reason coming out for the ongoing Pi Network price dip is its looming token unlocks.

As a result, it is down over 60% from mid-May, and in the past few days, it has continued bleeding, without a single daily green candle. Amid this strong pressure, analysts have projected a further southward move towards $0.4 to come in Pi coin.

Keep reading to know more.

PI Price On Continuous Decline, What Lies Ahead?

When writing, the PI crypto price was trading at $0.6427 and is over 20% down in the past week, down over 60% since May’s high of $1.65, and down 1% intraday.

The trend is clear and that is red, and despite the overall gloomy sentiment, May’s return is “+13.57%”, when writing.

The last month’s return is still positive, many are curious whether it could rebound again, despite the huge blow last month. Also, recently, PI crypto’s official X account pushed a gaming-related ecosystem update, but experts believe it is not enough to revive confidence in the asset yet.

The lack of confidence is due to the lower adoption and no actual utility makes the risk higher. Experts believe that without a clear forward goal, the PI crypto could be trapped on the rough road.

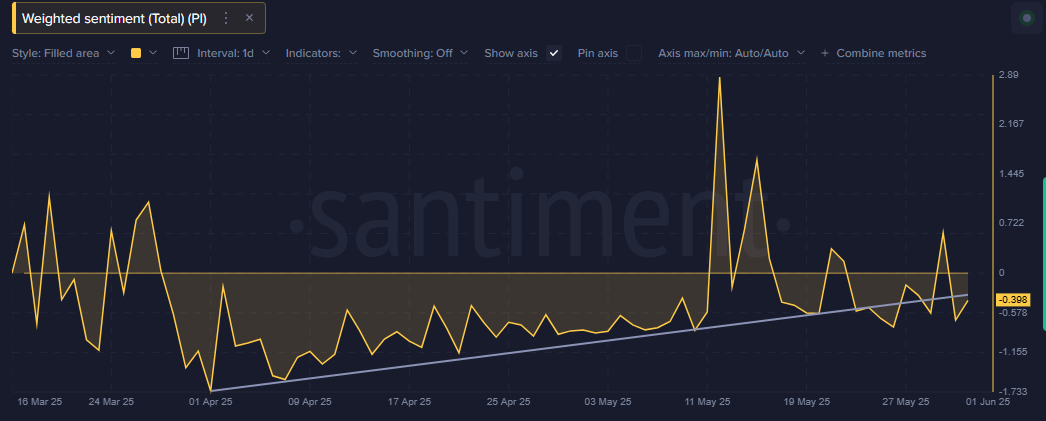

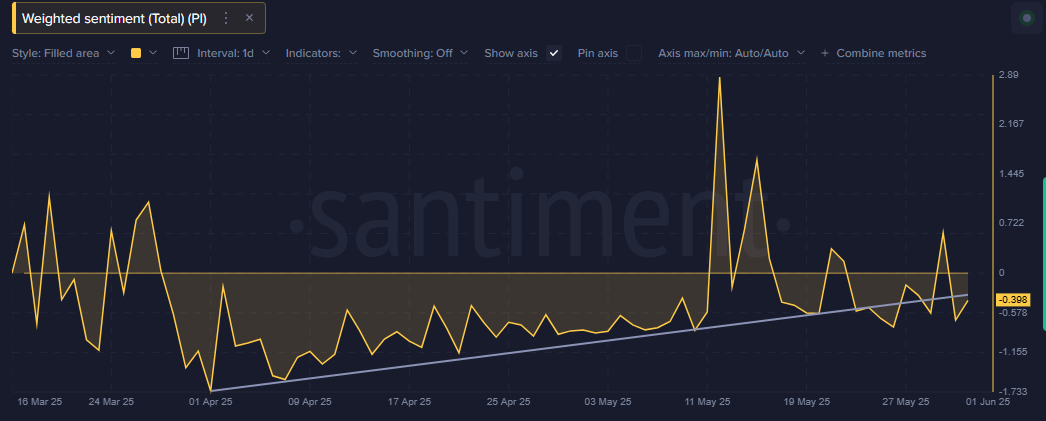

Moreover, the weighted sentiment, which was on the rise before, after the crash in mid-May, has decreased to “-0.398”. This shows that people are talking more negatively than positively.

Among them, a further drop to $0.40 is being projected on several X posts, which is its April low.

The short-term price action hints strongly for a fall, but in the long term, a rebound is still a possibility if bullish forces step in from the $0.40 mark, like April, then a move could come, but that remains uncertain, as bulls wouldn’t join until a clear catalyst is in the market.

Therefore, the investors must understand its red flags and must wait for a clear market driver. DYOR.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Monero

Monero  Stellar

Stellar