According to Arcane Research, the “7-day average daily real bitcoin volume” hit a yearly high. It comes after the top cryptocurrency exhibited significant momentum in recent weeks. But the market is starting to show extreme greed.

Bitcoin is showing some resilience above $16,000. Although there is low resistance above $16k, analysts say that a pullback is likely if BTC’s rally slows down.

Slowing momentum is probable given that the real volume of Bitcoin rose 270% in the past month, according to Arcane. Following such a strong month in terms of trading activity, declining momentum could occur.

Greed is taking over the Bitcoin market

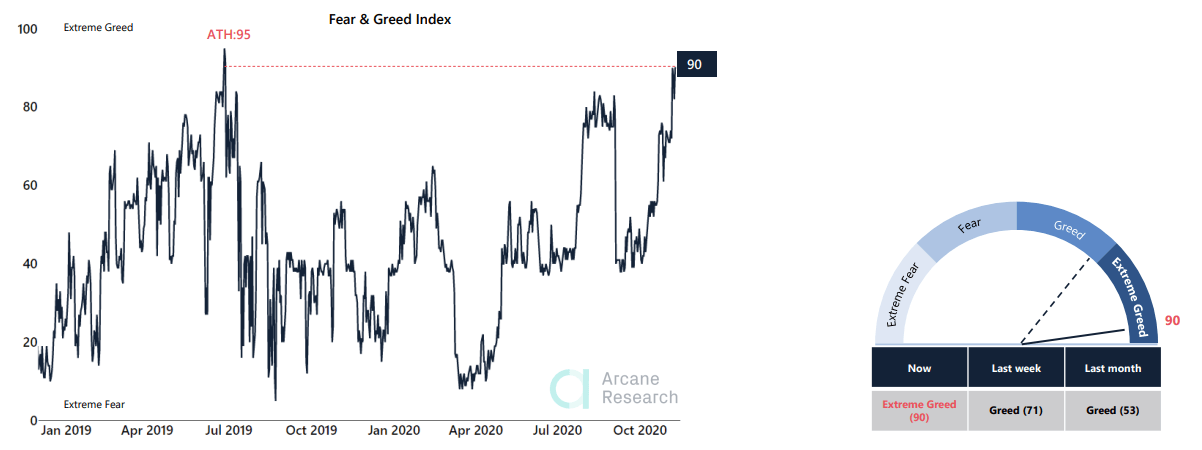

Data shows that the Fear and Greed Index is above 90. When the index nears 100, it shows that the market is exhibiting “extreme greed.”

Historically, researchers at Arcane said that when greed levels stayed above 90, it had been ideal periods to take profit. They said:

“The Fear and Greed Index pushed above 90 last week and is currently at the highest levels seen since the index was launched in the beginning of 2018. We have only been higher one time, during the absolute peak last summer. As emphasized many times already this year, this is not a level we stay at for a long time and has historically been a good time to take some profit.”

The Fear and Greed index pointing at extreme greed coincides with Bitcoin testing $16,000 for the first time since 2017.

Considering that BTC is at a heavy resistance level, a taking profit correction could be more likely than a rally continuation.

Extreme volatility is expected

Atop the various on-chain indicators that anticipate either an explosive rally or a deep pullback, volatility trends also suggest a major price movement is nearing.

Arcane found that the volatility rose significantly last week, causing the 7-day volatility to reach 4.6%. With the volatility at a two-month high, a large price movement has become increasingly probable. The analysts wrote:

“The first double-digit percentage since July certainty resulted in a large spike in volatility last week. The 7-day volatility is now at 4.6%, the highest in two months. This week has begun with massive moves across global markets as well, and we could be in for yet another eventful week in the crypto market.”

There are several variables, however, that could prevent a large pullback from occurring in the near term. The most convincing argument that a deep correction is unlikely is the sell-off from miners in November.

Miners have sold significant amounts of BTC from late October to early November. There is a chance that this could lower the selling pressure on BTC considerably, especially if miners sell less bridging over to December.

Bitcoin, currently ranked #1 by market cap, is up 0.78% over the past 24 hours. BTC has a market cap of $297.23B with a 24 hour volume of $26.19B.

Bitcoin Price Chart

BTCUSD Chart by TradingView

Like what you see? Subscribe for daily updates.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Sui

Sui  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Canton

Canton  Hedera

Hedera  Shiba Inu

Shiba Inu  sUSDS

sUSDS  USDT0

USDT0  Toncoin

Toncoin  Dai

Dai  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Uniswap

Uniswap  PayPal USD

PayPal USD  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Mantle

Mantle  Rain

Rain  Pepe

Pepe  MemeCore

MemeCore  Aave

Aave