Read U.TODAY on

Google News

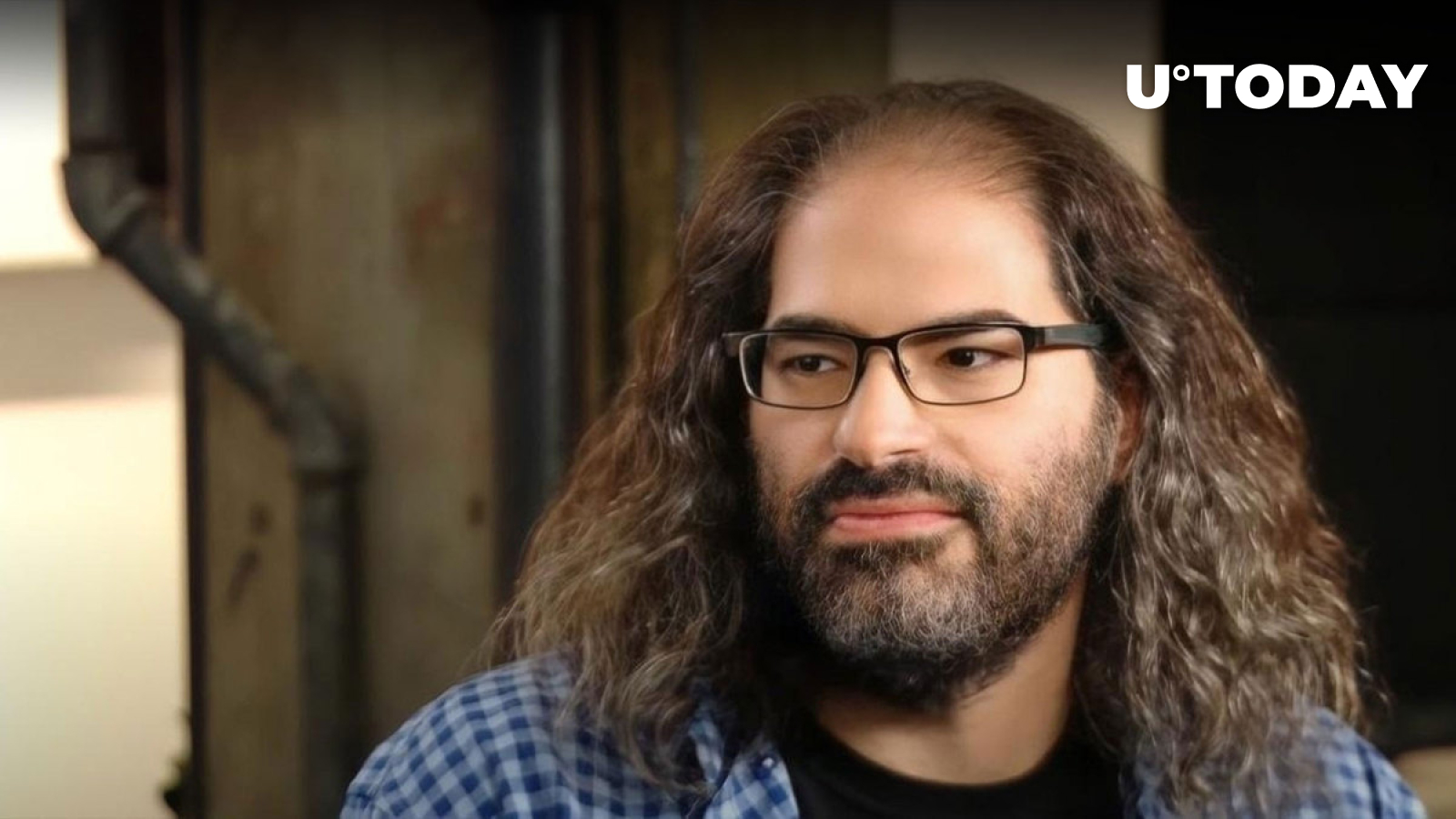

An XRP community member who goes by the name “RealXRPboy” has offered a throwback in time by sharing a post by Ripple CTO David Schwartz way back.

In the post, Schwartz underlined 10 points under the caption, “Here’s how I’ve been explaining it recently.” At the end of the post, Schwartz stated, “I think that pretty much covers our vision. There is of course no guarantee for success.”

“We stopped using lockups a long time ago. They don’t really work the way I initially hoped they would,” Schwartz answered.

Simply defined, token lockup is the practice of limiting the transferability of tokens for a predetermined amount of time, including those obtained through airdrops, initial coin offerings (ICOs) or sale events. Investors are not permitted to transfer or sell their tokens during the lockup period.

A token lockup has two purposes: first, to incentivize long-term investment in a project or company, and second, to prevent large amounts of tokens from flooding the market.

That said, it bears mentioning that in 2017, Ripple placed 55 billion XRP into time-based escrows for the second reason: to prevent large amounts of tokens from flooding the market and potentially lowering the XRP price.

Ripple escrows ensure that the supply of XRP in circulation is predictable and increases at a slow but steady rate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  WETH

WETH  Monero

Monero  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Canton

Canton  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  USDT0

USDT0  Dai

Dai  Shiba Inu

Shiba Inu  Toncoin

Toncoin  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Mantle

Mantle  Polkadot

Polkadot  MemeCore

MemeCore  Rain

Rain  Bitget Token

Bitget Token