Shiba Inu coin Price has begun 2026 on a bullish note, retesting a key long-term support zone that previously sparked major rallies in 2021 and 2024. Trading around 700–750, this level has historically acted as a strong demand base, preventing further declines and showing sustained buyer interest.

SHIB Supply Tightens as Holders Grow

Daily SHIB burns jumped 10,728%, removing 173 million SHIB from circulation. In just the last 24 hours, over 200 billion SHIB left exchanges, bringing exchange supply down to 81 trillion, roughly 14% of the total circulating supply, similar to Bitcoin and Ethereum. Reduced supply is fueling optimism and strengthening the case for a short-term bullish trend.

Despite a challenging 2025, the SHIB community continues to expand. Over 70,000 new holders joined last year, raising the total to 1.54 million. Long-term investors have steadily accumulated SHIB, decreasing exchange supply by 60 trillion, signaling confidence in the memecoin’s potential recovery.

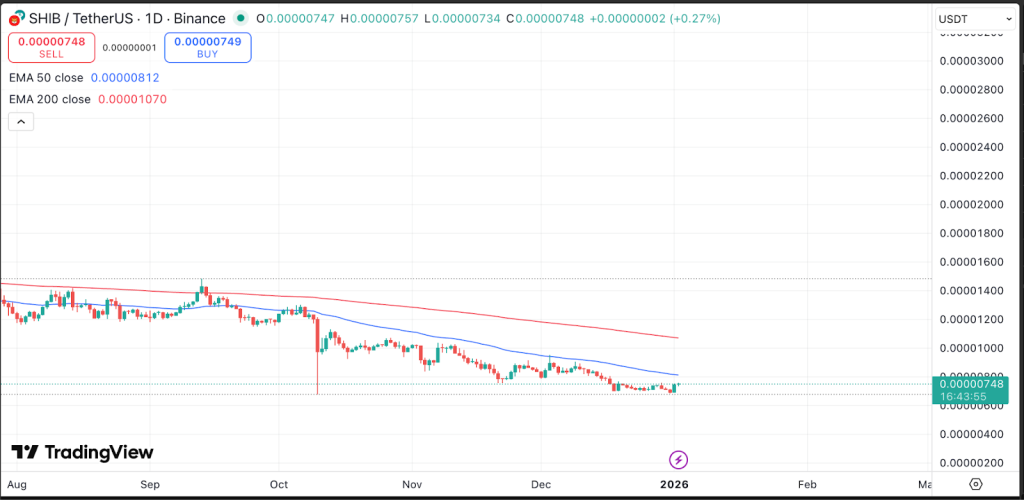

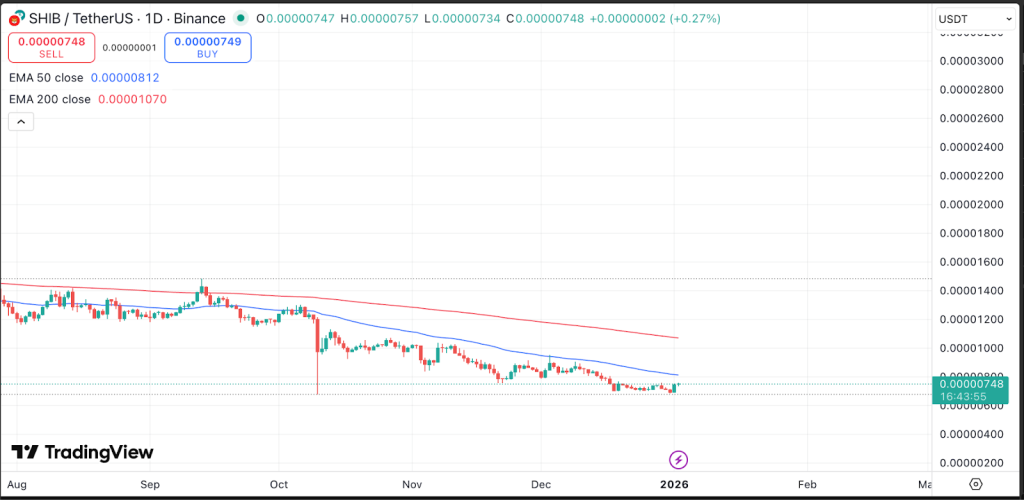

Shiba Inu Coin Price To See Major Rally With Golden Cross Formation Ahead

A key bullish signal on analysts’ radar is the potential formation of a golden cross, where the 50-day EMA crosses above the 200-day EMA. Currently, the 50-day EMA is still below the 200-day EMA, but price action is slowly moving in the right direction. A golden cross typically occurs after periods of consolidation rather than sudden spikes, and it historically signals strong upward momentum.

- Also Read :

- Why Is PEPE Coin Price Up Today? Meme Coin Jumps 26%

- ,

To accelerate this pattern, SHIB needs to break out of its descending wedge and hold above the 820 level. Technical indicators, including narrowing candle ranges and early bullish formations like the inverse head-and-shoulders, suggest price absorption and base formation ideal conditions for a golden cross.

SHIB Price Short-Term Analysis

Momentum indicators such as the 12-hour stochastic RSI have begun flipping bullish. Combined with the strong demand zone, reduced exchange supply, and ongoing accumulation by holders, SHIB could see a short-term rebound. If SHIB maintains support and builds momentum, the golden cross may form later in 2026, potentially signaling a sustained upward trend.

Current forecasts indicate that SHIB will reach $0.0000085 by the end of January 2026, offering approximately 25% upside from current levels. While some volatility is possible, strong support zones, accelerating burns, increasing holder accumulation, and the potential golden cross pattern suggest that Shiba Inu could start the year on a bullish trajectory.

FAQs

Shiba Inu price is rising due to strong support zones, rising burns, growing holders, and accumulation by long-term investors.

Over 70,000 new Shiba Inu holders joined in 2025, bringing total holders to 1.54 million and showing confidence in the coin.

As per the Shiba Inu price forecast, Shiba Inu’s price may trade at an average of $0.000210 for the year 2029.

With the coming updates and strong community, Shiba Inu remains a strong candidate in the crypto world.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Wrapped SOL

Wrapped SOL  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Zcash

Zcash  WETH

WETH  Monero

Monero  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Avalanche

Avalanche  Sui

Sui  Canton

Canton  Hedera

Hedera  USDT0

USDT0  Shiba Inu

Shiba Inu  Dai

Dai  Toncoin

Toncoin  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  Cronos

Cronos  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Polkadot

Polkadot  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token