Before Toncoin’s (TON) recent bounce to $6.75, the cryptocurrency experienced a 12% decline over the last six days. TON initially broke below a vital area and has since been unable to rise past it.

Based on this analysis, it can be challenging for the token to break this resistance. As such, the price may remain below $7 in the coming days.

Toncoin Metric Reveals Potential Sell-Off

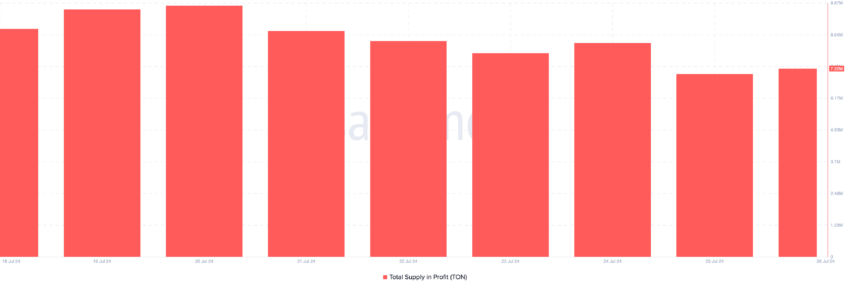

According to IntoTheBlock, TON’s decline over the last month has ensured that the number of holders in profits is no longer at the previous peak. Furthermore, the In/Out of Money Around Price (IOMAP) reveals how the price may fare, with data showing a significant sell-wall.

The IOMAP group addresses holding a crypto asset based on their unrealized losses or profits. If a large number of addresses are in unrealized loss, the price range will act as resistance. However, if the higher number is in profits, it will be a support point for the crypto in question.

For Toncoin, 2,290 addresses that purchased 1.15 million tokens at an average price of $7.05 are currently in unrealized losses. This is a higher figure than the 1,510 addresses that bought 636,690 TON tokens at an average price of $6.61.

Read More: 6 Best Toncoin (TON) Wallets in 2024

This means that if TON’s price continues its bounce and reaches at least $6.93, these addresses may place a significant sell order, potentially causing the price to fall.

If this happens, TON’s next level could be around $6.43 and $6.52. The supply of exchanges provides further evidence of this.

On July 25, Toncoin’s supply on exchanges was a little under seven million. But at press time, the figure had climbed to 7.32 million. The increase in this metric implies that investors are sending more tokens out of self-custody, suggesting potential selling pressure.

If the number were lower, it would have implied lower selling pressure and increased potential for prices to jump. But If this exchange supply continues to rise, TON’s price decrease, as mentioned above, could be validated.

TON Price Prediction: Potential Rebound or Further Decline?

Between May and July 21, TON formed an ascending trendline that ensured that the price did not break below $6.03. However, press time data shown on the daily chart reveals that the price has slipped below the trendline and the support at $7.00.

The Relative Strength Index (RSI) corroborates this condition, as the reading is below the neutral line. When the RSI is below the midpoint, it means that the momentum around a cryptocurrency is bearish. Hence, the price is likely to continue a downward trend.

Another indicator that supports the bearish bias is the Ichimoku cloud. The Ichimolky cloud spots support and resistance levels and identifies trend direction. If the cloud is below the price, the trend is bullish.

However, for TON, the cloud is above the price, indicating a bearish momentum. From the chart shown below, Toncoin’s price could decline to $6.57, which is where the 23.6% Fibonacci retracement positions.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

But if buying pressure increases, this forecast may be invalidated. If that happens, TON can rebound to $7.18 or as elevated as $7.45.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Ethena USDe

Ethena USDe  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Sui

Sui  WETH

WETH  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  WhiteBIT Coin

WhiteBIT Coin  Zcash

Zcash  Monero

Monero  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Dai

Dai  Bittensor

Bittensor  Polkadot

Polkadot  MemeCore

MemeCore  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Uniswap

Uniswap  Aave

Aave  Bitget Token

Bitget Token  OKB

OKB  USD1

USD1  Ethena

Ethena  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund