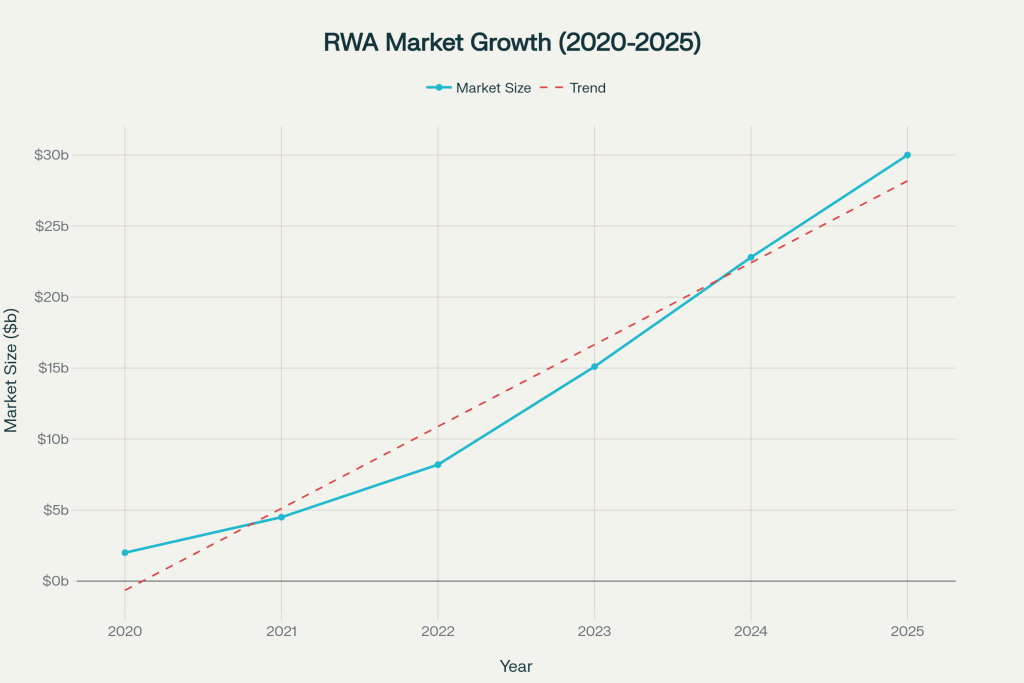

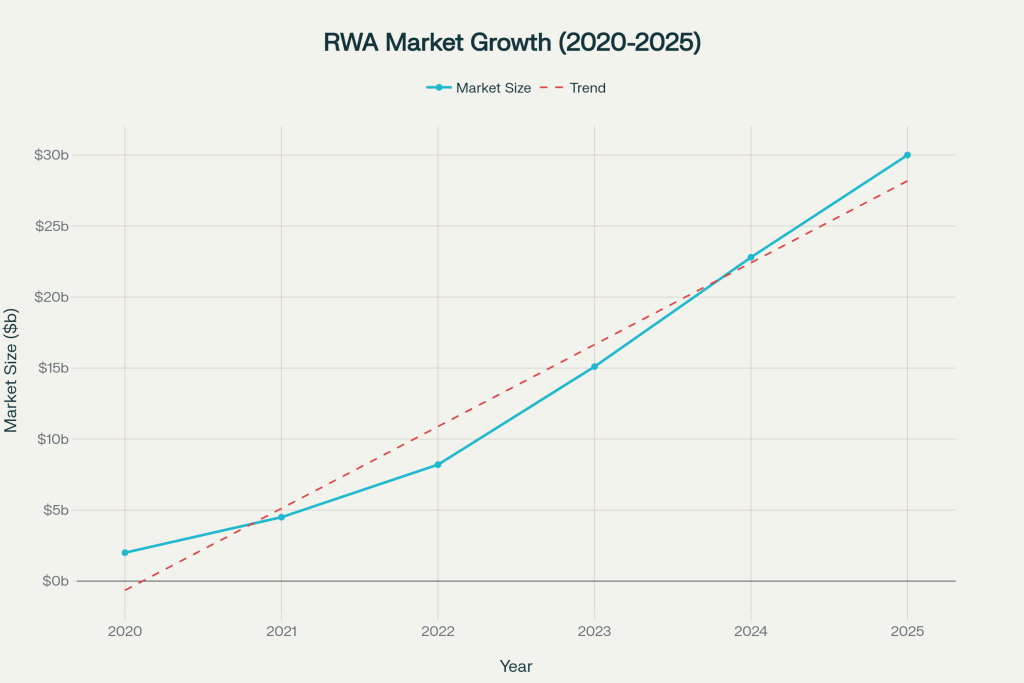

The Real-World Asset (RWA) tokenization market has been booming following several regulatory implementations and positive approach of the SEC toward crypto. This has boosted the market sentiment of RWA assets, pushing top institutions to explore and expand this sector. As a result, leaders of the market are bridging the gap between traditional finance and decentralized financial systems. With an on-chain value reaching $30 billion in 2025, representing a massive 400% growth over three years, RWA tokenization has transitioned to scaled institutional adoption.

Market Overview of RWA: Gained 260% in H1 2025

The RWA tokenization ecosystem has experienced explosive growth in recent years, expanding from merely $85 million in 2020 to $30 billion by mid-2025. This massive growth shows a sentimental shift in how institutions and big investors approach asset ownership, liquidity, and accessibility.

The market’s evolution has been particularly dominant in 2025, with the sector growing approximately 260% in the first half alone, climbing from $8.6 billion to over $23 billion.

Key market trends driving this growth include rising interest rates making traditional yield-bearing assets attractive again, improved regulatory clarity across major jurisdictions, and institutional comfort with blockchain technology.

Major financial institutions including BlackRock, JPMorgan, Franklin Templeton, and Apollo have moved beyond experimentation to production-scale deployment.

Which Category is Dominating?

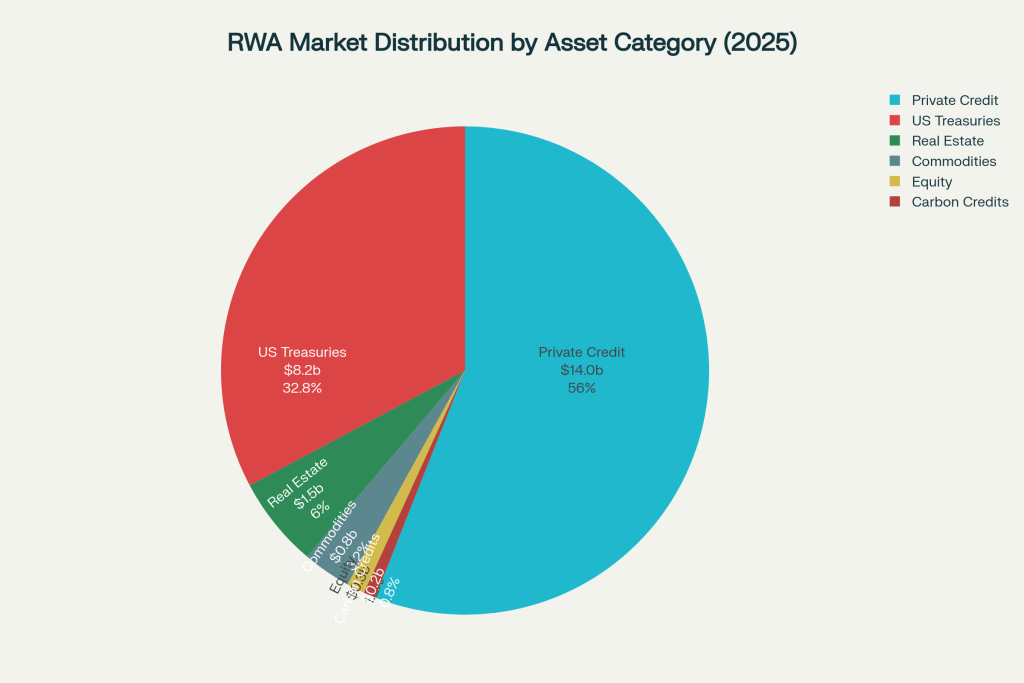

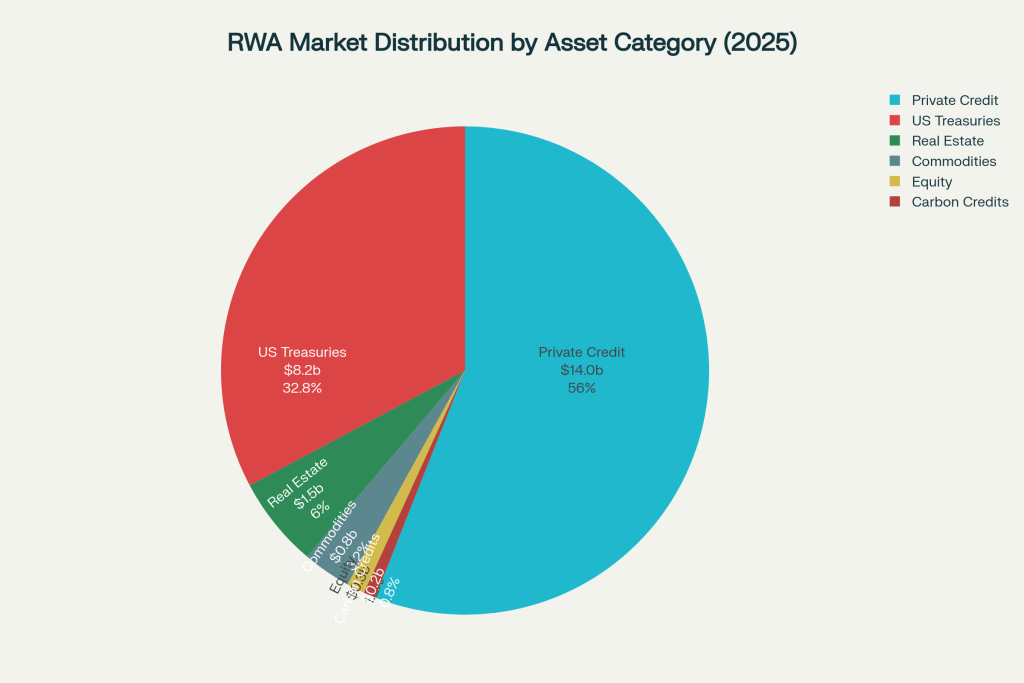

Private credit dominates RWA tokenization with 58% market share ($14B), followed by US Treasuries at 34% ($8.2B)

Private credit has become a dominant segment, commanding 58% of the RWA market with approximately $14 billion in tokenized value. This asset class addresses the sector’s primary constraints by lowering operational costs, improving accessibility, and creating potential for robust secondary liquidity markets.

US Treasuries represent the second-largest category at 34% market share ($8.2 billion), driven by institutional demand for yield-bearing, blockchain-native assets that provide 24/7 trading capabilities. The tokenized treasury market has experienced remarkable growth, surging 539% from January 2024 to April 2025.

- Also Read :

- Real World Assets (RWA) Market Surges to $76B as Institutions Embrace Tokenization

- ,

Other significant categories include real estate tokenization (6%), commodities (3%), equity tokens (1%), and carbon credits (1%). The diversification across asset classes demonstrates the broad applicability of tokenization technology across traditional financial instruments.

Top RWA Cryptocurrency Projects and Platforms

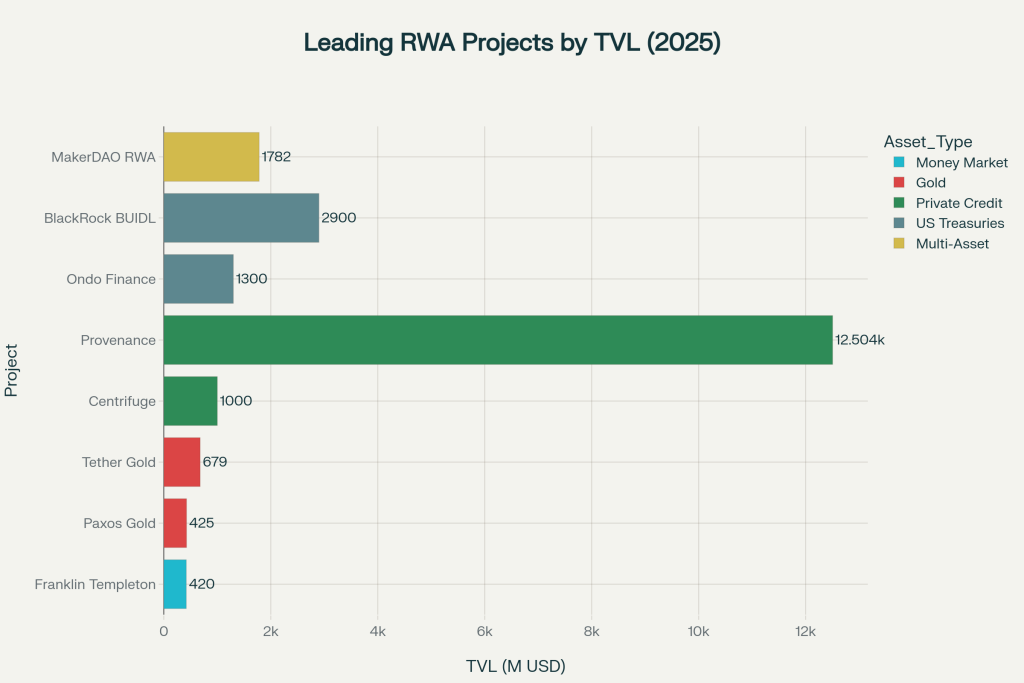

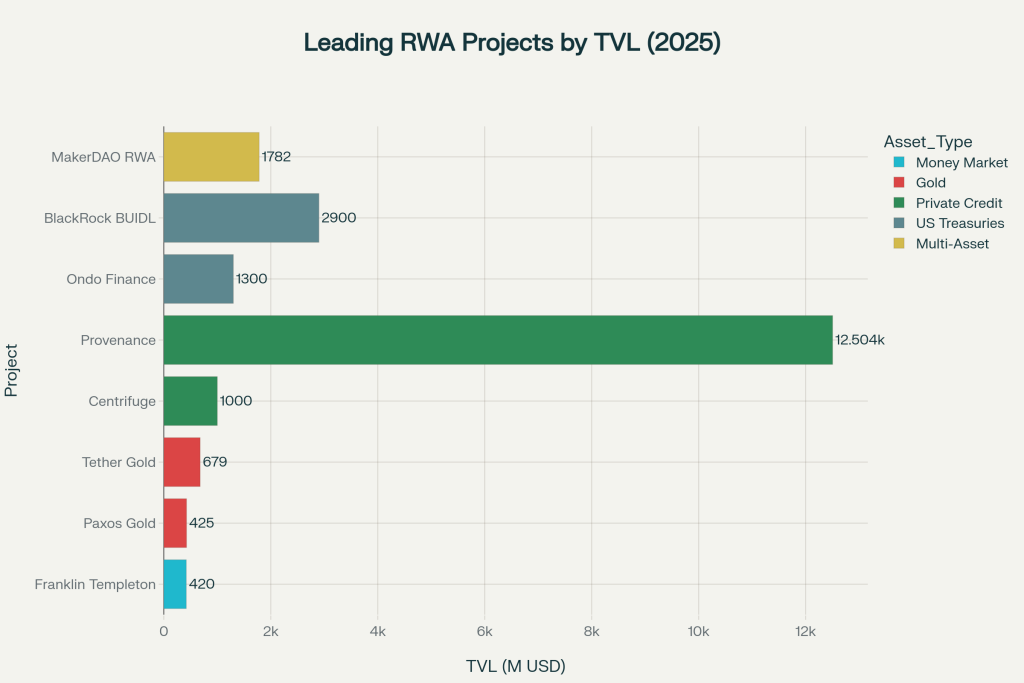

Provenance leads RWA projects with $12.5B TVL, followed by BlackRock BUIDL at $2.9B and MakerDAO RWA vaults at $1.8B.

BlackRock BUIDL Fund

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has built itself as the leading tokenized treasury product, with $2.9 billion in assets under management. Launched in March 2024, BUIDL has gained $700 million in new investments over just 11 days, demonstrating strong institutional demand.

The fund operates as a tokenized money market fund investing 100% of assets in short-term U.S. government securities and cash equivalents, offering approximately 4.5% annual yield through daily dividend accruals.

BUIDL’s success has been highlighted by its acceptance as collateral on major exchanges including Crypto.com and Deribit, marking the first tokenized U.S. Treasury fund to achieve this milestone.

Provenance Blockchain

Developed by fintech firm Figure, Provenance holds the commanding 42.3% market share of the on-chain RWA market with $12.5 billion in tokenized assets. The platform specializes in financial services and asset tokenization, particularly for tokenized loans, private credit, and regulated products.

Provenance shows the rising demand of blockchain networks designed specifically for institutional financial services.

Ondo Finance

Ondo Finance has emerged as a leader in tokenized U.S. Treasuries, with over $1.3 billion in total value locked across multiple blockchain platforms. The platform’s flagship products include OUSG (Ondo Short-Term US Government Treasuries) and USDY (United States Dollar Yield), which provide investors with exposure to short-term treasuries while maintaining 24/7 stablecoin mints and redemptions. Ondo has expanded across multiple blockchain ecosystems, including launches on Sei Network, XRP Ledger, and Stellar, demonstrating the multi-chain approach necessary for strong institutional adoption.

Centrifuge

Centrifuge has achieved $1 billion in Total Value Locked, making it the third RWA protocol to reach this milestone. The platform focuses on tokenizing real-world assets like invoices, receivables, and trade finance instruments, pushing them into DeFi markets as collateral.

In 2025, Centrifuge completed its V3 migration, delivering unified multichain RWA infrastructure across six EVM chains: Ethereum, Plume, Base, Arbitrum, Avalanche, and BNB Chain. The platform won the $1 billion Spark Tokenization Grand Prix and launched Janus Henderson’s flagship AAA CLO strategy on-chain.

Franklin Templeton BENJI

Franklin Templeton’s tokenized money market fund (BENJI) represents $420 million in assets, making it the third-largest tokenized treasury product. The Franklin OnChain U.S. Government Money Fund (FOBXX) was the first U.S.-registered mutual fund to leverage a public blockchain as the system of record for transactions and share ownership.

BENJI has partnered with multiple blockchain networks including Ethereum, Avalanche, Arbitrum, Base, and Stellar, offering enhanced utility compared to traditional financial market rails.

MakerDAO RWA Vaults

MakerDAO operates $1.78 billion in RWA vaults, allowing real-world assets like real estate and invoices to be used as collateral to mint DAI stablecoin. The protocol has opened a program to tokenize up to $1 billion in additional assets, with expected interest from top DeFi firms and potential involvement from BlackRock.

Chainlink (LINK)

While not an RWA issuer itself, Chainlink provides critical infrastructure for RWA tokenization through its decentralized oracle network. The platform acquires 84% of Ethereum’s oracle market, enabling secure real-world data feeds essential for accurate asset valuation and smart contract execution.

Chainlink’s role includes providing data feeds for asset prices, Proof of Reserve solutions for verifying asset backing, and Cross-Chain Interoperability Protocol (CCIP) for seamless blockchain interaction. The platform’s oracle dominance positions it as strong infrastructure for the growing RWA ecosystem.

Partnerships and Regulation Boost RWA Demand

The RWA sector has benefited from significant regulatory developments in 2025. The U.S. GENIUS Act has provided clearer frameworks for tokenized asset adoption, allowing major firms including Bank of America, Citi, BlackRock, and Coinbase to explore tokenization tools. Singapore’s implementation of CRS 2.0 and Hong Kong’s securities issuance guidelines have further supported global adoption.

Additionally, major collaborations are accelerating RWA adoption. Centrifuge partnered with Aave Labs to launch Horizon, increasing RWA liquidity in decentralized finance.

Multi-Chain Expansion

Leading RWA projects are expanding across multiple blockchain networks to maximize accessibility. BlackRock’s BUIDL is now available on Ethereum, Solana, Aptos, Arbitrum, Avalanche, Optimism, and Polygon. Franklin Templeton’s BENJI has similarly expanded to eight blockchain platforms.

Industry Leader Perspectives

The RWA tokenization movement has gained strong support from industry leaders across traditional finance and blockchain sectors:

Larry Fink, CEO of BlackRock: “I believe the next generation for markets, the next generation for securities, will be tokenization of securities”. Fink has stated that “every asset can be tokenized” and described the potential for “revolutionary” changes in investing.

Sergey Nazarov, Founder of Chainlink: “If even a small portion of the quadrillions of dollars in value flowing through the Swift network & its over 11,000 member banks makes its way onto blockchains, the entire blockchain industry could grow multiple times larger quickly”. Nazarov emphasizes that “cryptographic truth is a superior way for the entire world to operate”.

Nathan Allman, CEO of Ondo Finance: “By bringing USDY to Sei, we’re combining an institutional-grade product with a next-generation execution layer, enabling capital-efficient use cases for protocols, developers, and users alike”.

Bhaji Illuminati, CEO of Centrifuge: “Centrifuge V3 is the infrastructure for the next generation of financial markets. This launch is the culmination of almost a year of building, auditing, and validating. By going live across the most secure and scalable ecosystems in DeFi, we’re unlocking utility, liquidity, and accessibility for tokenized assets”.

Carlos Domingo, CEO of Securitize: “With BUIDL now accepted as collateral on Crypto.com and Deribit, the fund is evolving from a yield-bearing token into a core component of crypto market infrastructure”.

Projections on RWA Future Outlook

The RWA tokenization market shows tremendous growth potential across multiple forecasting scenarios. McKinsey projects the tokenized asset market could reach $2-4 trillion by 2030, while Boston Consulting Group estimates $16 trillion by 2030. The most ambitious projections from Standard Chartered suggest the market could reach $30 trillion by 2034.

Analysts add several reasons to drive this growth:

- Liquidity: Tokenization transforms traditionally illiquid assets into 24/7 tradeable assets.

- Fractional Ownership: Lower investment minimums democratize access to premium asset classes

- Operational Efficiency: Blockchain technology eliminates T+2 settlement delays and reduces intermediary costs

- Global Accessibility: Cross-border investment opportunities without traditional geographical barriers

- Programmable Compliance: Smart contracts automate regulatory requirements and reduce operational overhead

Despite this growth, the RWA tokenization sector faces several challenges. Regulatory compliance remains hard across multiple jurisdictions, requiring complex legal frameworks and ongoing adaptation to evolving regulations. Data verification and oracle reliability are critical for maintaining trust in tokenized asset valuations.

Technical infrastructure must continue scaling to support institutional-grade requirements, including custody solutions, settlement systems, and interoperability protocols. Market education and adoption among traditional finance participants remain ongoing priorities for the overall sector growth.

Conclusion

The Real-World Asset tokenization market represents one of the most significant developments as the crypto industry gains strong recognition. With over $30 billion in current market capitalization, institutional adoption accelerating, and regulatory frameworks becoming clearer, RWA tokenization is set to dominate in the coming years.

As major financial institutions continue promoting tokenization and regulatory clarity improves, the RWA sector appears set for sustained growth toward the multi-trillion-dollar projections forecasted by leading market analysts.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

RWA tokenization is the process of converting tangible assets like real estate, bonds, or private credit into digital tokens on a blockchain, enabling fractional ownership and global accessibility.

The biggest RWA projects by total value locked (TVL) include Provenance ($12.5B), BlackRock BUIDL ($2.9B), and MakerDAO RWA vaults ($1.8B). Market cap leaders include Chainlink (LINK) and Ondo Finance (ONDO), though Chainlink provides infrastructure rather than being a direct RWA issuer.

RWA tokenization benefits investors by increasing liquidity and enabling fractional ownership of high-value assets, making them more accessible. For institutions, it offers operational efficiency, 24/7 global trading, and a way to reach a wider pool of investors.

In 2025, the RWA market is benefiting from improved regulatory clarity. The U.S. GENIUS Act provides a framework for tokenized assets, while jurisdictions like Singapore and Hong Kong have issued clearer guidelines, fostering global institutional adoption.

Investors can participate by purchasing tokens that represent fractional ownership of assets. This can be done through dedicated RWA platforms like Ondo Finance or by using DeFi protocols like MakerDAO, which accept RWAs as collateral.

The RWA sector is expected to see a shift from experimentation to production-scale deployment by major institutions. Future trends include further multi-chain expansion, the introduction of new asset classes like carbon credits, and increased integration with decentralized finance (DeFi).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Zcash

Zcash  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Dai

Dai  Shiba Inu

Shiba Inu  USDT0

USDT0  PayPal USD

PayPal USD  Uniswap

Uniswap  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Mantle

Mantle  Toncoin

Toncoin  Ethena Staked USDe

Ethena Staked USDe  Canton

Canton  Polkadot

Polkadot  USD1

USD1  Bitget Token

Bitget Token  Rain

Rain  MemeCore

MemeCore