Ethereum price today showed a climb back above $4,000 after a week marked by sharp declines and strong buys. The recent price movement is a result of institutional flows and strategic whale moves. And also signs of exhaustion in oversold technical metrics. This analysis explores the drivers behind ETH’s latest upturn and its broader implications for traders and investors.

ETF Demand: The Bullish Engine?

Major financial institutions are fueling optimism for Ethereum by deepening their ETF offerings. Vanguard, a $10 trillion asset manager, announced its intention to launch crypto ETFs. After echoing BlackRock’s significant Ethereum ETF holdings and recent $254 million inflow in a single day.

Given Ethereum’s market cap of $485.42 billion, just one-fifth that of Bitcoin, these ETF-driven inflows amplify buy pressure. Supporting the Ethereum price target of regaining previous highs. In the last 30 days, ETH ETF AUM surged by 57% to $18.4 billion. The next key marker will be the SEC’s decision on new filings and ongoing ETF inflow statistics. Successively, this could set the stage for further bullish momentum

Whale Accumulation and Staking

Despite strong price headwinds, whales have played a double-edged role in ETH’s price action. During the recent downturn near $3,900, major wallets acquired over $2 billion in ETH. This includes a single $503M purchase via FalconX and another $661M staked in a single day. The aggressive buy pulls liquid supply off exchanges, heightening price sensitivity to new buying.

At the same time, profit-taking by high-profile holders like co-founder Jeffrey Wilcke injected some volatility. As millions in ETH were transferred to exchanges, sparking fears of short-term corrections. With 30% of supply now staked, the balance between accumulation and selling defines the near-term Ethereum price metric oversold conditions.

Ethereum Price Targets

ETH’s technical landscape signals potential stabilization after an acute sell-off. The asset rebounded off $3,829, mirroring the 78.6% Fib retracement, and climbed above $4,020. The RSI recovered from 38.76, moving out of the oversold range. While the MACD histogram showed marked improvement.

Although the ETH price remains below important moving averages, the broadening Bollinger Bands and oversold RSI suggest exhaustion of recent Ethereum price dip liquidations. If the Ethereum price can hold above $4,000 and break through $4,160 resistance. Then bulls may aim for a price target near $4,500.

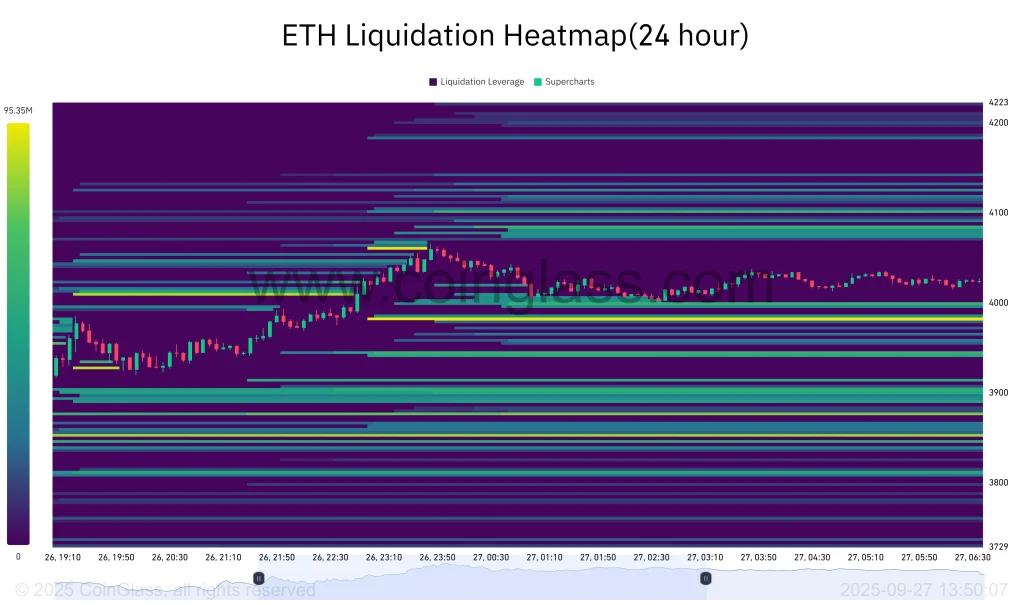

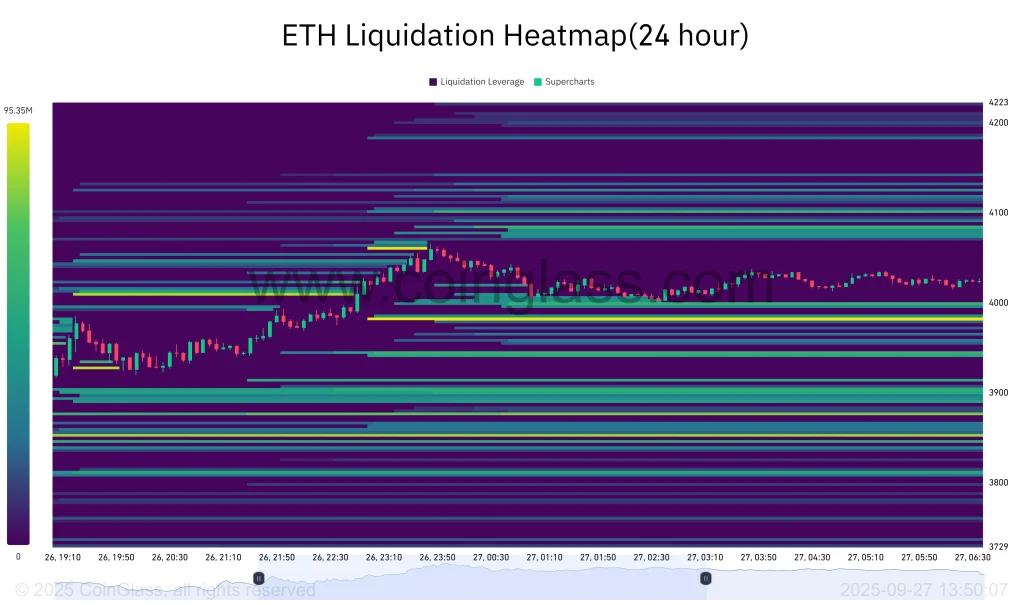

ETH Liquidation Heatmap

The ETH liquidation heatmap reveals concentrated clusters of leverage liquidations near the $4,000 and $3,900 levels. These intensified sell-offs coincided with sharp price movements, quickening the shift from oversold conditions. This provided crucial liquidity for whales and short-term buyers, contributing to rapid recovery.

Market Sentiment and Social Drivers

The recovery is mirrored in social sentiment, where 79% of discussions reflect optimism about institutional adoption, tech upgrades, and ecosystem growth. The remainder highlights price volatility and competition from other blockchains, underlining the market’s caution.

FAQs

A combination of institutional ETF demand, heavy whale accumulation, and oversold technical signals led to renewed buying interest near $3,900, sparking a price recovery above $4,000.

Current technicals suggest ETH has exited the oversold zone, but with high volatility and profit-taking among whales, caution is warranted.

If the uptrend continues and ETH breaks above $4,160, bulls could target $4,500 as the next resistance. However, a failure to hold $3,900 might result in further declines toward $3,400.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  Hedera

Hedera  Canton

Canton  Shiba Inu

Shiba Inu  USDT0

USDT0  sUSDS

sUSDS  Dai

Dai  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  PayPal USD

PayPal USD  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  USD1

USD1  Polkadot

Polkadot  Rain

Rain  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave