As October draws to a close, optimism around Bitcoin price prediction 2025 is heating up. With BTC reclaiming key technical levels and macro events aligning in the final week of the month, November could emerge as the ignition point for a major bullish phase across crypto markets led by Bitcoin’s resurgence.

Macro Triggers Align for a Perfect Storm

This final week of October is shaping up to be one of the most pivotal in months. Multiple macro catalysts are converging simultaneously, as an analyst has mentioned that the end of quantitative tightening (QT) could be near, potential rate cuts have a higher likelihood than ever, a $1.5 trillion liquidity injection could boost US sentiment, and renewed U.S.-China cooperation could completely rejuvenate the market.

If these developments unfold as anticipated, the result could be a massive surge in global liquidity and risk appetite. The combination of macro, liquidity, and narrative dynamics sets a near-perfect stage for a breakout going into November.

- Also Read :

- Crypto Market Live: Bitcoin (BTC) Poised for Major Volatility as Price Targets $120,000 This Week

- ,

Technical Breakout: Bitcoin Price Chart Signals Renewed Momentum

Bitcoin price today is trading around $115,196, marking a sharp 12% rebound from its mid-October low of $103,750. This surge has propelled BTC price above its 200-day EMA, a historically significant indicator.

The last time Bitcoin crossed this level was in Q2 2025, it triggered a powerful upward rally, and similar momentum appears to be building again.

On the Bitcoin price chart, the move above all above major EMAs into new support zones. Now, sustaining above them reinforces bullish sentiment and increases the likelihood of continued upside in the BTC price USD range.

Based on the bullish circumstances from this week’s event, the coming November could see the primary target of $ 130,000 and the next target at $ 145,000 before the year concludes, if bullish momentum continues.

ETF Inflows Return as On-Chain Metrics Flash Green

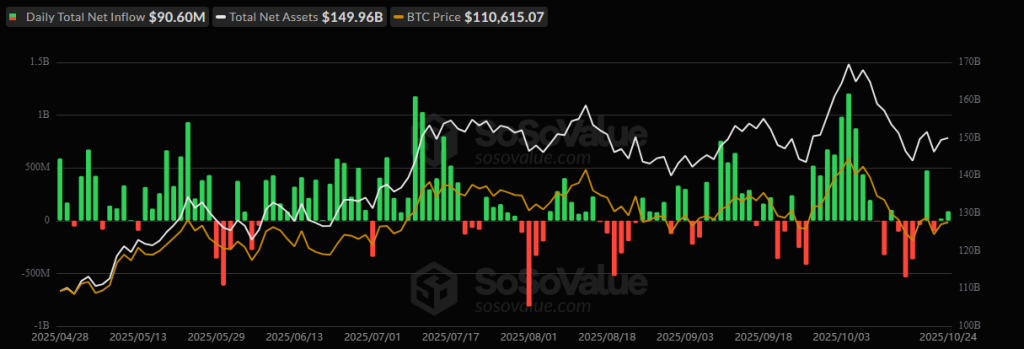

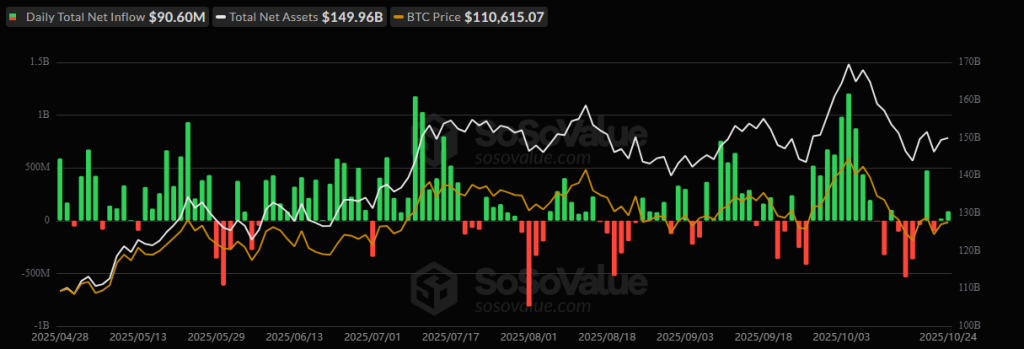

Following a series of outflows, Bitcoin ETF products are now experiencing net positive inflows. On October 24, $90 million in fresh institutional capital flowed into Bitcoin ETFs, signaling renewed investor confidence.

If this momentum continues, october ending days could attract even more institutional liquidity into the market before heading into November.

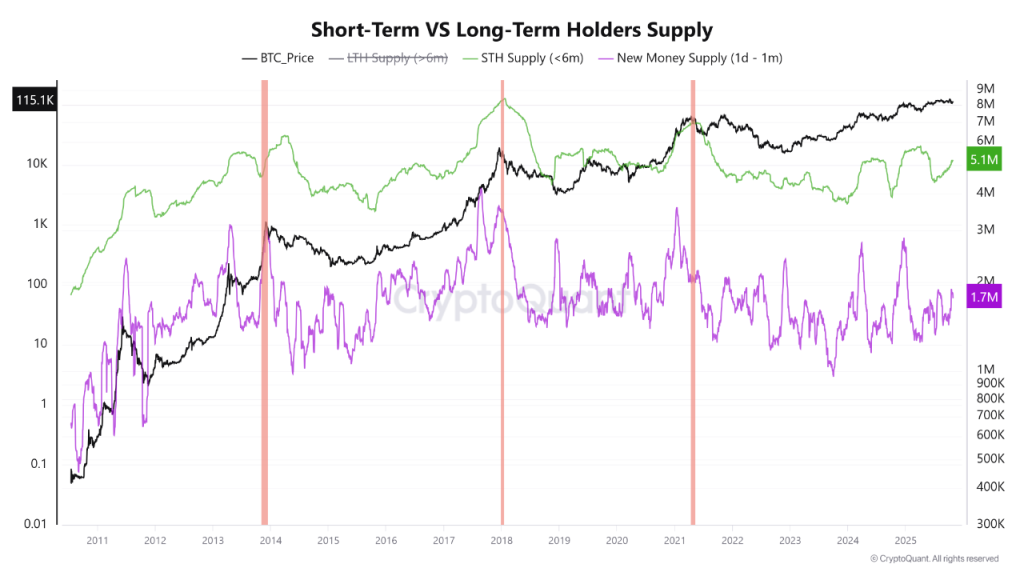

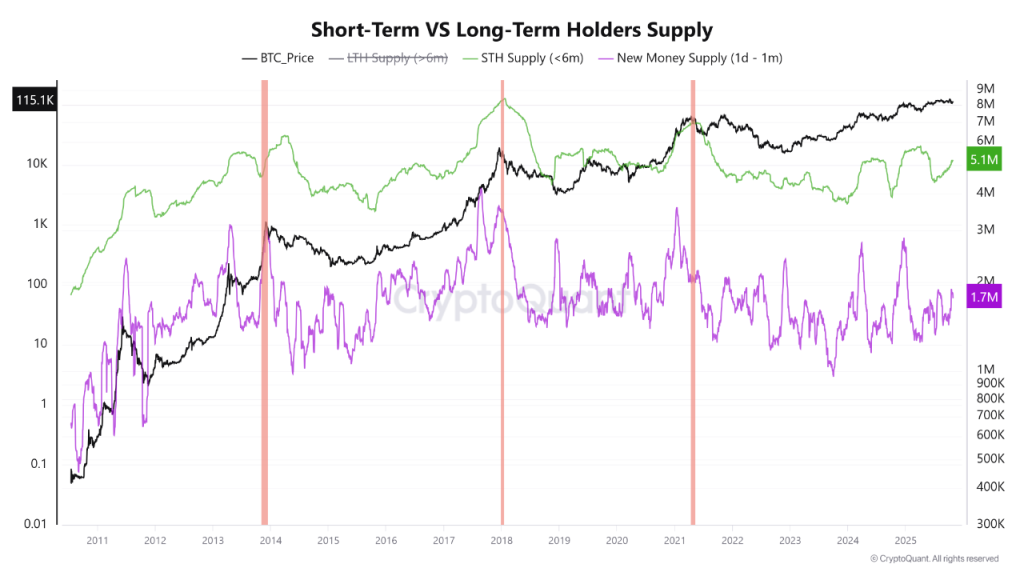

Simultaneously, on-chain data reveals a steep decline in Bitcoin exchange reserves since September, implying mass accumulation by long-term holders.

Over the past ten days, nearly 7 million BTC have moved back into profit territory, including 5.1 million coins held by investors under six months, per an CryptoQuant insight. This shift indicates growing conviction among newer market participants and a strengthening market structure.

Psychological Shift Reinforces Bitcoin Price Forecast November 2025

Behaviorally, profitability breeds confidence. As short-term holders see consistent gains, they’re less likely to sell prematurely and more inclined to add to positions. This gradual transformation from short-term speculation to medium-term conviction is a hallmark of early bull market phases.

If Bitcoin maintains its position above these realized price levels, it could confirm a structural transition back to optimism potentially paving the way for another leg up in the broader crypto rally. With momentum, macro alignment, and ETF inflows all trending upward, the Bitcoin price prediction 2025 looks increasingly promising.

FAQs

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Figure Heloc

Figure Heloc  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Sui

Sui  USDS

USDS  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Avalanche

Avalanche  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hedera

Hedera  USDT0

USDT0  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Zcash

Zcash  Toncoin

Toncoin  Mantle

Mantle  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  Dai

Dai  Uniswap

Uniswap  Bittensor

Bittensor  World Liberty Financial

World Liberty Financial  Aave

Aave  Ethena

Ethena  MemeCore

MemeCore  OKB

OKB  sUSDS

sUSDS  Bitget Token

Bitget Token