The SOL price could explode in December, many are upvoting this as Bitcoin and SOL price regains strength ahead of the December 10 FOMC meeting in sync. This setup is critical because, historically, Solana tends to follow the king crypto’s trend, and current market structure suggests SOL may mirror BTC’s next major breakout if liquidity conditions turn favorable.

BTC and SOL Track the Same Market Rhythm

The current landscape shows the Solana crypto market closely mirroring Bitcoin’s trajectory. Both assets peaked on October 6 during Q4 2025 and then entered a multi-week cooldown phase.

However, from November 21 onward, the trend shifted. Both BTC and SOL began stabilizing and started trading near crucial daily-timeframe support zones, indicating a potential synchronized rebound activity.

This alignment matters right now the most because historically, when the BTC/USD structure strengthens, the SOL price often reacts with amplified volatility. The similarity in their Q4 movements adds weight to the argument that Solana crypto may be gearing up for a sharp continuation once Bitcoin triggers the next major wave.

Trendline Strength and EMA Barriers Define the Short-Term Setup

From a technical standpoint, the Solana price chart highlights an 18-day rising trendline where buyers have consistently defended dips. However, the 20-day EMA remains a ceiling for both BTC and SOL, temporarily restricting momentum.

Yet, external catalyst supports the breakout odds, both structures appear primed for acceleration. For SOL/USD, reclaiming $144 is the first step, while BTC faces its own barrier near $94,495.

Once these levels are cleared, the charts suggest the next magnet zones sit near $173 for SOL and $103,816 for BTC. These aims align with the broader SOL price prediction December 2025 and the target aligns well with the 200-day EMA band.

FOMC Decision Becomes the Critical Catalyst

The December 10 FOMC meeting is central to the narrative. An expected 0.25% rate cut could significantly boost liquidity, allowing both assets to break their resistance levels. In such a scenario, the SOL price USD outlook becomes exceptionally bullish for December, with extension potential into Q1 2026.

Conversely, a rate-hold scenario could trigger a retest of lower support zones. Despite this risk, long-term positioning remains strong due to liquidity trends and accumulation behavior.

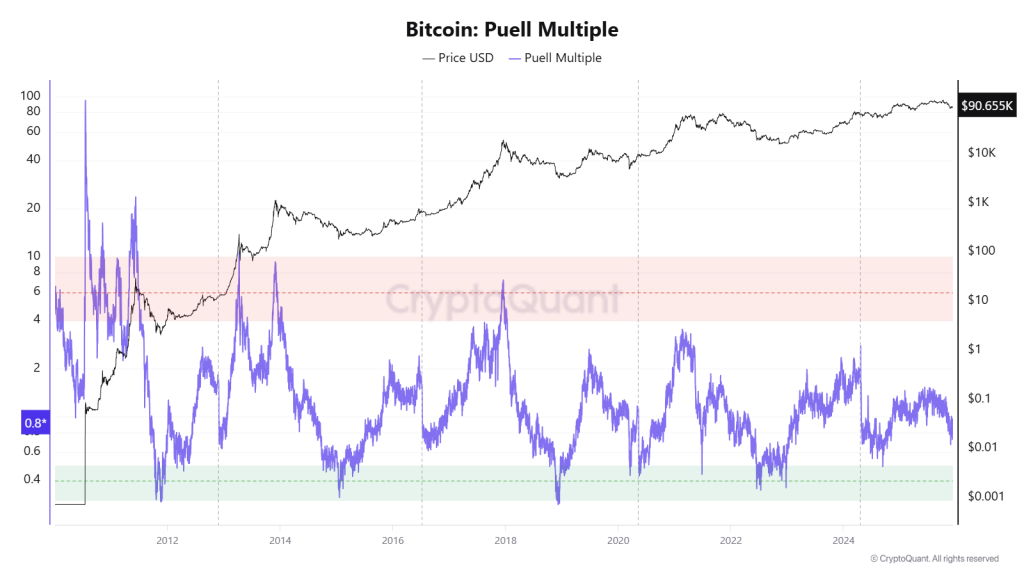

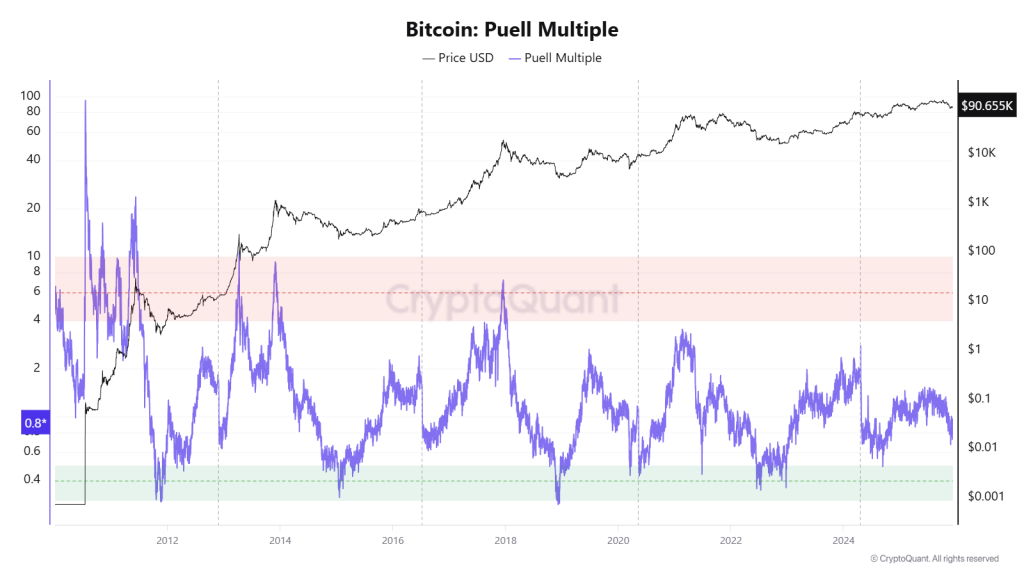

Puell Multiple and Whale Behavior Strengthen the Bull Case

A major insight fueling confidence is the latest Puell Multiple reading of 0.8, far below the “cycle top” zone above 6. This suggests the real Bitcoin bull phase has not even started. Whales continue accumulating, implying deep conviction in upcoming upside.

If Bitcoin’s next leg ignites, Solana remains one of the strongest contenders to outperform based on past cycle behavior and ongoing structural strength.

Ultimately, the SOL price is in sync with Bitcoin’s recovery structure, for now, supported by rising trendline strength, favorable liquidity signals, and macro conditions that may soon turn decisively bullish. If BTC breaks out following the FOMC decision, Solana could be positioned for one of its strongest short-term rallies in recent months.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  WETH

WETH  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Hyperliquid

Hyperliquid  Zcash

Zcash  Monero

Monero  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Cronos

Cronos  PayPal USD

PayPal USD  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  Uniswap

Uniswap  Bittensor

Bittensor  Aave

Aave  USD1

USD1  Canton

Canton  Bitget Token

Bitget Token  OKB

OKB