Bitcoin price is once again at a critical pivotal zone as the price hovers near the $90,000 zone, a level which acts as a psychological and technical support.

After failing to hold above recent highs, BTC price has entered a consolidation zone between $85k-$95k, reflecting hesitation across the broader crypto market.

While the Bitcoin price hasn’t shown strong directional momentum, the market structure suggests that something bigger is cooking beneath the surface.

At press time, Bitcoin price stayed calm above its 100 day EMA support at $90,550. Its market cap was at $1.8T.

Bitcoin Price Analysis: Why Is $85K-$95K So Important?

Bitcoin’s current price range between $85k-$95k shows a clear battle between buyers and sellers. Bulls are defending the $85-$90k support zone, while sellers continue to cap upside near $95k.

As long as BTC remains trapped between these levels, further consolidation could be seen ahead.

However, if Bitcoin price loses the $90k support zone, a retracement toward $80k or even $70k could be seen ahead. On the other hand, a strong bounce from this zone could reignite bullish momentum.

Despite price consolidation, technical indicators are slowly improving. The Relative Strength Index (RSI) has started moving upward on a weekly timeframe and may post a crossover ahead.

Furthermore, BTC price stays close to the trendline support, if momentum strengthens BTC could attempt a rebound toward $100k-$105k in the near term.

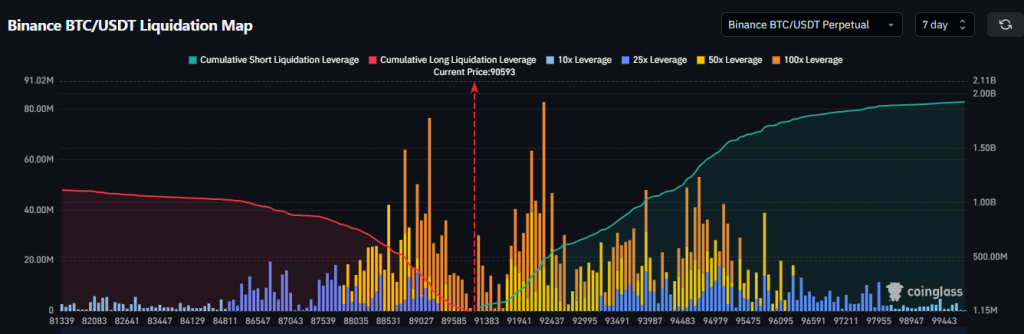

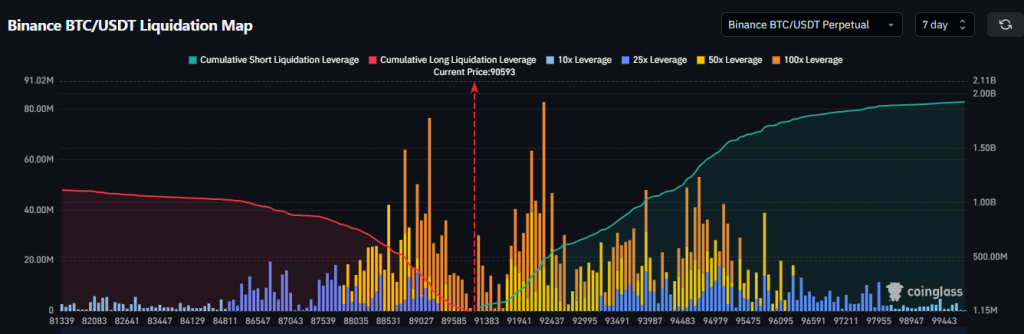

Adding to the bullish narrative, BTC’s liquidation map shows that nearly $1.5 billion worth of BTC short positions could be wiped out if Bitcoin rallies above the $95k mark.

This means a minor upward move could force short sellers to cover their positions, triggering a massive short squeeze. This setup may increase the chance of a rapid breakout.

Final Takeaway

Amidst the battle between the bulls and bears, Bitcoin price has been stuck in a waiting phase. However, BTC appears to be preparing for its next major price swing.

For now patience remains key, because when BTC price breaks any side of this range, the move could be fast and decisive.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Sui

Sui  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Zcash

Zcash  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  Canton

Canton  USDT0

USDT0  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Dai

Dai  Toncoin

Toncoin  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Uniswap

Uniswap  Polkadot

Polkadot  USD1

USD1  Mantle

Mantle  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor  Aave

Aave