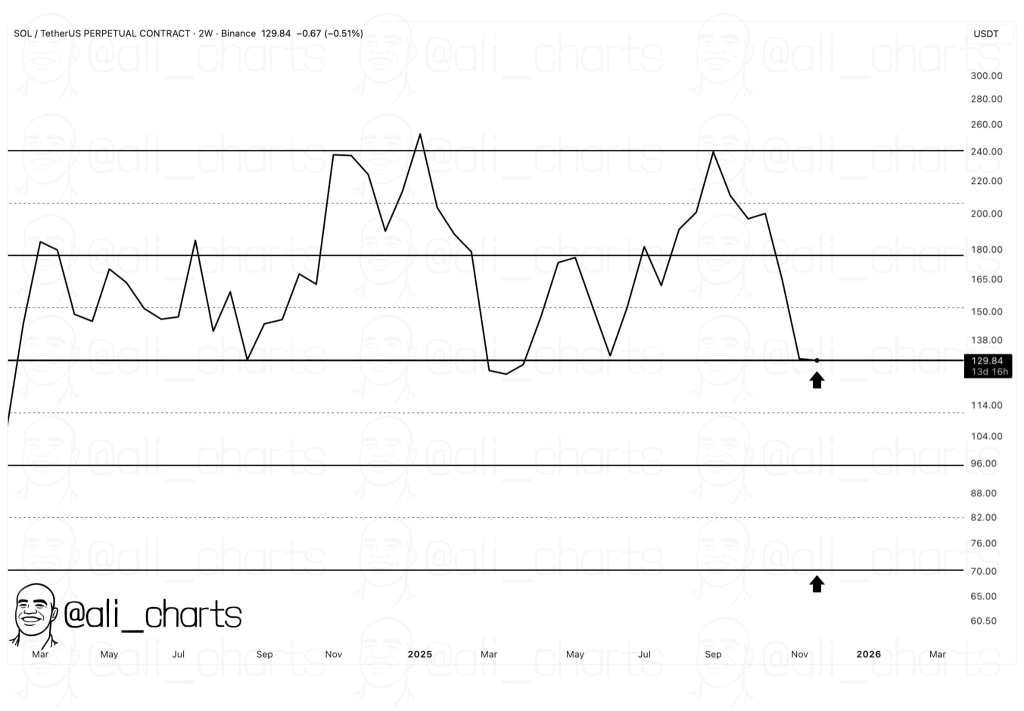

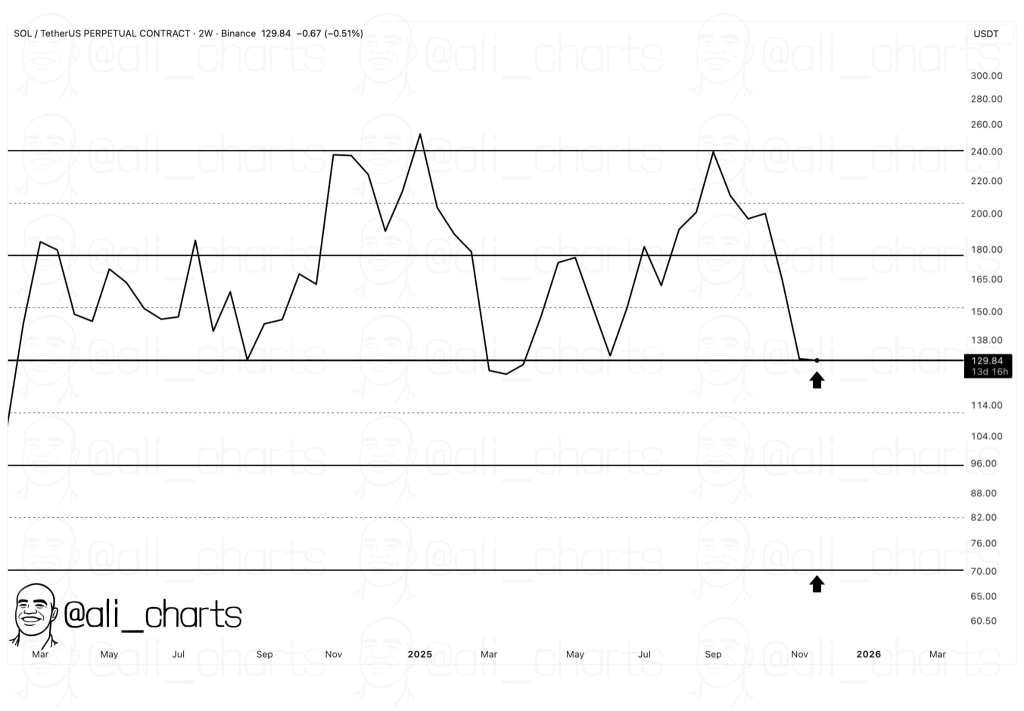

The SOL price is facing a decisive moment as it tests the upper boundary of its two-week horizontal range near $120. This level acts as the key pivot for bullish or bearish continuation. Despite weakening support, there are still signals like growing institutional interest and CME’s incoming futures listing for Solana crypto, which suggests the next month is critical.

SOL Price Reaches Crucial $120 Barrier After Weeks of Sideways Movement

Over the two weeks timeframe, the Solana price chart has formed a parallel horizontal range, reflecting indecision across the market. As November closes, the SOL price pushes into the lower border of this range at approximately $120. At this stage the level is carrying immense importance.

A breakout above it could extend the rally, while rejection may send the asset into a deeper retracement toward $96 and eventually $70.

However, several indicators suggest this level may be weakening. Price action of SOL/USD shows that repeated tests of $120 have reduced its structural integrity, and underlying support may no longer be as strong as during earlier attempts.

As a result, traders remain cautious about whether the current move has enough momentum to sustain a breakout.

SOL Price Faces Bearish Pressure, but ETF Inflows Challenge the Downside

Despite the technical odds favoring a decline, recent developments across institutional channels are countering the bearish narrative.

One standout trend is the performance of newly launched Solana spot ETFs. Since their introduction, it has recorded 20 consecutive days of net inflows, highlighting persistent institutional accumulation.

This streak is particularly notable given the recent volatility in broader markets. Consistent inflows indicate that larger investors maintain a strong conviction in Solana cryptocurrency, even as the SOL price fluctuates in a tightening range.

Furthermore, steady ETF demand introduces additional liquidity and reduces the likelihood of abrupt downside spirals, potentially reinforcing the $120 level at a time when it is being heavily tested.

SOL Price Forecast Strengthens as CME Prepares Spot-Quoted Futures Launch

Adding to the growing interest, analyst confirms CME Group’s spot-quoted Solana futures. This is scheduled to launch on December 15, 2025, pending regulatory approval. This initiative introduces a major new venue for institutional derivatives trading tied directly to the SOL price chart.

The launch of spot-priced futures generally enhances market structure by improving hedging efficiency, enabling larger capital flows, and tightening spreads.

If approved, this could immediately increase liquidity, boosting SOL price prediction outlooks and potentially reducing volatility over time. It may also amplify market participation from professional traders seeking clearer, regulated exposure to the asset.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Zcash

Zcash  WETH

WETH  Monero

Monero  Stellar

Stellar  Sui

Sui  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Hedera

Hedera  Shiba Inu

Shiba Inu  Canton

Canton  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  Toncoin

Toncoin  USDT0

USDT0  Dai

Dai  Cronos

Cronos  Uniswap

Uniswap  Polkadot

Polkadot  PayPal USD

PayPal USD  Mantle

Mantle  Ethena Staked USDe

Ethena Staked USDe  USD1

USD1  Pepe

Pepe  Rain

Rain  MemeCore

MemeCore  Bittensor

Bittensor