Crypto and financial markets, in general, are reeling from renewed volatility and mounting geopolitical pressure. As a result, speculation is intensifying around whether the Federal Reserve (Fed) will pivot back toward Quantitative Easing (QE).

A potential QE would be reminiscent of the aggressive monetary interventions of 2008 and 2020. For crypto, the implications could be enormous, with many traders bracing for a potential V-shaped recovery and a historic rally if QE is revived.

Analysts Share Signals Why the FED Could Act

Analysts have shared reasons that could prompt the Fed to intervene, with one citing the MOVE Index. This is Wall Street’s “fear gauge” for the bond market. At 137.30, the index is currently within the 130–160 range where the Fed has historically acted during crises.

“Now it’s at 137.30, in the 130–160 range where the Fed might step in, depending on the economy. If they don’t, they’ll still cut rates soon because they have to refinance the debt to keep the Ponzi going,” wrote Vandell, co-founder of Black Swan Capitalist.

This signal aligns with other warning signs of financial instability, including global market sell-offs that set the tone for the crypto black Monday narrative. This prompted the Fed to schedule a closed-door board meeting on April 3.

According to analysts, this timing was not random, with mounting pressure likely to see the Fed cave and President Trump having his way.

“With the Fed hinting at QE, everything changes Risk: Reward is now in favor of the bulls. Watch for choppy price action, but do not miss the recovery rally. And remember… it’s easier to trade this market than to hold through it,” said Aaron Dishner, a crypto trader and analyst.

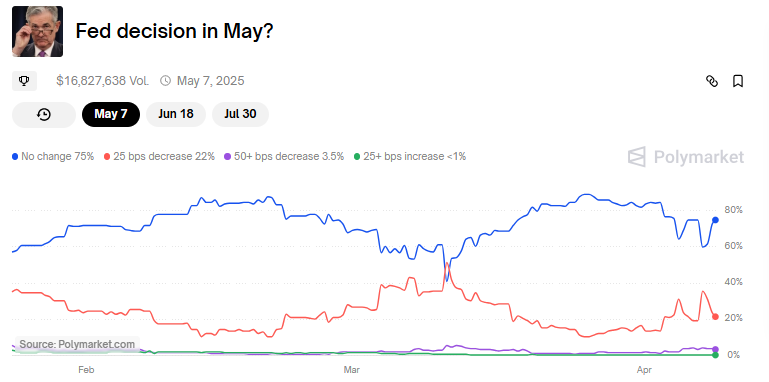

This suggests that investors are reading between the lines, particularly with the Fed’s next scheduled policy decision not until May 6–7. JPMorgan recently became the first Wall Street bank to forecast a US recession amid Donald Trump’s proposed tariffs, adding urgency to the conversation.

The bank suggests the Fed may be forced to act sooner, possibly with rate cuts or even QE, before the scheduled FOMC meeting. Against this backdrop, crypto investor Eliz shared a provocative take.

“I honestly think Trump is doing all this to speed up the Fed’s process to lower rates and QE,” they noted.

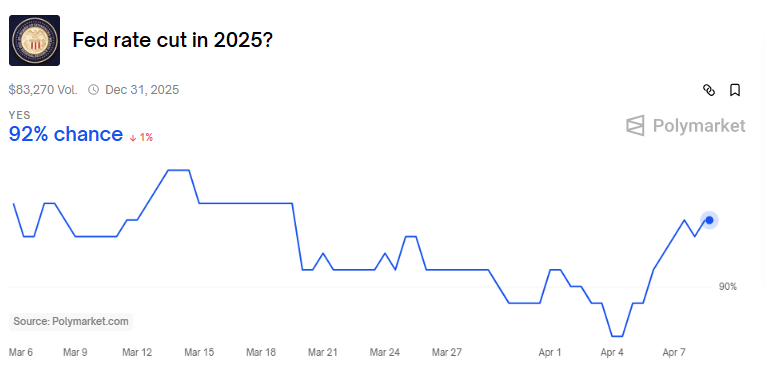

That may not be far-fetched given that the Fed must also manage over $34 trillion in federal debt. Noteworthy, this becomes harder to service at higher interest rates. According to Polymarket, there is now a 92% chance the Fed will cut rates at some point in 2025.

Why Crypto Could Benefit From QE

Should QE materialize, history suggests crypto could be one of the biggest beneficiaries. BitMEX founder and former CEO Arthur Hayes predicted that QE could inject up to $3.24 trillion into the system, nearly 80% of the amount added during the pandemic.

“Bitcoin rose 24x from its COVID-19 low thanks to $4 trillion in stimulus. If we see $3.24 trillion now, BTC could hit $1 million,” he said.

This aligns with his recent prediction that Bitcoin could reach $250,000 by year-end if the Fed shifts to QE to support markets.

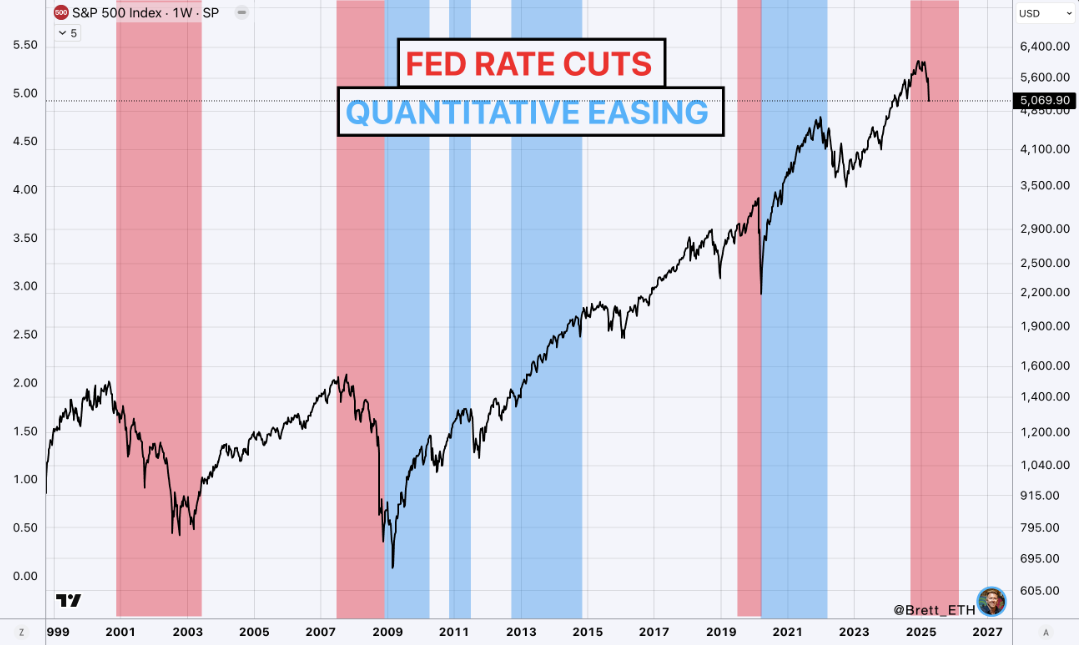

Analyst Brett offered a more measured view, noting that QE typically follows rate cuts rather than precedes them.

“We’re likely going to see rate cuts through mid-2026…like in 2008 and 2020, Powell has said QE doesn’t come until rate cuts are complete,” Brett explained.

Based on this, the analyst committed to buying selectively but did not expect a V-shaped bounce unless something drastic changed.

That “something” could be Trump reversing his tariffs or the Fed front running a recession with emergency easing measures. If either happens, the crypto market could rally hard and fast.

Altseason on the Horizon?

Meanwhile, Our Crypto Talk says a Quantitative Easing in May could lay the groundwork for a possible altcoin season.

Their forecast echoes previous cycles where QE triggered explosive moves in risk assets. When QE kicked off in March 2020, altcoins surged over 100X by the time it ended in 2022.

Traders are now eyeing May as a potential kickoff for the next liquidity wave, with bettors wagering a 75% chance the Fed will hold rates steady. If those odds shift, traders expect the money printer to follow.

While some anticipate more price “chop” in the short term, most agree that the long-term setup is increasingly favorable.

“If QE really kicks off in May, this chop is just the calm before the giga pump,” wrote MrBrondorDeFi on X.

Even if quantitative easing does not occur immediately, confidence remains strong that it will happen this year.

“Maybe not May, then later. It will happen this year, which is good for another rally and new highs,” Our Crypto Talk added.

Therefore, the buck stops with the Fed. Whether it is rate cuts, QE, or both, the implications for crypto are enormous.

If history repeats and the Fed opens the liquidity floodgates again, Bitcoin and altcoins could be poised for a historic breakout. This could eclipse the gains seen during the 2020-2021 bull run.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  WETH

WETH  Zcash

Zcash  Stellar

Stellar  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  Hedera

Hedera  sUSDS

sUSDS  Shiba Inu

Shiba Inu  Dai

Dai  USDT0

USDT0  Canton

Canton  Toncoin

Toncoin  PayPal USD

PayPal USD  World Liberty Financial

World Liberty Financial  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  USD1

USD1  Polkadot

Polkadot  Rain

Rain  Bitget Token

Bitget Token  MemeCore

MemeCore  Tether Gold

Tether Gold