Victims of the infamous Mt. Gox hack in 2014 are set to receive a record 150,000 Bitcoin reimbursement in the coming months. But that may cause selling pressure as some might cash out their gains.

A brief Mt. Gox story

As a brief background, the Japan-based Mt. Gox was once the largest crypto exchange on the planet: It’s said to have handled over 80% of all Bitcoin transactions in its early years.

But a massive 740,000 Bitcoin hack in 2014 — over 6% of Bitcoin supply at the time — led to the exchange going bankrupt and the start of years of legal cases against former CEO Mark Karpelès and the exchange. The hacked funds were valued at over $14 billion as per December 2017 prices.

While 200,000 Bitcoin was eventually recovered, the whereabouts of the remaining 650,000 remains a mystery. However, under Japanese law and case coverages available here and here, creditors were liable to receive a chunk of their lost funds at massively inflated prices — and a near-instant profit after years of waiting.

Recovered Bitcoin to be reimbursed soon

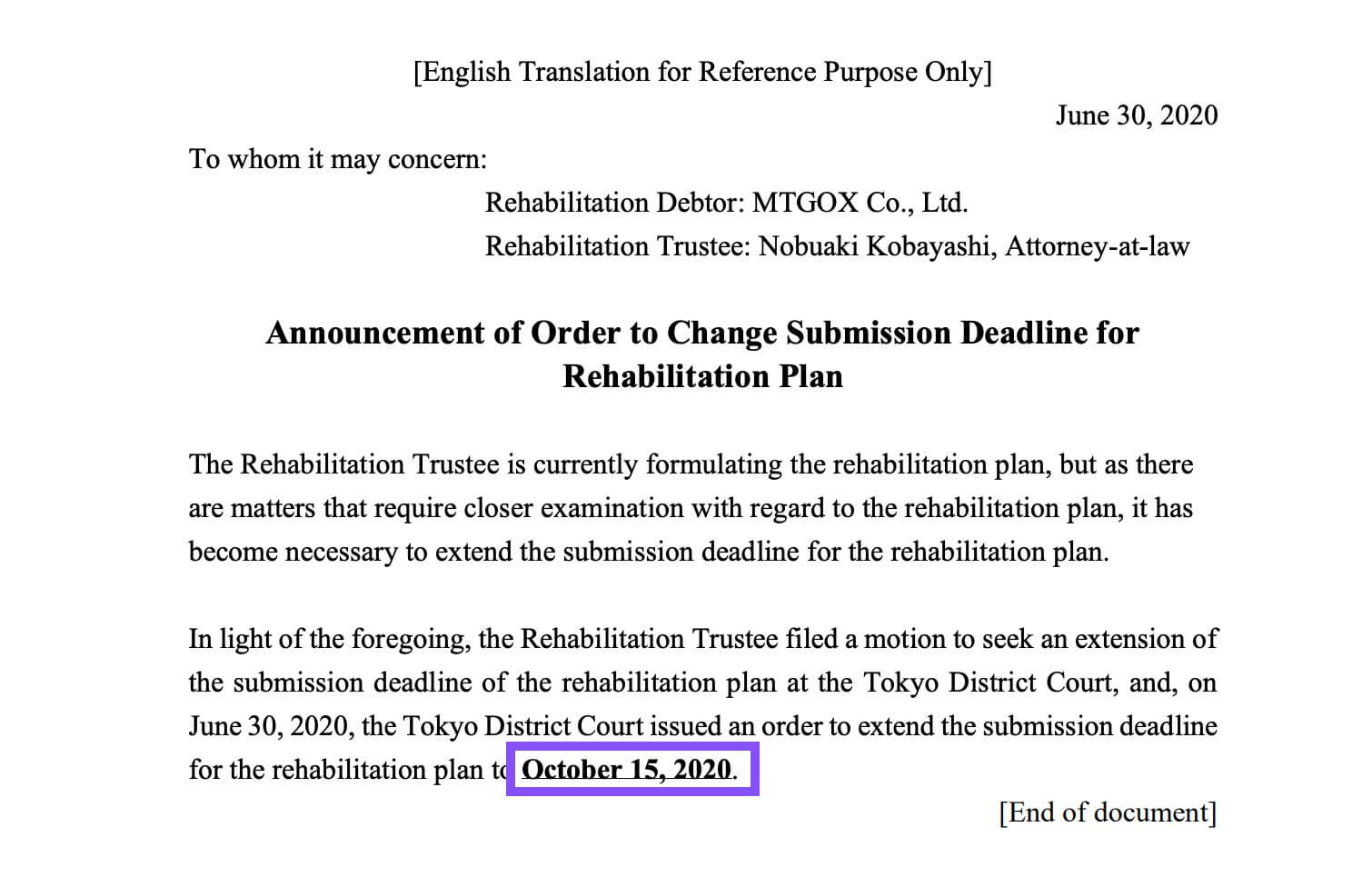

As per a document by the Tokyo District Court and a refiled date by the Mt. Gox Rehabilitation Trustee, all Mt.Gox victims are supposed to receive a new date for the funds they once lost on the exchange.

The funds were earlier supposed to be returned on July 1, but a court hearing delayed it to an October date (for filing a new rehabilitation plan) after Nobuaki Kobayashi, Mt. Gox’s Trustee, submitted a motion demanding another extension for the Bitcoin settlement.

Under the terms, the creditors are set to cumulatively receive over 150,000 Bitcoin ($nearly $1.5 billion at current rates). And if one assumes the original purchase costs of around $400 and a 20% recovery rate, each creditor is set to receive an extra $2,000 based on Bitcoin’s price growth, as per crypto exchange Bybit.

“While some of these creditors may choose to hold, others will inevitably sell for a profit of over 300%,” the exchange’s analysts added.

Meanwhile, “Mr.Whale,” an anonymous, popular Twitter account who shares long-term calls and insights on the crypto market, weighed in on the topic via a tweet:

“If 150,000 BTC is sold on the market, it would cause a brutal drop, and fear would quickly spread across the markets.”

Bitcoin was only $400 during the hack.

Now it’s over $10,000.

I’m assuming once returned, many will begin taking profits on the over 2,600% ROI from 2014. pic.twitter.com/Sndf64syO2

— Mr. Whale (@CryptoWhale) October 4, 2020

And although the new date under the Mt.Gox refiling on October 15 may defer any sell-offs, a major sell-side even could be on the cards for Bitcoin and the broader crypto market after the creditors receive funds.

Like what you see? Subscribe for daily updates.