The most popular cryptocurrency, bitcoin (BTC) keeps pushing its all-time highs up as it jumped above the USD 29,000 for the first time today and it now needs to increase by around 3% in order to hit another psychologically important milestone – USD 30,000.(Updated at 10:15 UTC: updates throughout the entire text. Updated at 15:03 UTC: an announcement from eToro USA was added).

After surpassing USD 29,200 earlier today, at the time of writing (10:02 UTC), BTC trades at USD 28,998 and is up by 4% in a day and 24% in a week. The price rallied by 48% in a month and almost 300% in a year.

Other coins from the top 10 list are mostly up by 1%-3% in day. Even the most troubled major coin, XRP is up by 3% today, trading at USD 0.217, despite more platforms announced they’re suspending trading in this coin. XRP is down by 20% in a week and 68% in a month as the US Securities and Exchange Commission filed a lawsuit against XRP-affiliated Ripple.

Binance.US said it will delist XRP on January 13, while crypto prime broker Genesis is also reportedly suspending XRP trading and lending. Also, eToro USA said it has decided to prohibit purchases of XRP on the eToro platform and to prohibit any conversion of XRP held in a customer’s eToro Wallet beginning on January 3.

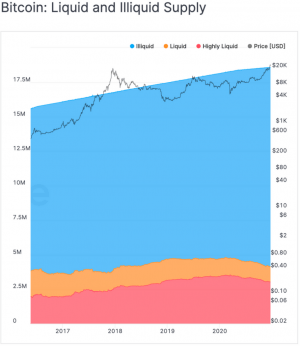

Meanwhile, according to crypto market analysis firm Glassnode, only BTC 4.2m (22%) are currently in constant circulation and available for buying and selling.

“We can see a clear upwards trend of Bitcoin illiquidity. This indicates that the present bull market is driven by the staggering amount of illiquidity,” they said, adding that more than 1 million BTC has become illiquid in the course of 2020.

Also, according to Arcane Research, the aggregated exchange balance has fallen throughout the year, and net more than 0.5 million BTC has been withdrawn from the major exchanges.

Among the reasons for this, they listed:

- It’s likely that a significant sum of the withdrawn BTC has been moved to cold-storage wallets, evident by the increase of 10.5% in addresses holding more than 0.1 BTC.

- However, it is also fair to assume that these bitcoins have moved elsewhere to other custodians in the space.

- The most notable likely destination for the withdrawn BTC is found on the Ethereum blockchain, as there currently are 139,725 BTC on Ethereum with the Wrapped Bitcoin protocol alone holding 113,235 BTC.

- Another likely destination for BTC moved of exchanges are centralized lending providers such as BlockFi, Genesis, and Nexo allowing holders of bitcoin to deposit funds and receive a yield while doing so.

However, they estimate that, in 2021, the aggregated BTC exchange balance will rise as more holders seek to realize profits or to trade other cryptocurrencies.

___

Other reactions:

Bitcoin could triple in 2021, according to Tom Lee of @fundstrat. He unpacks his top picks for the new year and why… https://t.co/ln8kbX8Iho

— CNBC’s Fast Money (@CNBCFastMoney)

$BTC looks like it wants to send. No sellers showing up at the highs. I’m not short anymore, nor ‘hedged’, seems li… https://t.co/IWfOHFoAxp

— SalsaTekila (@SalsaTekila)

What’s the biggest bullish event for #BTC in 2020? IMO it’s MassMutual. Insurance is among the most financially con… https://t.co/KB6BmlAGLB

— Qiao Wang (@QwQiao)

Investor “It feels like December 2017”

— George Kikvadze ? (@BitfuryGeorge)

Most important chart of 2020

— Dan Tapiero (@DTAPCAP)

Ok I found a seller:

— Brad Mills ✍️? (@bradmillscan)

____

Learn more:

Bitcoin Wheel Cannot Be Stopped

Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, Chainlink Price Predictions for 2021

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Crypto Adoption in 2021: Bitcoin Rules, Ethereum Grows & Faces Rivals

Crypto in 2021: Institutions Prefer Bitcoin, Retail Open to Altcoins