Crypto Trust to Convert to Bank, FinCEN Extends New Rule Comment Period

By: Veronica Reynolds

The Anchorage Trust Company, a subsidiary of Anchor Labs, an advanced digital asset platform (Anchorage), secured conditional approval this week from the Office of the Comptroller of the Currency (OCC) to convert to a National Trust Bank. As a trust company, Anchorage offers custody services related to transactions in digital assets and cryptocurrencies, as well as governance, staking and settlement services, and will continue to perform the activities of a fiduciary, agency or custodian post-conversion. As part of a conditional operating agreement underlying the conversion, Anchorage agreed to certain of the OCC’s risk management expectations as well as capital and liquidity requirements.

Also this week, the U.S. Financial Crimes Enforcement Network (FinCEN) announced an extension of the comment period for its proposed rule-making related to certain transactions involving convertible virtual currency (CVC) or digital assets with legal tender status (LTDA). The comment period was extended by 15 days for the proposed requirements on verifying the “identity of customers in relation to transactions above certain thresholds involving CVC/LTDA wallets not hosted by a financial institution” and “CVC/LTDA wallets hosted by a financial institution in certain jurisdictions identified by FinCEN.” Separately, the comment period was extended to 45 days for the proposed requirements that “banks and MSBs report certain information regarding counterparties to transactions by their hosted wallet customers.”

For more information, please refer to the following links:

Bitcoin Firms List on Public Markets, Japan Diverges from SEC on XRP Status

By: Jordan R. Silversmith

This week one of the largest U.S. marketplaces for cryptocurrencies and other digital assets announced that it would become a publicly traded company through a merger. The combined company will be renamed and will be listed on the New York Stock Exchange. Outside the United States, there were announcements this week related to two new bitcoin exchange-traded products (ETPs). In Canada, a prospectus for a new bitcoin exchange-traded fund (ETF) was filed with the Ontario Securities Commission. If approved, the ETF is planned to be listed on the Toronto Stock Exchange. A new bitcoin ETP also recently listed on the Swiss stock exchange SIX. The ETP tracks the price of bitcoin and is physically backed, bringing SIX’s total number of ETP providers to six and the number of ETPs listed to 34.

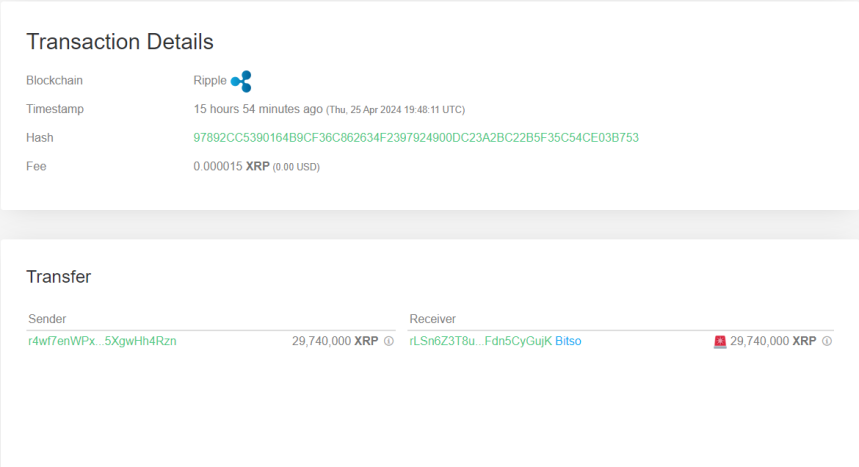

Following the Securities and Exchange Commission’s (SEC) lawsuit against Ripple Labs alleging that its XRP token is a security under federal law, a major U.S. digital currency manager announced it had begun dissolution of its XRP Trust. According to reports, the company will distribute cash proceeds from the trust’s liquidated store of XRP to trust shareholders. Meanwhile, Japan’s Financial Services Agency (FSA), the country’s securities regulation body, has reportedly said that XRP is not a security under Japanese law. This marks the first time that the FSA has commented directly on the legal status of XRP.

According to reports this week, Tether, a leading stablecoin project, announced that it had printed two billion dollar-backed tokens last week. Over 24.6 billion tethers circulate across Ethereum, Tron and Bitcoin’s Omni Layer, a fivefold increase from 4.8 billion in circulation one year ago. In another development, a major U.S. financial services company with significant investments in bitcoin recently announced a grant to fund a bitcoin developer’s work on software to improve the pool hash power of mining collectives. The grant comes in the form of an undisclosed sum for work on an implementation of Stratum V2, the next iteration of bitcoin mining protocol software.

For more information, please refer to the following links:

Navy Contracts for Blockchain Solution, SSI Report and Market Data Published

By: Robert A. Musiala Jr.

According to a recent press release, blockchain enterprise firm SIMBA Chain has been awarded a $1.5 million Small Business Innovation Research contract by the U.S. Office of Navy Research “to design and build a blockchain solution to enable demand sensing for the Defense Logistics Agency.” The press release notes that “demand sensing is essential to ensuring the U.S. military has critical replacement parts for various weaponry available when required.” The goal of the project will be “to use blockchain to dramatically improve vital supply chain interactions … to mitigate against disruption, issues, and threats to engineering and maintenance operations.”

In an article published this week, a leading self-sovereign identity (SSI) organization provided an overview of its work building solutions for digital identity management leveraging blockchain technology, cryptography, and supporting software and standards. The article discusses key areas of focus for SSI solutions, including vaccination credentials, government-issued IDs and expanding interoperability across SSI networks.

According to a recently published report by a technology research firm, “industrial blockchain revenue” is expected to reach $374 million in 2020, increase to $1 billion in 2022 “and then double by 2025.” The report attributes this expected growth to advancements in using blockchain to track and trace product supply chains in the food and beverage, transport, retail, and consumer sectors. The report also notes growing consumer interest in product provenance for ethical and environmental reasons.

For more information, please refer to the following links:

Enforcement Actions Target Dark Web Market and Illicit Crypto Exchange

By: Teresa Goody Guillén

According to a press release this week, the world’s largest illegal marketplace on the dark web has been taken offline as the result of an international operation involving law enforcement from Germany, Australia, Denmark, Moldova, Ukraine, the United Kingdom and the United States. The marketplace is reported to have had almost 500,000 users, more than 2,400 sellers, over 320,000 transactions, and over 4,650 bitcoin and 12,800 monero transferred, which collectively correlates to over US$169.6 million transacted on the site. It is believed that the vendors on the marketplace traded various drugs and sold counterfeit money, stolen or counterfeit credit card details, and anonymous SIM cards and malware.

According to another recent press release, a Bulgarian national was sentenced to 121 months in prison for his role in a transnational and multimillion-dollar scheme that defrauded at least 900 Americans. As reported, trial evidence showed that, among other things, the defendant owned and managed RG Coins, a cryptocurrency exchange headquartered in Bulgaria; and the defendant knowingly and intentionally engaged in business practices designed to assist fraudsters in laundering criminal proceeds. The criminal conspiracy engaged in a large-scale scheme of online auction fraud in which false advertisements were posted to popular online auction and sales websites (e.g., craigslist and eBay) for high-cost goods (typically vehicles) that did not actually exist. Upon receiving victims’ money, the conspiracy engaged in a complicated money laundering scheme including converting funds to cryptocurrency and transferring proceeds in the form of cryptocurrency to foreign-based money launderers.

This week, the United Kingdom’s Financial Conduct Authority (FCA) warned consumers that investing in cryptoassets, or investments and lending linked to them, generally involves very high risk, and consumers should be prepared to lose all their money. The FCA announcement cautioned against investments advertising high returns based on cryptoassets and noted specific concerns related to consumer protection, price volatility, product complexity, charges and fees, and false marketing materials.

For more information, please refer to the following links: