The DeFi market’s assets have collectively surpassed XRP’s market cap as the latter faces a major lawsuit from the SEC.

Data from Messari shows that DeFi’s total market cap ($11.5 billion) has overtaken that of the lawsuit-stricken XRP ($10.26 billion), in the aftermath of the recent cryptocurrency market sell-off.

DeFi Sector Movin’ on Up

Popular DeFi assets like UNI and MKR experienced a tremendous rally alongside Bitcoin and the ETH 2.0 launch. The crypto community has theorized that Bitcoin’s bull run has seen a migration of profits into DeFi. Many analysts also concur that the DeFi industry will likely continue to grow in 2021, on top of its phenomenal 2020 performance.

Meanwhile, Ripple and XRP have experienced a horrid start to the new year. The United States Securities and Exchange Commission (SEC) filed a lawsuit against Ripple in late December 2020. Following the announcement, the asset’s value began to bleed out, with investors fearing its imminent demise.

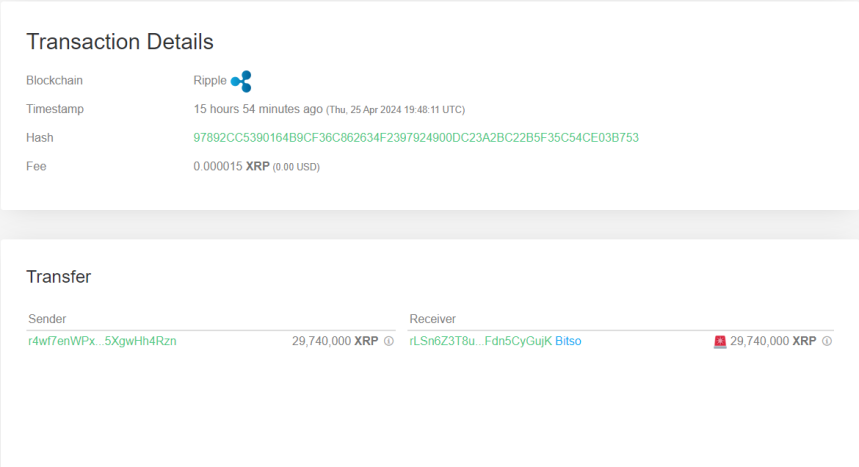

XRP’s market cap dropped from approximately $30 billion before the lawsuit. Some might argue that the signs were always pointing to a securities case.

Prominent analysts like Peter Brandt have long since maintained that Ripple was a security — even before the lawsuit was brought to fruition:

Ripple’s Reputation Takes A Hit

The SEC lawsuit is only one of many that Ripple has had to face. Several independent investors have also sued the firm for various reasons. Ripple Labs has said that it would fight the cases, but a lot of damage has already been done.

Exchanges and institutions have also begun suspending XRP from trading, including Coinbase. Grayscale Investments even sold over 9 million in XRP to distance itself from risk. These are significant markets for XRP, the hopes for which rest on winning the lawsuit.

It remains to be seen how Ripple and XRP will come out of this. It may be a long time before its situation is resolved, as was the case with Kik and Telegram.