Sushi, the governance-cum-liquidity pool tokens for SushiSwap, have seen an unexpected boom in their nascent lifespan in terms of both prices and controversies.

Not only did the token’s founder, the anonymous Twitter account “Chef Nomi,” sell over $10 million in return for their “week’s worth” of work before handing over admin keys to FTX founder Sam Bankman-Fried, but Sushi prices also zoomed nearly 1,300% from a few cents to over $12.40.

However, one company says that the supposed utility of the Sushi token, that of allowing decentralized governance based on community inputs, is overstated and is likely behind the token’s massive overvaluation.

The $SUSHI token has seen a spectacular rise and fall in its short lifetime.

But beyond the hype and FUD, what are the fundamentals behind the native @SushiSwap token’s value?

Read the full analysis ?https://t.co/6o2rSFy44C

— glassnode (@glassnode) September 8, 2020

Inflation leading to unsustainable prices

In a blog post this week, on-chain analytics firm Glassnode said Sushi served these two fundamental points for users:

- Revenue share – The SushiSwap protocol takes a 0.3% fee on each trade; 0.25% goes to liquidity providers, and the remaining 0.05% is converted into SUSHI and distributed to SUSHI token holders as the 0.05% reward amount.

- Governance – SUSHI holders can use their tokens to vote on governance proposals regarding changes and upgrades to the protocol.

However, Glassnode analyst Liesl Eichholz expressed her concerns, “although the value of protocol governance should not be understated, it is difficult to quantify.”

“Similarly, the hype value of yield farming projects (especially in markets such as these) is not easily quantifiable,” she said.

Eichholz pointed out that SushiSwap’s primary mechanism of rewarding liquidity providers with Sushi tokens to sell on the open market to book profits led to drastic inflation, one that benefited pool holders but not retail investors.

“Investors should be aware: anyone holding SUSHI without providing liquidity will be diluted. As such, investors looking at buying SUSHI should do so with caution and with an understanding of the risks behind the underlying token mechanics.”

Sushi just $0.13?

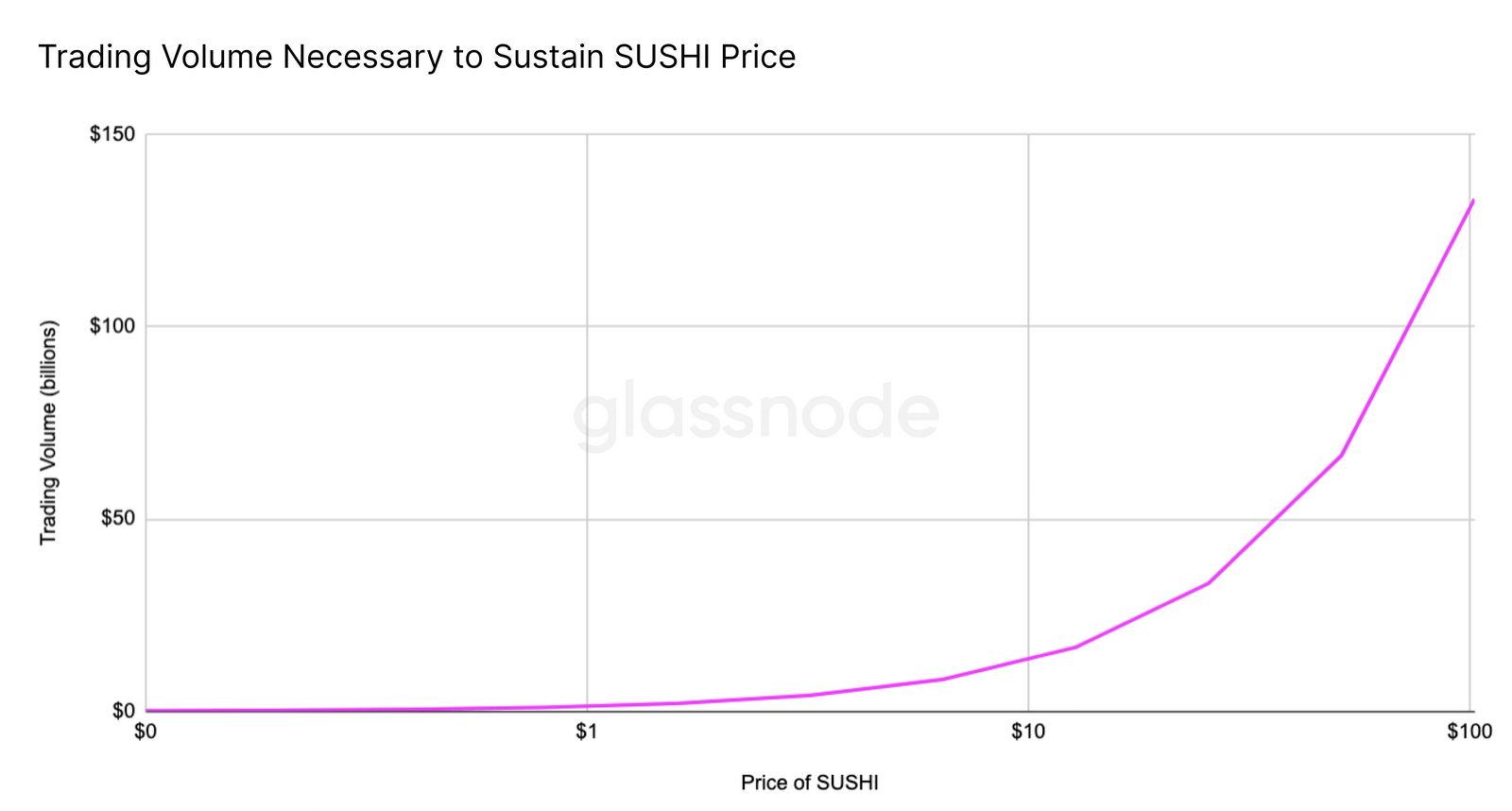

While SushiSwap has an in-built 0.05% buyback mechanism that can help maintain its inflation rate; a certain amount of daily trading volume must be sustained to maintain a given price.

And that’s wherein the valuation issue arises. The report said that without significantly high volumes, SUSHI prices above $10 were “preposterous and unsustainable.”

Eichholz noted:

“In reality, assuming that SushiSwap captures a more realistic daily trading volume of $400 million, the sustainable price for SUSHI would be $0.31 – a full 97% lower than its all-time high of $11.93.”

But that does not necessarily mean a decline for Sushi prices in the short-term. Eichholz stated prices were likely to remain inflated in the short term due to hype and a lack of fundamental understanding among retail investors.

Sushi trades at $2.30 at press time as per data on FTX. It is down over 81% from an all-time high of $12.40 on September 1.

Like what you see? Subscribe for daily updates.