As the bitcoin market sees red, DeFi opportunities in stablecoin trading have some borrowing rates exploding to double digits.

- Bitcoin (BTC) trading around $11,342 as of 20:00 UTC (4 p.m. ET). Slipping 4% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,299-$11,943

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Heavy sell volumes on spot exchanges such as Coinbase caused a fall in bitcoin’s price to as low as $11,299 Tuesday. Profit-taking is one driver of the dip, according to Chris Thomas, head of digital assets for broker Swissquote. “There are naturally some traders looking to take short term profits here, which is driving us lower,” Thomas told CoinDesk.

Read More: Bitcoin Rally Stalls as Increasingly Correlated Gold Drops Below $2K

Katie Stockton, a technical market analyst for Fairlead Strategies, says there are signs the bitcoin market in the short term may be headed even lower. “Bitcoin has seen upside follow-through on the back of its breakout above important resistance in the $10,000-$10,055 area,” Stockton said. “There are some signs of short-term exhaustion, however, that suggest a pullback could unfold over the next week.”

Traders were hitting the sell button on economic hedges Tuesday. Gold was in the red 5.6% and at $1,913 as of press time. Over the past month gold remains up, having gained 6.4%. Meanwhile, bitcoin has appreciated 22%.

Andrew Tu, an executive at crypto quant training firm Efficient Frontier, says a temporary bearish market for bitcoin won’t last, despite price dumps. “If the market faces exhaustion, we could see a larger correction,” he said. However, a positive news cycle will eventually bring another rally, Tu noted. “With all the positive news surrounding bitcoin, as well as the recent altcoin pumps, it is clear that the market sentiment is highly positive.”

Read More: MicroStrategy Buys $250M in Bitcoin, Calling the Crypto ‘Superior to Cash’

USDC opportunities skyrocketing dYdX rates

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Tuesday trading around $378 and slipping 4% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Read More: Alchemy Goes Public With Developer Platform in Bid to Grow DeFi

The decentralized finance, or DeFi, lending and trading platform dYdX is seeing a jump in borrowing rates on its platform. It’s currently over 11.7% on average, a high not seen since its competitor lender Compound’s emergence in late June, ushering in a wave of interest in DeFi overall.

The catalyst for rising rates on dYdX are derived from the USDC stablecoin, which has seen its borrowing rate jump as high as 25% this week.

DeFi observer “Ceteris Paribus” noted on Twitter that borrowed USD coin (USDC) is being used by traders for quick arbitrage opportunities. In this instance, a trader took advantage of stablecoin tether’s (USDT) price relative to USDC on trading platform Uniswap and borrowed from dYdX. This caused lending rates to jump outrageously as it soaked up the supply of loanable funds; the trade likely involved trading USDC for ether, then trading ether for tether because it is more liquid than trading USDC for USDT outright. The two stablecoins are both supposed to be priced close to one U.S. dollar, but supply and demand on individual exchanges may cause prices to fluctuate.

“Trader had $45,000 USDC, borrowed another $405,000 on dYdX to give them $450,000 USDC,” reads the tweet. “Traded that $450,000 USDC for $492,000 USDT on Uniswap. Traded $492,000 USDT for $492,000 USDC on Curve. Paid off $405,000 dYdX loan. Started with $45,000 USDC, ended with $87,000 USDC, and paid $2,000 in fees.”

Thus the arbitrage opportunity, although risky, would net a trader $40,000 on just $45,000 of crypto collateral, a profit of nearly 89% in a short amount of time.

Other markets

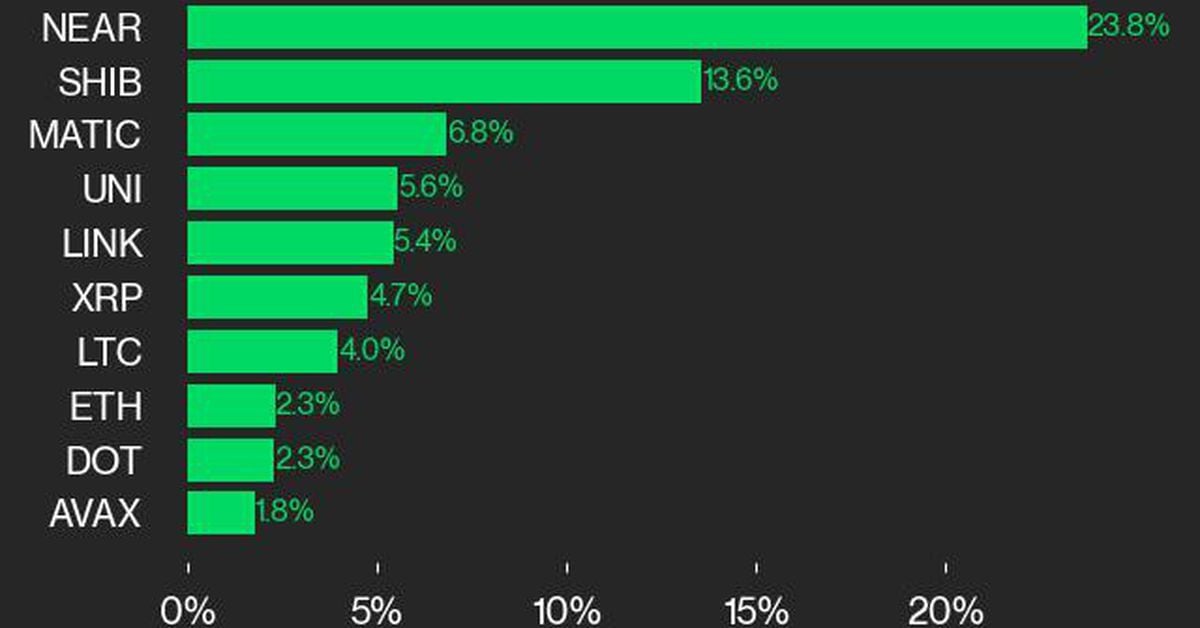

Digital assets on the CoinDesk 20 are mostly in the red Tuesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Read More: Chia Network Raises $5M to Rival New Crop of DeFi-Friendly Base Layers

Notable losers as of 20:00 UTC (4:00 p.m. ET):

Read More: Ethereum Classic’s Terrible, Horrible, No Good, Very Bad Week

Read More: Riot Blockchain Mined 508 Bitcoin in Q2

- Oil is down 1%. Price per barrel of West Texas Intermediate crude: $41.52

Read More: Falling 65% This Year in Bitcoin Terms, Do ‘Stablecoins’ Need a Rebranding?

- U.S. Treasury bonds all climbed Tuesday. Yields, which move in the opposite direction as price, were up most on the two-year, in the green 9.8%.

Read More: India May Be Starting Its Biggest Bitcoin Bull Run Yet