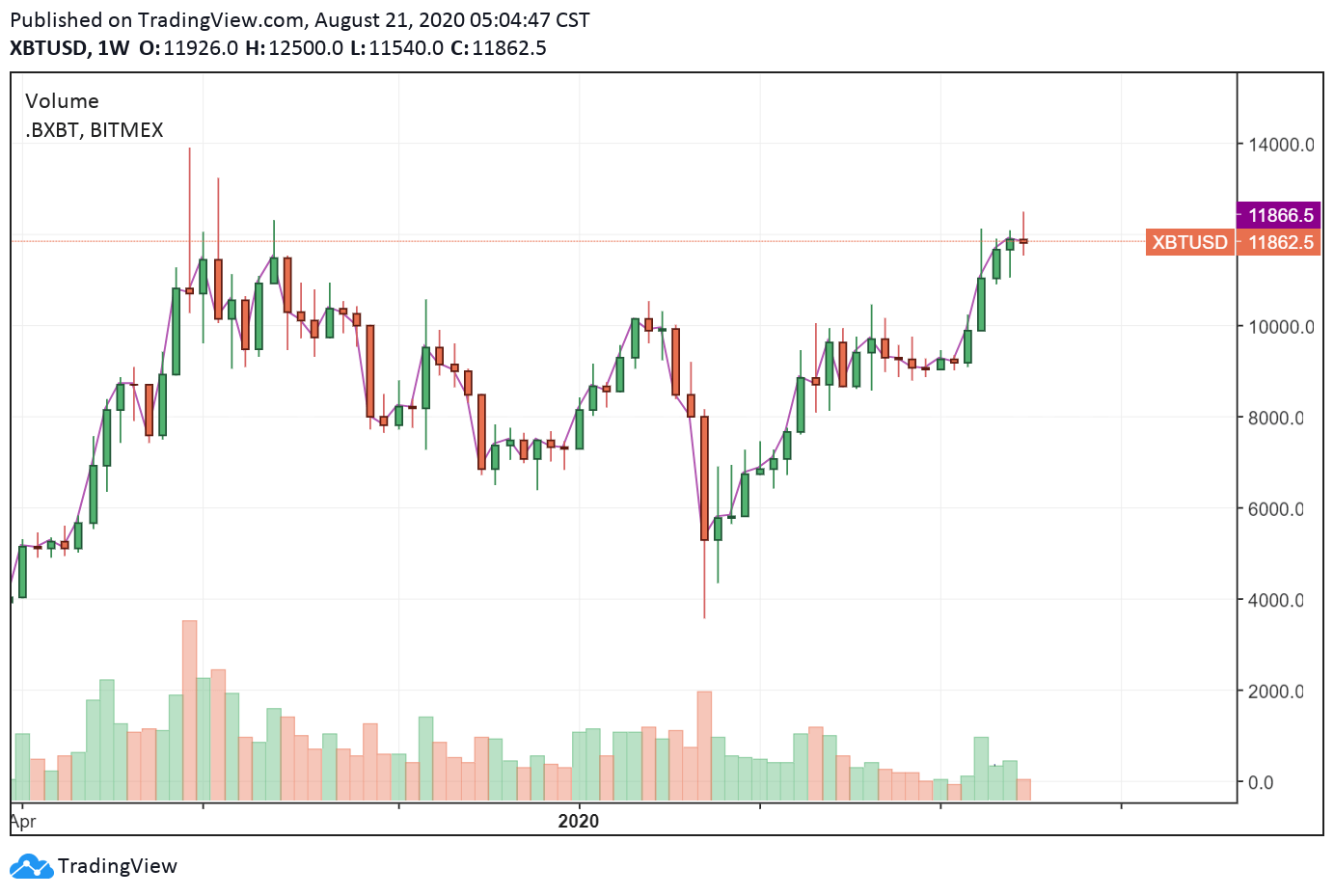

Throughout its relatively young history, Bitcoin (BTC) has not stayed above the pivotal $10,000 level for many prolonged periods. In the last several weeks, the top cryptocurrency has remained relatively stable above $10,000.

According to data from the pseudonymous analyst “Hsaka,” the recent uptrend is the fourth-longest period BTC stayed beyond $10,000.

The trend suggests that Bitcoin is treating $10,000 as strong support, which typically is a positive medium-term sign.

On-chain data also pinpoint $10,000 as an important support level

Whether the prolonged stability of Bitcoin above $10,000 could serve as a foundation for a larger rally remains uncertain.

In June and July 2019, Bitcoin spent 25 and 28 days, respectively, above $10,000. Shortly thereafter, within two months, Bitcoin corrected to $9,500 then eventually to the $7,400 region.

But other on-chain data points strengthen the argument that the foundation for an extended uptrend is building.

In a report, OKEx analysts said various on-chain data shows that the maturing market is treating $10,000 as an important support level.

Traders reportedly opened a significant number of positions between $6,200 and $9,700, closing most of them in profit.

The exchange’s analysts said new positions at $10,000 have started to emerge, causing the selling pressure on Bitcoin to decline.

The report reads:

“These observations — together with the apparent lack of downward pressure moving forward and the generally positive market sentiment around this recent price action — suggest that the market’s days of trading Bitcoin under $10K may be numbered.”

Technicals support favorable fundamental factors

The robust $10,000 support level of Bitcoin is complemented by positive fundamental factors, such as continuous institutional inflow and hashrate.

This week, the hashrate of the Bitcoin blockchain network achieved a new all-time high. It suggests that the mining industry is stable, which could lead to lower selling pressure.

The data also show that miners anticipate a higher BTC price in the medium to long term.

Through Grayscale and CME, institutional inventors have also increasingly gained exposure to Bitcoin since early 2020.

Data from Skew shows that CME’s Bitcoin futures market’s open interest has hit a new high.

The assets under management (AUM) of Grayscale recently surpassed an all-time high above $6.1 billion, indicating surging interest for cryptocurrencies.

Kevin Svenson, a chartist at Cryptowat.ch, emphasized that BTC balances on exchanges have not dropped this fast since the last Bitcoin bull run in 2017. He wrote:

“Looking at Bitcoin balances on exchanges: the last time exchanges saw this fast a decline in BTC holdings, was before Bitcoin’s bull run during the course of 2017. This metric indicates growing confidence amongst BTC Hodlers.”

The confluence of a strong support level and favorable fundamental factors raise the chances for a longer upsurge in the medium term.

Bitcoin, currently ranked #1 by market cap, is up 1.05% over the past 24 hours. BTC has a market cap of $218.98B with a 24 hour volume of $21.03B.

Bitcoin Price Chart

Like what you see? Subscribe for daily updates.